The Evolving Use of Sanctions

A look at the newest trends and updates from key sanction regimes around the world.

Stay compliant with real-time sanctions and watchlist data

Request Demo

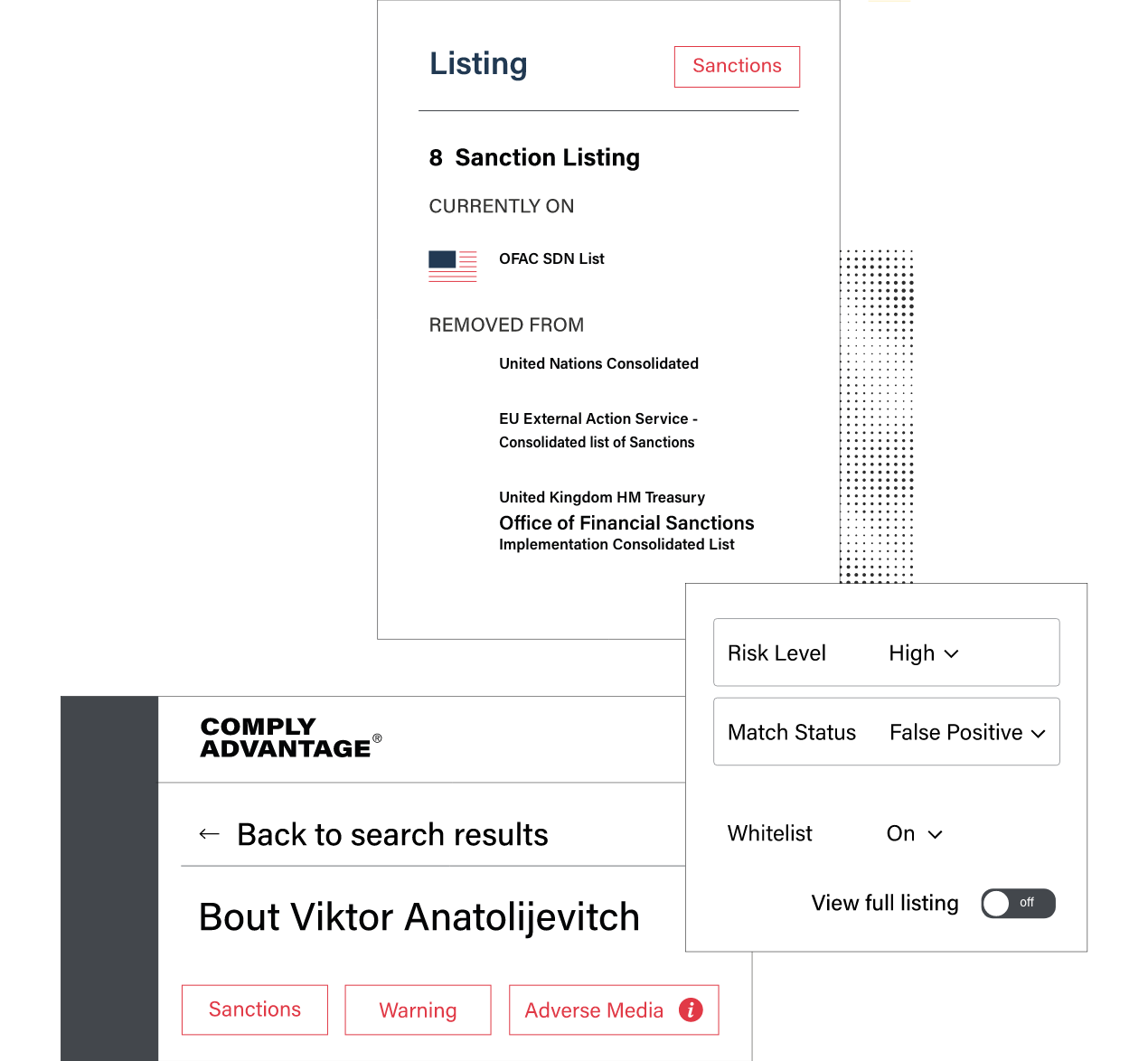

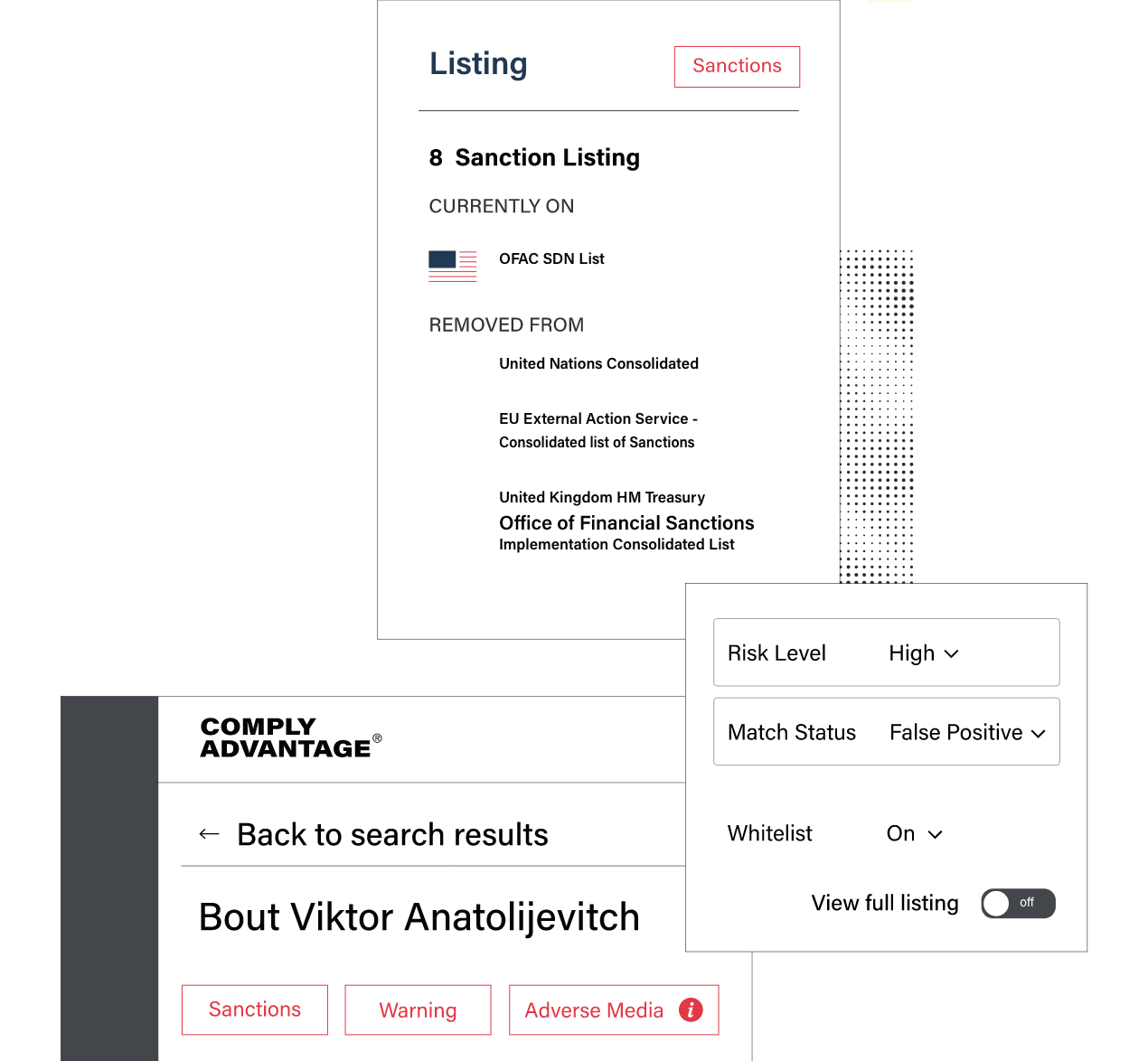

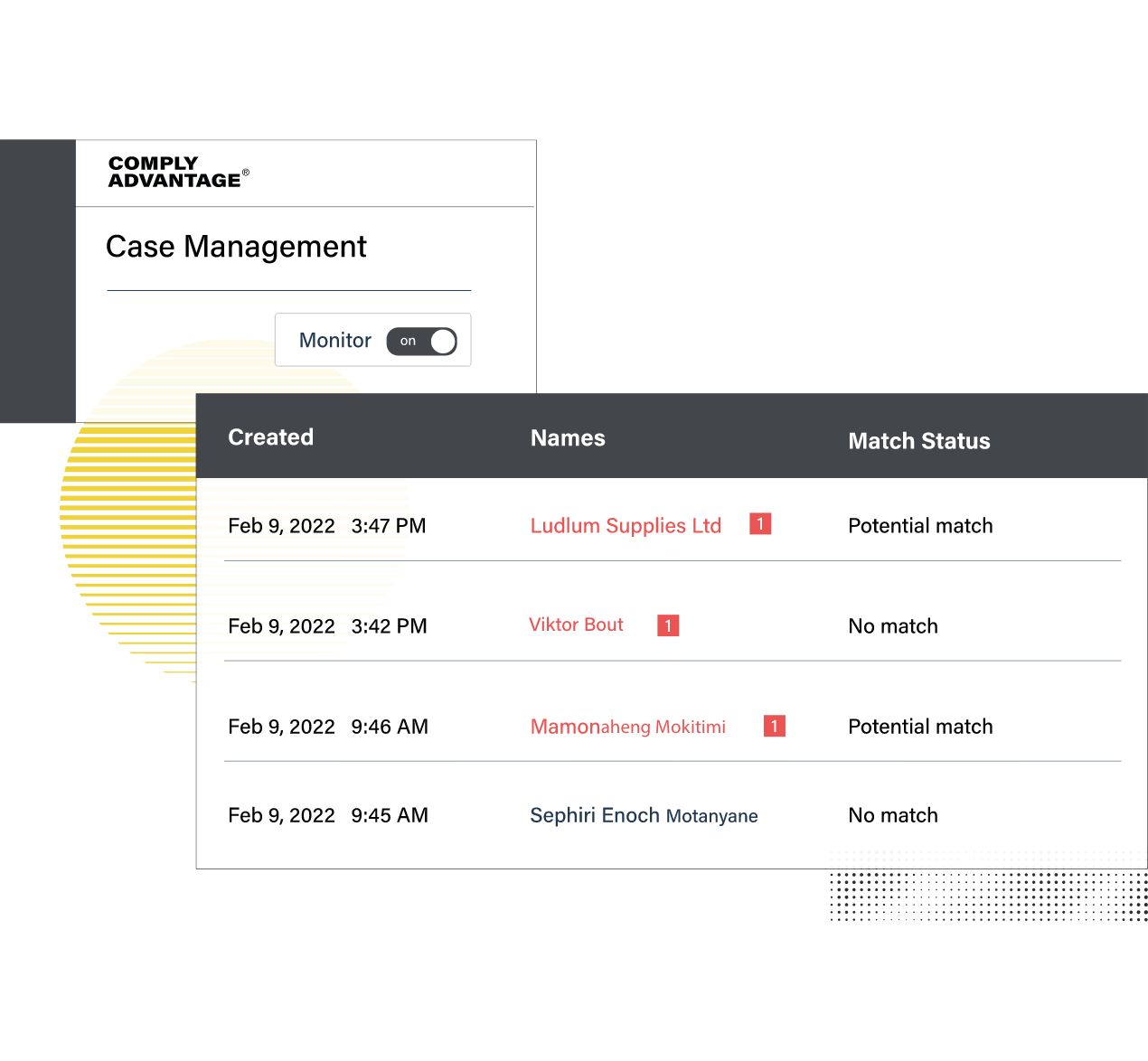

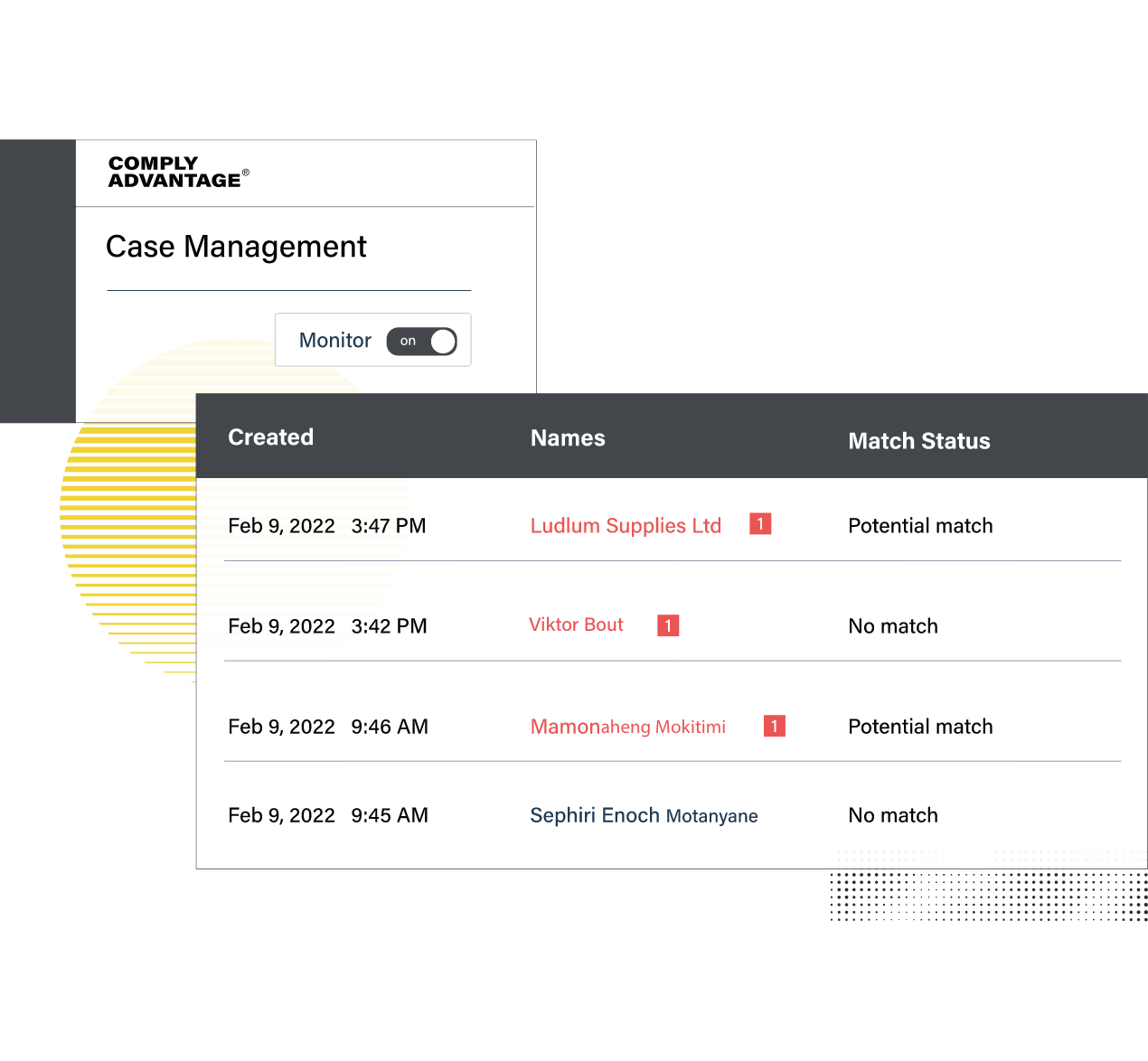

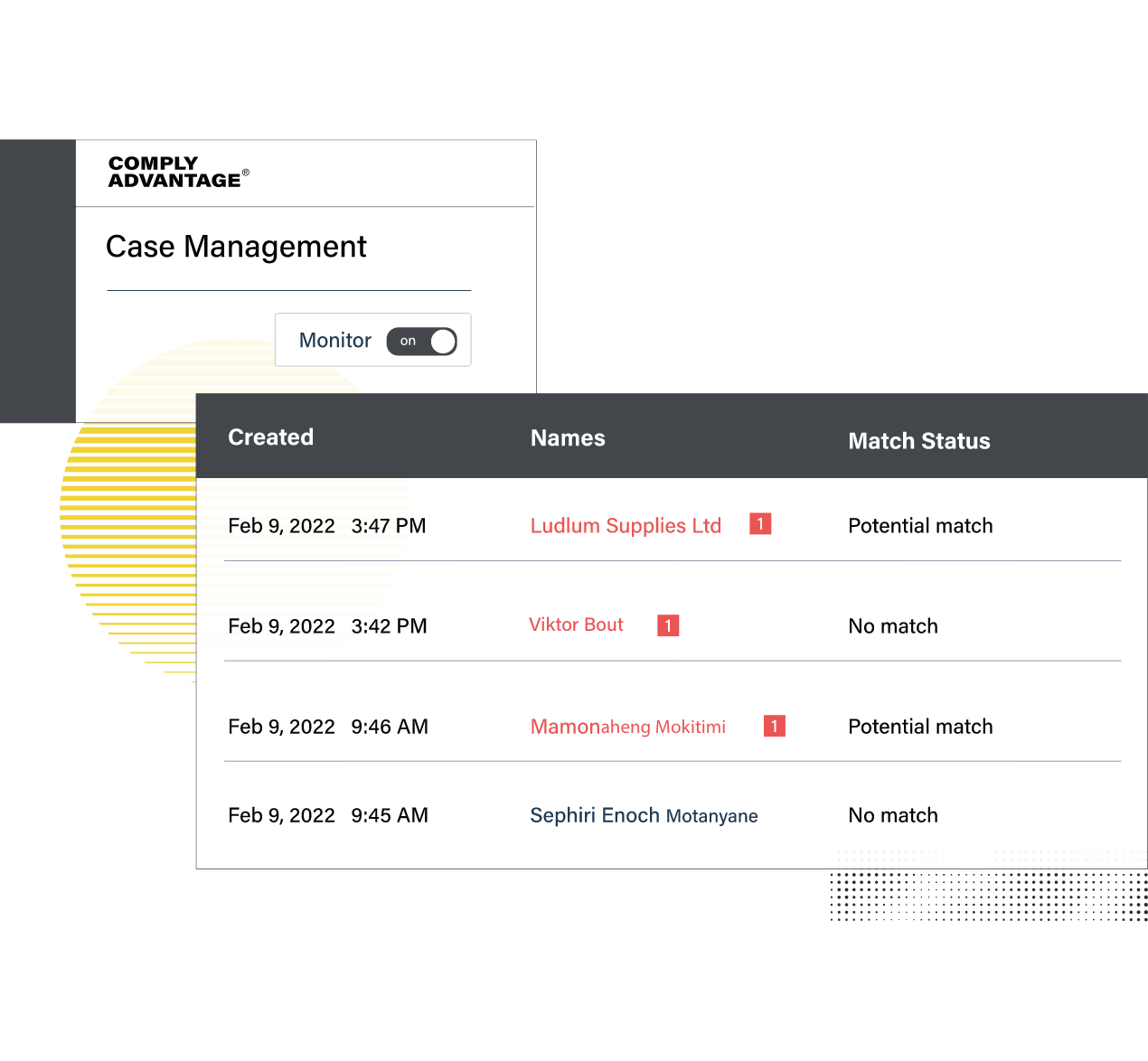

