Use our Adverse Media Database for Free

Using a search engine for adverse media? Use our adverse media solution focussed on financial crime for free

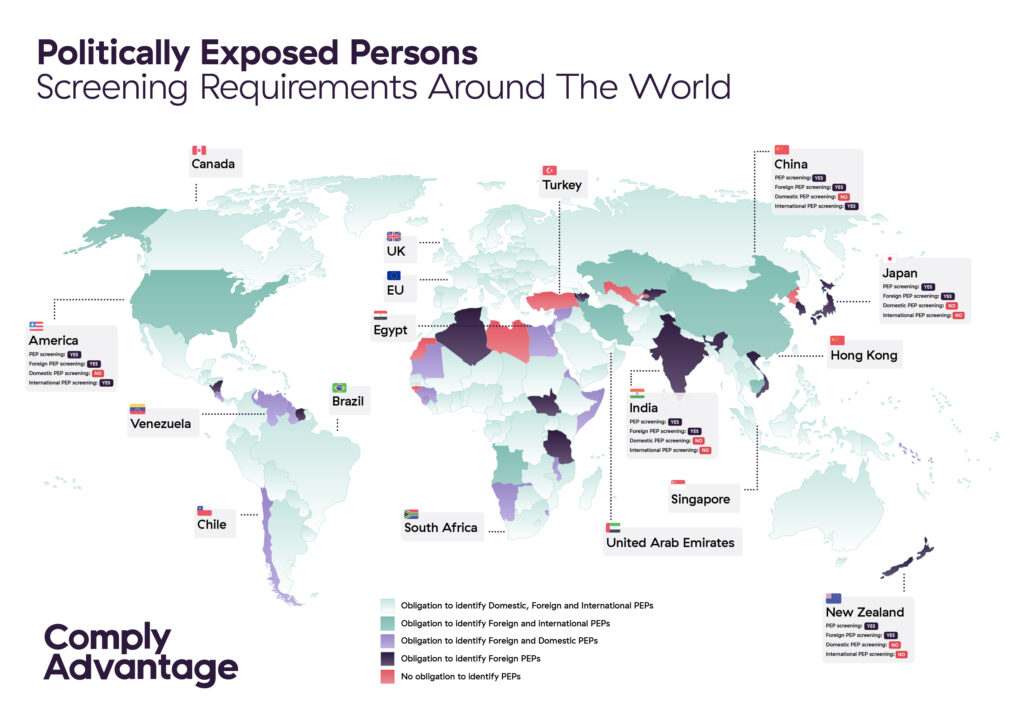

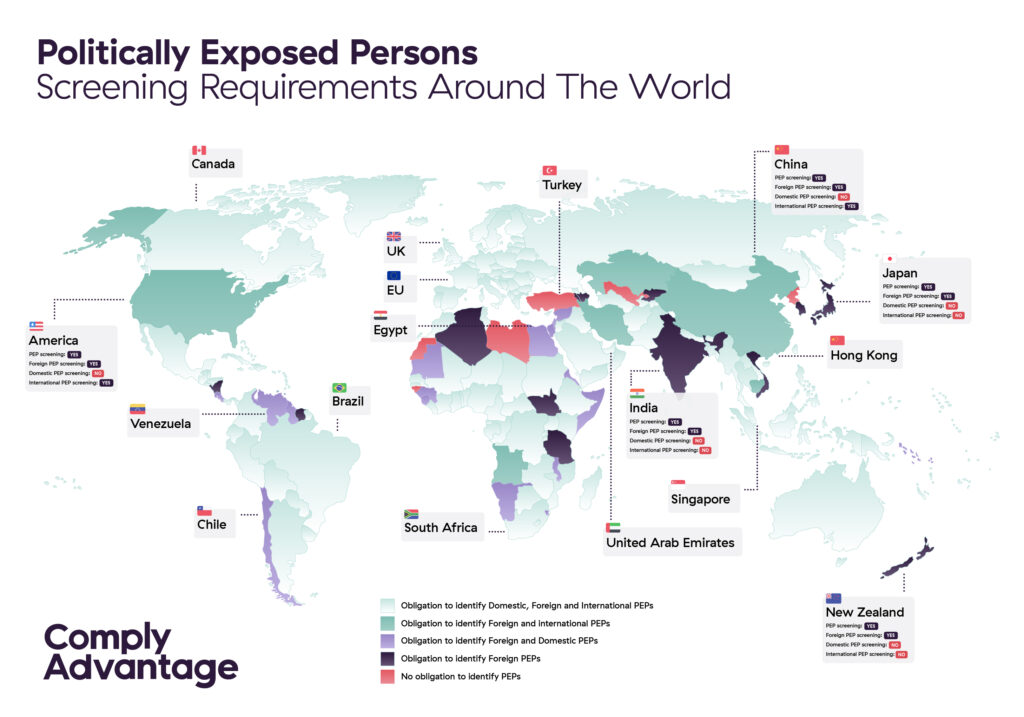

Screen for FreeWhen individuals are elected to prominent political positions or assigned high-profile public roles, they should be categorized as politically exposed persons (PEPs) to reflect their increased risk of involvement in money laundering or terrorism financing.

Global financial authorities require banking and financial institutions to implement suitable PEP screening measures as part of their AML programs in order to determine their customers’ PEP status. While PEP status is not an indication of criminal activity or involvement, it does confer important compliance obligations in almost every part of the world due to potential risk: firms must be aware of the PEP regulations applicable within their jurisdiction and be prepared to implement the relevant AML/CFT measures at onboarding and on an ongoing basis throughout the business relationship.

There is no global definition of a politically exposed person, but the Financial Action Task Force (FATF) defines a PEP as “an individual who is or has been entrusted with a prominent public function.” Although the term varies by jurisdiction, along with screening requirements imposed by local financial authorities, most financial authorities separate PEPs into three categories:

Politically exposed person screening requirements may also apply to relatives and close associates (RCAs) of PEPs. RCAs are at risk of money laundering as a result of their professional or social proximity to PEP-status individuals.

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes (except USA)

Obligation for international PEP screening: Yes

PEP regulations in North America are broadly similar: Canada and Mexico require foreign, domestic and international PEP screening as part of their AML/CFT frameworks, while the United States diverges by not requiring domestic PEP screening. In 2018, a FATF assessment of Mexico highlighted the threat of organized crime and corruption within the country and identified specific deficiencies in PEP screening thanks to the lack of robust domestic PEP risk categorization.

In more detail, PEP screening regulations in the US and Canada are as follows:

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: No

Obligation for international PEP screening: Yes

