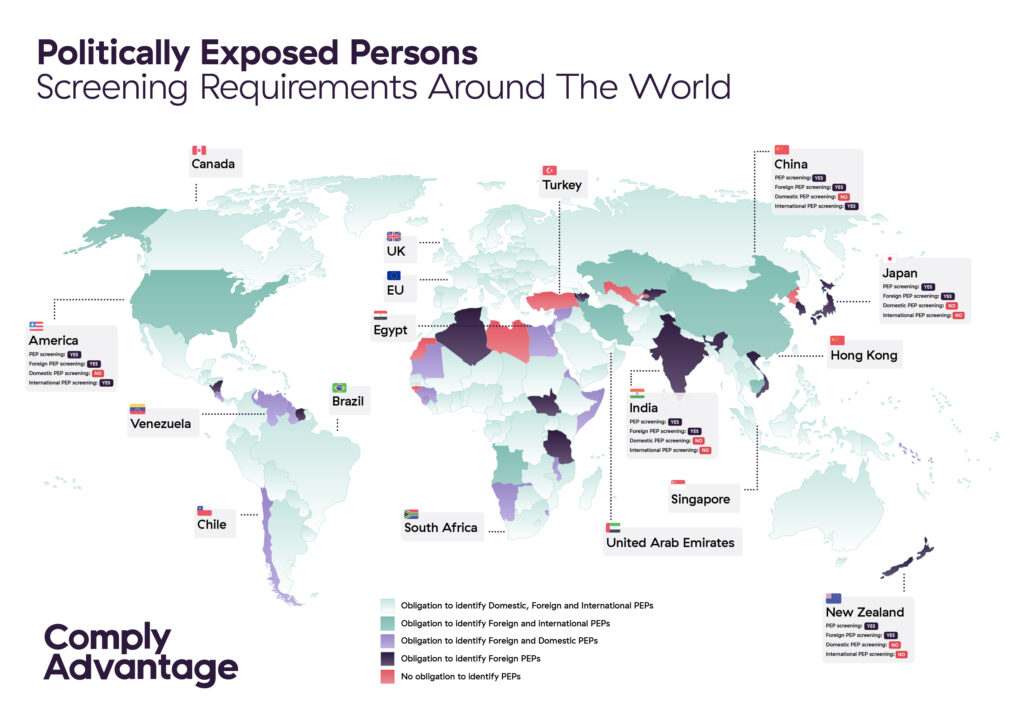

When people are elected to important political positions or given prominent public roles, they should be categorized as Politically Exposed Persons (PEPs) to reflect the increased risk that they will participate in money laundering or terrorist financing operations.

Global financial authorities require banking and financial institutions to apply relevant PEP screening measures as part of their anti-money laundering program to know who among their customers are PEPs. Although PEP status is not an indicator of criminal activity or actual participation in such practices, it does involve significant compliance obligations in almost all regions of the world due to the potential risk. Financial institutions should be aware of the applicable PEP regulations in their jurisdiction and be prepared to deploy relevant AML/CFT measures when onboarding a PEP and throughout the business relationship.

The different categories of PPE

There is no overarching definition of a politically exposed person, but the Financial Action Task Force (FATF) defines a PEP as “a person who is or has been charged with an important public function”. Although the term varies from jurisdiction to jurisdiction, alongside the screening requirements imposed by local financial authorities, most of these distinguish between three categories of PEPs:

- Foreign : Individuals elected to political office or appointed to a significant public role or office in a foreign country should be classified as foreign PEPs for AML/CFT purposes. Foreign PEPs can be heads of state, members of government, civil servants, high-ranking military personnel or magistrates. They may also be senior executives of public companies or prominent members of political parties.

- Domestic : Individuals elected to political office or appointed to important public office in their country of residence are classified as domestic PEPs. Like foreign PEPs, the domestic category includes heads of state and other foreign government officials as well as members of political parties, senior officials, magistrates and senior executives of state-owned companies.

- Internationals: Senior managers (or persons of equivalent level) who are entrusted with important functions by international companies may be classified as international PEPs. Examples of international PEPs include senior executives, directors and board members of companies.

