Adverse Media Screening

Verify high-risk clients with reputable adverse media screening software

Cut through the noise and analyze true adverse media context at scale with our robust adverse media screening software.

Request demo

Customer Value

Machine learning delivers contextual understanding

- Leverage AI and natural language processing to analyze true adverse media context at scale.

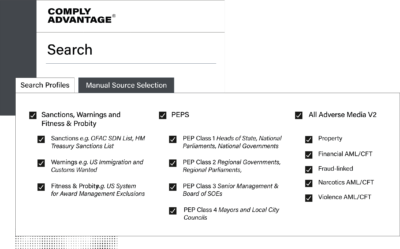

AML/CFT taxonomy aligned to regulatory guidance

- Easy to justify categories aligned to the latest FATF and EU MLD recommendations.

Structured profiles continuously updated

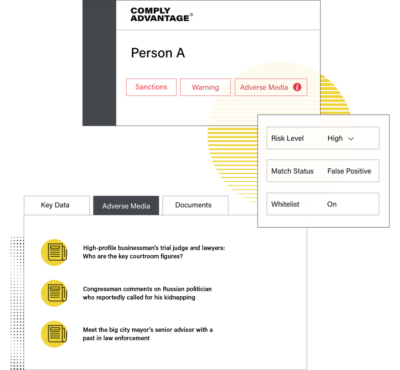

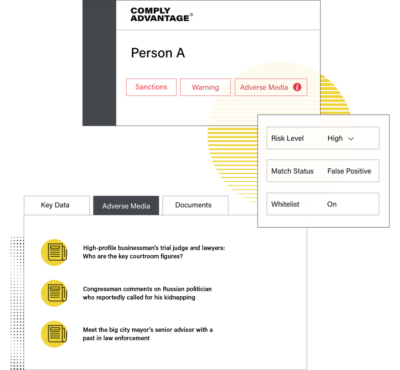

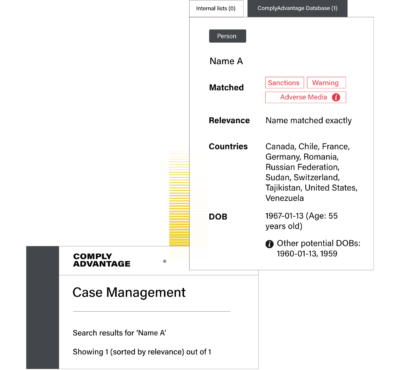

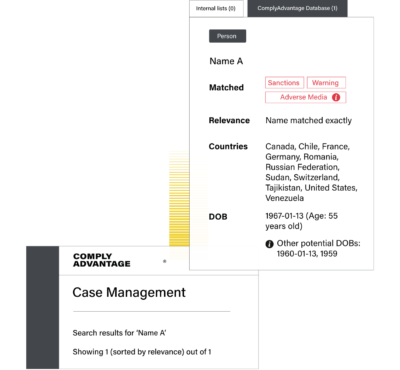

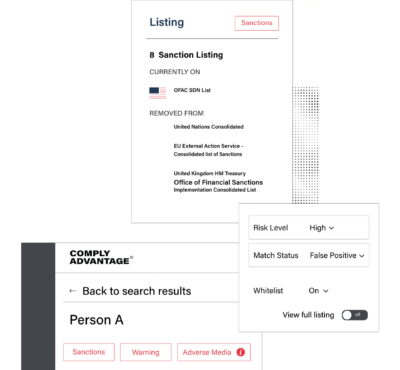

- Screen against a database of entity and individual profiles, not endless articles.

Source list curated by financial crime experts

- Ensuring only reliable media informs the identification of adverse entities.

Capabilities

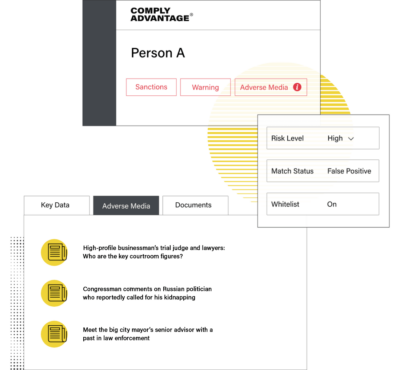

- Contextual understanding

- AML/CFT taxonomy

- Live structured profiles

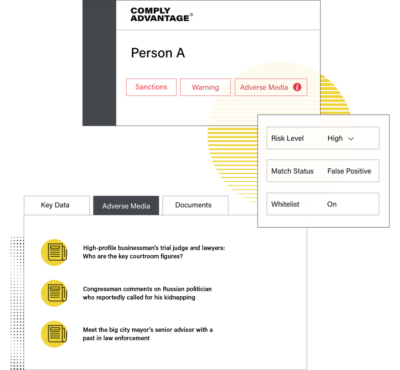

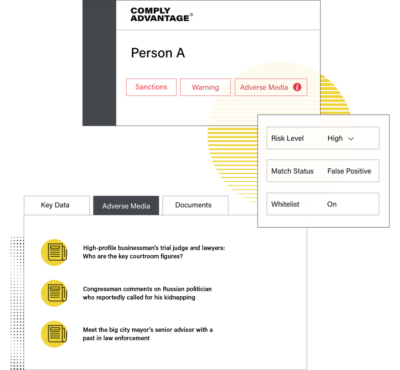

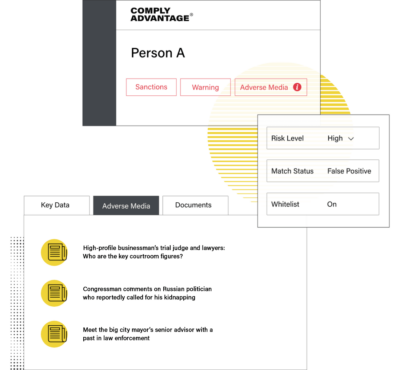

- Entity-based alerts

- Secondary identifiers

- Native language media

- Curated source list

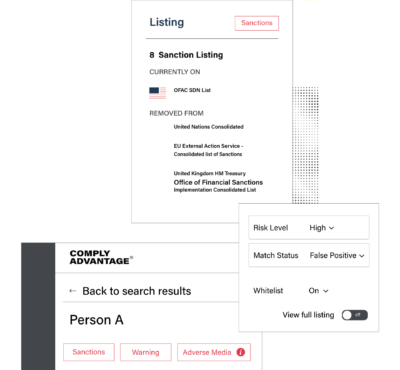

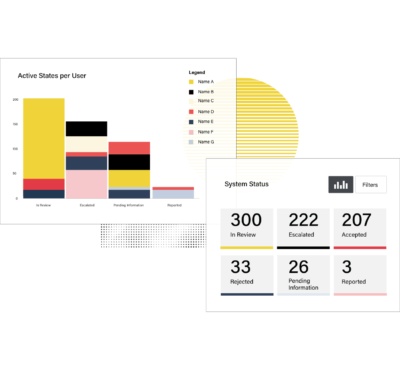

- Alert management web portal

- REST API integration