Using the term “foreign official” to refer to PEP-status individuals, the United States’ PEP regulations are set out in the Bank Secrecy Act and the Patriot Act and implemented by the Financial Crimes Enforcement Network (FinCEN). PEP screening in the United States should be part of a firm’s risk-based AML/CFT program: this means that firms must use reasonable judgment to integrate the appropriate screening processes, including customer due diligence (CDD) measures and enhanced due diligence (EDD) for higher-risk PEPs. When a firm detects or suspects that a PEP may be engaged in money laundering activities, it should submit a suspicious activity report (SAR) to FinCEN.

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes

Obligation for international PEP screening: Yes

Following FATF recommendations for implementing AML/CFT regulations, PEP screening in Canada should be part of a risk-based AML/CFT program. Canada’s Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) sets out specific requirements for domestic PEP screening: while foreign PEPs are always considered high-risk in Canada, the risk presented by domestic PEPs should be determined during onboarding and monitored on an ongoing basis. PEP screening regulations in Canada are enforced by FINTRAC.

Upcoming changes: Proposed amendments will broaden the PCMLTFA, extending AML/CFT requirements to certain non-financial businesses and professions (NFBP) and casinos. Under the changes, these entities will be required to make PEP determinations about their clients like other financial entities.

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes

Obligation for international PEP screening: Yes

PEP screening in France is also mandated by EU Money Laundering Directives, which are transposed into the French Criminal Code, the Monetary and Financial Code and other articles of financial legislation. PEP regulations are primarily enforced by the AMF and the ACPR.

Using a search engine for adverse media? Use our adverse media solution focussed on financial crime for free

Screen for Free

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes (except Suriname)

Obligation for international PEP screening: Varies by country

The Financial Action Task Force of Latin America (GAFILAT) works towards a standardized AML/CFT strategy for the region, setting out PEP requirements that converge with the rest of the world. PEP screening in Latin America requires firms to conduct risk-based customer due diligence and enhanced due diligence during onboarding and throughout business relationships. Latin American PEP definitions vary by country: for example, some include mayors, candidates for political office and high-profile business owners (such as football team owners), along with grandparents and grandchildren as RCAs. Best practice suggests that firms in Latin America should consider beneficial ownership during PEP screening and work to facilitate efficient information exchange.