PEP screening requirements may also apply to relatives and close associates (RCAs) of PEPs. Indeed, the latter may be exposed to a risk of money laundering due to their professional or social proximity to people with PEP status.

PPE regulations around the world

North America

Obligation to screen PEPs: Yes

Obligation to screen foreign PEPs: Yes

National PEP Screening Obligation: Yes (except USA)

Screening obligation for international PEPs: Yes

In North America, the various national regulations regarding PPE are largely similar. Thus, Canada and Mexico require screening of foreign, national and international PEPs in the context of the AML/CFT fight, while the United States departs from this by not requiring screening of domestic PEPs. In 2018, a FATF assessment of Mexico highlighted the threat of organized crime and corruption in that country and identified specific gaps in screening PEPs in the absence of rigorous risk categorization. to national PEPs.

Specifically, the regulations on screening PEPs in the United States and Canada are as follows:

UNITED STATES

Obligation to screen PEPs: Yes

Obligation to screen foreign PEPs: Yes

Obligation to screen national PEPs: No

Screening obligation for international PEPs : Yes

Using the term “foreign agent” to refer to individuals with PEP status, U.S. regulations regarding PEPs are defined in the Bank Secrecy Act and the Patriot Act and enforced by the network against financial crime (FinCEN). In the United States, PEP screening should be integrated into the company’s risk-based AML/CFT program. Financial institutions should therefore use reasonable judgment to incorporate appropriate screening processes, including Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD) requirements.for PEPs presenting more risks. When a financial institution detects or suspects that a PEP may be involved in money laundering activities, it must submit a suspicious activity report (SAR) to the FinCEN network.

Canada

Obligation to screen PEPs: Yes

Obligation to screen foreign PEPs: Yes

Obligation to screen national PEPs: Yes

Screening obligation for international PEPs: Yes

In accordance with FATF recommendations for the application of AML/CFT regulations, screening of PEPs in Canada should be part of a risk-based AML/CFT program. Canada ‘s Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) sets out specific requirements for screening domestic PEPs. Indeed, while foreign PEPs are still considered high risk in Canada, the risk posed by domestic PEPs must be assessed upon onboarding and monitored on an ongoing basis. In Canada, PEP screening regulations are enforced by the Financial Transactions and Reports Analysis Center of Canada (FINTRAC).

Upcoming changes : The proposed amendments will expand the PCMLTFA by extending AML/CFT requirements to certain non-financial activities and professions and casinos. Under these changes, these entities will be required, like other financial entities, to determine which of their customers are PEPs.

Latin America

Obligation to screen PEPs: Yes

Obligation to screen foreign PEPs: Yes

National PEP Screening Obligation: Yes (except Suriname)

Screening obligation for international PEPs: Depending on the country

The Latin American Financial Action Task Force (GAFILAT) is working to develop a standardized AML/CFT strategy for the region by defining requirements for PEPs that converge with the rest of the world. In Latin America, PEP screening requires financial institutions to exercise due diligence and increased risk-based due diligence on customers and when onboarding them and throughout the duration of the commercial relationship. In Latin America, the definition of a PEP varies by country. Examples of PEPs include mayors, candidates for political office and prominent business owners (including football team owners) while grandparents and grandchildren are considered RCA.beneficial ownership when screening PEPs and engage in effective information exchange.

Among Latin American countries, the following countries practice screening of PEPs:

Brazil

Obligation to screen PEPs: Yes

Obligation to screen foreign PEPs: Yes

Obligation to screen national PEPs: Yes

Screening obligation for international PEPs: Yes

In Brazil, PEP screening is mandatory for all three categories of PEPs. The FATF assessment of Brazil identified AML/CFT weaknesses in the country’s border regions and in a predominantly informal economy, so any PEP screening measures must take these parameters into account. In 2019, the Financial Activities Control Council (COAF) , under the authority of the Central Bank of Brazil , expanded the definition of PEPs to include mayors of all cities, as well as councilors, state representatives, and other officials .