Notable PEP screening jurisdictions in Latin America include:

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes

Obligation for international PEP screening: Yes

PEP screening in Brazil is required for all three categories of PEP. FATF’s assessment of Brazil has identified AML/CFT weaknesses in border regions of the country and in a prevalent informal economy, so any PEP screening measures should take those issues into account. In 2019, the Council for Financial Activities Control (COAF), under the authority of the Central Bank of Brazil, expanded the definition of PEP to mayors from all cities, along with councilors, state representatives and other officials.

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes

Obligation for international PEP screening: No

In Chile, PEP screening requirements are applied to foreign and domestic PEPs but not to international PEPs. PEP screening in Chile is mandated by the Anti-Money Laundering Act, under the authority of the Comisión para el Mercado Financiero (CMF) and the Unidad de Análisis Financiero (UAF), and requires firms to perform enhanced due diligence when dealing with PEP-status customers. While it has experienced incidents of public and governmental corruption, Chile is not considered high-risk by organizations such as the FATF or the EU.

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes

Obligation for international PEP screening: Yes (except Bosnia and Herzegovina)

The European Union implements a uniform PEP screening policy across its member states through its periodic Anti-Money Laundering Directives, while non-EU states tend to align their own PEP policies with the bloc. Accordingly, politically exposed persons in Germany, for example, are subject to the same screening regulations as they are in France, Spain and other EU or EEA countries. PEP screening in the EU is implemented as part of a risk-based approach to AML/CFT, and the EU follows FATF in its definition of a PEP and RCA. Some countries in Europe may warrant greater PEP scrutiny: Albania, for example, is considered high-risk by FATF, while Bosnia and Herzegovina has been identified as high-risk in previous EU Anti-Money Laundering Directives.

Since not all countries in Europe are members of the EU, there is regulatory divergence across the continent. Examples of notable European jurisdictions include:

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes

Obligation for international PEP screening: Yes

The UK has now left the European Union, but its PEP screening requirements remain broadly similar thanks to its prior implementation of EU Anti-Money Laundering Directives. In the UK, politically exposed person screening requirements are set out by the Financial Conduct Authority (FCA).

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes

Obligation for international PEP screening: Yes

As an EU member state, Germany implements the EU’s Money Laundering Directives as part of the continent-wide risk-based approach to AML/CFT. In Germany, politically exposed person screening requirements are enforced by the Federal Financial Supervisory Authority (BaFin) and set out in the Money Laundering Act.

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes

Obligation for international PEP screening: Yes

Since it is not an EU member state, Albania is also not obliged to implement EU Money Laundering Directives and their associated PEP regulations. While Albania does implement PEP screening requirements for foreign, domestic and international PEPs, FATF currently considers it a high-risk country: accordingly, firms should implement robust PEP screening measures to accommodate that elevated risk. Albanian PEP screening regulations are set out in the General Directorate for the Prevention of Money Laundering (GDPML) and enforced by the Albanian Financial Services Authority (AMF).

Recent changes: Under the Fifth Anti-Money Laundering Directive (in effect from January 10, 2020), all PEPs within the EU must be considered high-risk regardless of their foreign, domestic or international classification. The new legislation also requires all EU member states to issue a functional PEP list.

Obligation for PEP screening: Yes (except Libya, Guinea-Bissau and West Sahara)

Obligation for foreign PEP screening: Varies by country

Obligation for domestic PEP screening: Varies by country

Obligation for international PEP screening: Varies by country

Most African countries observe the general global understanding of what constitutes a PEP and include heads of state, members of parliament, government officials, employees of state-owned companies and RCAs. Many African states, including South Africa, are members of FATF, and these countries have regulations in place that require firms to screen foreign, domestic and international PEPs. However, many jurisdictions within Africa diverge significantly, and several states struggle with high levels of corruption and financial crime. Currently, Uganda, Ghana, Botswana and Zimbabwe are identified as high-risk countries by FATF.