Chile

Obligation to screen PEPs: Yes

Obligation to screen foreign PEPs: Yes

Obligation to screen national PEPs: Yes

Obligation to screen international PEPs: No

In Chile, PEP screening requirements apply to foreign and domestic PEPs, but not to international PEPs. In this country, the screening of PEPs is imposed by the law on the fight against money laundering, under the authority of the CMF commission (Comisión para el Mercado Financiero and the Financial Analysis Unit (Unidad de Análisis Financiero ) that require financial institutions to exercise increased due diligence when dealing with customers with PEP status. Although it has experienced incidents of public and government corruption, Chile is not considered a high-risk country by organizations such as the FATF or the EU.

Europe

Obligation to screen PEPs: Yes

Obligation to screen foreign PEPs: Yes

Obligation to screen national PEPs: Yes

Screening obligation for international PEPs: Yes (except Bosnia and Herzegovina)

The European Union applies a consistent policy of screening PEPs within its Member States by regularly issuing directives on the fight against money laundering while non-EU states tend to align their own PEP policies with those of the Union. Therefore, politically exposed persons in Germany, for example, are subject to the same screening requirements as in France, Spain and other EU or EEA countries. Screening of PEPs in the EU is implemented under a risk-based approach to AML/CFT and the EU has the same definition of a PEP and RCA as the FATF. But some countries in Europe would certainly require further consideration when it comes to PEPs. Albania for example,

As not all countries in Europe are members of the EU, there are regulatory discrepancies across the continent.

Some examples of important European jurisdictions:

United Kingdom

Obligation to screen PEPs: Yes

Obligation to screen foreign PEPs: Yes

Obligation to screen national PEPs: Yes

Screening obligation for international PEPs: Yes

The UK has now left the European Union, but its PEP screening requirements remain broadly similar thanks to its prior application of EU money laundering directives. In the UK, politically exposed person screening requirements are set out by the UK Financial Conduct Authority (FCA) .

France

Obligation to screen PEPs: Yes

Obligation to screen foreign PEPs: Yes

Obligation to screen national PEPs: Yes

Screening obligation for international PEPs: Yes

The screening of PEPs in France is also governed by the European directives on money laundering, which are transposed into the French penal code , the monetary and financial code and other pieces of financial legislation. Regulation on PEPs is mainly implemented by the Financial Markets Authority (AMF) and the Prudential Control and Resolution Authority (ACPR).

Germany

Obligation to screen PEPs: Yes

Obligation to screen foreign PEPs: Yes

Obligation to screen national PEPs: Yes

Screening obligation for international PEPs: Yes

As an EU Member State, Germany applies the European Money Laundering Directives in line with the continent’s risk-based approach to AML/CFT. In Germany, politically exposed person screening requirements are enforced by the Federal Financial Supervisory Authority (BaFin) and defined by the Money Laundering Act .

Albania

Obligation to screen PEPs: Yes

Obligation to screen foreign PEPs: Yes

Obligation to screen national PEPs: Yes

Screening requirement for international PEPs: Yes

Not being an EU member state, Albania is also not obliged to apply the European directives on money laundering nor the associated PEP regulations. Although Albania imposes screening requirements for foreign, domestic and international PEPs, the FATF currently considers this country to be high risk. Therefore, financial institutions need to put in place strong PEP screening measures to account for this high risk. Albanian PEP screening regulations are defined by the General Directorate for the Prevention of Money Laundering (GDPML) and enforced by the Albanian Financial Markets Supervisory Authority .

Recent development: Under the Fifth Anti-Money Laundering Directive (in force since January 10, 2020), all PEPs within the EU must be considered high risk, regardless of whether they are classified as foreign, domestic or foreign PEPs. international. The new legislation also requires all EU member states to publish a list of functional PEPs.

Africa

Screening obligation for PEPs: Yes (except Libya, Guinea-Bissau and Western Sahara)

Screening obligation for foreign PEPs: Depending on the country

National PEP Screening Obligation: Depending on the country

Screening obligation for international PEPs: Depending on the country

Most African countries adhere to the general definition of a PEP and include heads of state, MPs, civil servants, employees of public companies as well as parents and close associates (RCA) of a PEP. Many African states, including South Africa, are members of FATF and these countries have regulations in place that require financial institutions to screen foreign, domestic and international PEPs. However, in Africa, the situation differs from country to country and several states face high levels of corruption and financial crime. Currently, Uganda, Ghana, Botswana and Zimbabwe are identified as