While most African nations implement screening requirements for all PEP categories, there is significant divergence across the continent. In Egypt, Mauritania, Eritrea, Guinea, Sierra Leone, Somalia, Malawi, Namibia and Eswatini, firms must screen foreign and domestic PEPs. Angola implements PEP screening requirements for foreign and international PEPs but does not require domestic screening. By contrast, in Algeria, South Sudan and Tanzania, screening is only required for foreign PEPs.

Notable PEP screening jurisdictions in Africa include:

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: No

Obligation for international PEP screening: No

Egypt is a member of the Middle East and North Africa Financial Action Task Force (MENAFATF) and has committed to implementing the FATF’s AML/CFT recommendations. PEP screening in Egypt is required for foreign PEPs, while domestic and international PEP screening is not required. Egypt has previously struggled with money laundering and terrorism financing threats but MENAFATF points out that it has since worked to put appropriate CDD/EDD and monitoring measures in place under the authority of the Egyptian Financial Regulatory Authority (FRA).

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes

Obligation for international PEP screening: Yes

In its 2009 evaluation, the FATF identified drug crime and institutional corruption as a problem for South Africa but acknowledged that authorities were working to improve its AML/CFT framework. At that time, there were also no PEP screening requirements in the country. Since then, PEP regulations have been implemented to meet FATF standards under the authority of the South African Financial Intelligence Centre (FIC). PEP screening in South Africa is now required for foreign, domestic and international PEPs.

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Varies by country

Obligation for domestic PEP screening: Varies by country

Obligation for international PEP screening: Varies by country

The Middle East is a diverse AML/CFT environment. Most Persian Gulf states, including the UAE, Oman, Yemen, Saudi Arabia and Iraq, require foreign, domestic and international PEP screening, as do Israel, Jordan, Lebanon, Turkmenistan and Afghanistan. Iran requires firms to screen foreign and international PEPs, while Syria requires only foreign and domestic PEP screening. In proximity to Europe, Armenia and Azerbaijan require only foreign PEP screening.

FATF has placed Iran on its AML blacklist, while other Middle Eastern countries represent high-risk AML/CFT jurisdictions thanks to high levels of governmental corruption. Accordingly, PEP screening in the Middle East should reflect that elevated risk. Middle Eastern naming conventions and duplication potential can also present complicated challenges for customer due diligence measures, increasing the potential for false positives and negatives. Firms should ensure that their screening processes are sensitive to those factors and able to identify PEPs accurately on an ongoing basis.

Notable PEP screening jurisdictions in the Middle East include:

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes

Obligation for international PEP screening: Yes

PEP screening in Saudi Arabia is required for foreign, domestic and international PEPs. In its 2017 evaluation, FATF highlighted Saudi Arabia’s specific failures to identify and prosecute individuals involved in money laundering and terrorism financing. FATF pointed out that Saudi Arabia does not have a complete definition of what constitutes a PEP and that there are deficiencies in its PEP screening requirements for certain financial services firms. PEP regulations in Saudi Arabia are set out in the Anti-Money Laundering Law, under the authority of the Saudi Arabian Monetary Authority (SAMA).

Obligation for PEP screening: No

Obligation for foreign PEP screening: No

Obligation for domestic PEP screening: No

Obligation for international PEP screening: No

Turkey lies in both Asian and Europe and has no screening requirements in place for foreign, domestic or international PEPs, diverging from the majority of European countries. Turkey has previously initiated the EU membership application process, but its progress towards full membership has stalled and it remains outside the EU and the EEA. Nonetheless, Turkey has adapted its own AML legislation to converge with that of the EU’s Fourth Anti-Money Laundering Directive: PEP regulations are set out in the Prevention of Laundering the Proceeds of Crime Act and enforced by the Banking Regulation and Supervision Agency (BRSA).

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: No

Obligation for international PEP screening: Yes

FATF has placed Iran on its AML blacklist because of specific deficiencies in its AML/CFT framework and ongoing concerns that it provides support for international terrorist organizations. PEP screening in Iran is required for foreign and international PEPs but not for domestic PEPs, while PEP regulations are overseen by the Central Bank of Iran (CBI). Iran is currently subject to numerous financial sanctions, which prohibit most firms from establishing business relationships with Iranian persons.

Obligation for PEP screening: Yes (except Uzbekistan)

Obligation for foreign PEP screening: Varies by country

Obligation for domestic PEP screening: Varies by country

Obligation for international PEP screening: Varies by country

Asia is a diverse AML/CFT environment with disparity between PEP screening requirements in both highly developed and less developed countries. Politically exposed persons in the Philippines, for example, along with Australia, Indonesia, Russia and smaller countries, like Thailand, Malaysia and Pacific island states are required to screen foreign, domestic and international PEPs. By contrast, Cambodia requires only foreign and international PEP screening, while China, New Zealand, Vietnam, Japan, South Korea and India require only foreign PEP screening. By contrast, Uzbekistan has no requirements for PEP screening.

Like Middle Eastern jurisdictions, PEP screening in Asia should account for naming conventions and potential name duplication. Similarly, PEPs are a significant AML consideration in many Asian countries as a result of high levels of governmental and institutional corruption. Firms should be prepared for the elevated money laundering risk presented by certain countries: Myanmar, Cambodia and Pakistan are currently subject to increased monitoring by FATF, while North Korea is on the FATF blacklist.

Notable PEP screening jurisdictions in Asia:

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: No

Obligation for international PEP screening: Yes

China has recently introduced PEP screening requirements as part of its AML/CFT regulatory framework, overseen by the People’s Bank of China (PBC). PEP screening in China currently applies to foreign and international PEPs but not to domestic PEPs. FATF points out that the lack of domestic PEP screening is a significant vulnerability given that corruption is a significant predicate offense in China and that state-owned organizations play a major economic role.

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: Yes

Obligation for international PEP screening: Yes

Reflecting its status as a global financial hub, PEP screening in Singapore is required for foreign, domestic and international PEPs, under AML/CFT regulations enforced by the Monetary Authority of Singapore (MAS). In a recent evaluation report, FATF found Singapore to be compliant with its PEP recommendations.

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: No

Obligation for international PEP screening: No

PEP screening in South Korea is a significant AML consideration since FATF recently highlighted its high levels of fraud and corruption. Following FATF advice, Korea is taking steps to expand its AML/CFT regulations to address PEP-related money laundering. PEP regulations in South Korea are enforced by the Korea Financial Intelligence Unit (KoFIU).

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: No

Obligation for international PEP screening: No

Japan has traditionally resisted imposing increased PEP screening requirements, but a new focus on anti-bribery and anti-corruption by the Financial Services Agency (FSA) has prompted tighter AML/CFT restrictions. In Japan, transactions involving foreign PEPs are now automatically classified as high-risk and must be subject to enhanced due diligence measures.

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: No

Obligation for international PEP screening: No

Firms are required to screen only foreign PEPs in India. As an observing member of FATF, India is working towards full membership, which means that it implements a risk-based approach to AML/CFT: accordingly, firms should put enhanced due diligence measures in place to detect PEP-status customers. PEP regulations in India are set out by the Prevention of Money Laundering Act 2002 and enforced by the Reserve Bank of India (RBI).

Obligation for PEP screening: Yes

Obligation for foreign PEP screening: Yes

Obligation for domestic PEP screening: No

Obligation for international PEP screening: No

PEP screening in New Zealand only applies to foreign PEPs; however, New Zealand is a member of FATF so its AML/CFT regulations require firms to implement risk-based measures and take reasonable steps to establish the source of PEPs’ wealth. New Zealand’s PEP regulations are set out in the AML/CFT Act 2009 and enforced by the Reserve Bank of New Zealand (RBNZ).

In order to conduct global checks for politically exposed persons and comply with local PEP regulations, firms must collect and analyze large amounts of customer and transaction data. Customer due diligence and enhanced due diligence measures should involve not only available customer-submitted information but checks of existing PEP lists and a range of news sources, including online and traditional media outlets.

Conducting manual PEP screening can be costly and time-consuming. By contrast, integrating certain technology and software within an AML compliance solution can add efficiency and accuracy to the screening process. Smart technology tools help AML/CFT teams better manage their PEP data and compliance obligations, allowing for the segmentation of customers into prioritized risk-groups, speeding up the collection and analysis process and reducing the potential for human error.

This article should be used as a guide and not taken as legal advice.

Discover our guide to find out how to effectively manage challenges faced during the customer onboarding process.

Learn moreOriginally published 27 May 2020, updated 16 January 2023

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2023 IVXS UK Limited (trading as ComplyAdvantage).