Our robust monitoring, update and assurance processes, leveraging state of the art machine learning technology, means that we have the capability of monitoring 1,000 + Official sanctions, regulator and law enforcement watchlists concurrently in real-time.

Risk changes are captured via automatic means and then go through a formal process of approval and control. Have the context to make the right AML risk decisions with comprehensive entity-based profiles enhanced with the most up to date sanction lists and other watchlists (warnings, fitness & probity).

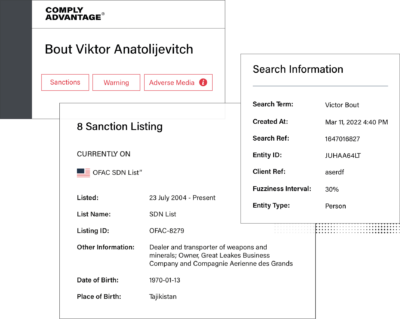

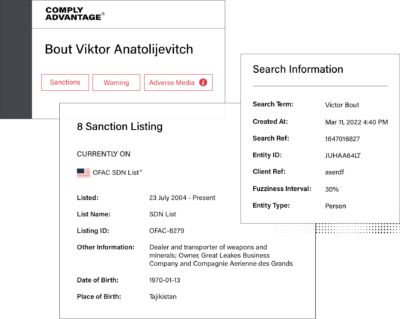

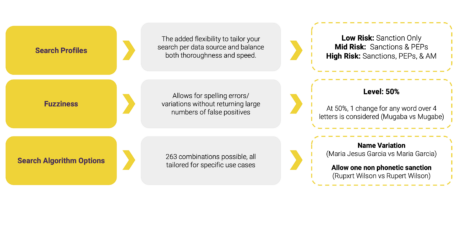

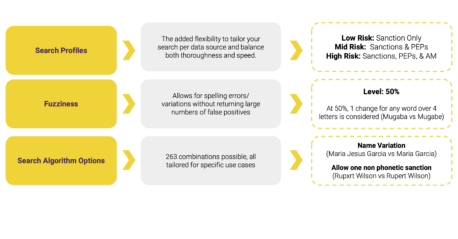

While individuals and companies can change names throughout their life and typos can occur during onboarding, many regulators expect companies to be able to account for and identify this.

Our industry-leading sanctions and watchlist screening software enables you to overcome these issues while configuring screening parameters that are aligned with your risk appetite

Governments and international organisations impose economic sanctions to alter the decisions of other actors (state and non-state) who burden their interests and breach international norms. According to the UN: “Sanctions are meant to be a last resort when it comes to addressing massive human rights violations, curbing illegal smuggling or stopping extremism groups (…) being used to support peace efforts, to ensure that elections are held, or to demobilize armed groups”.

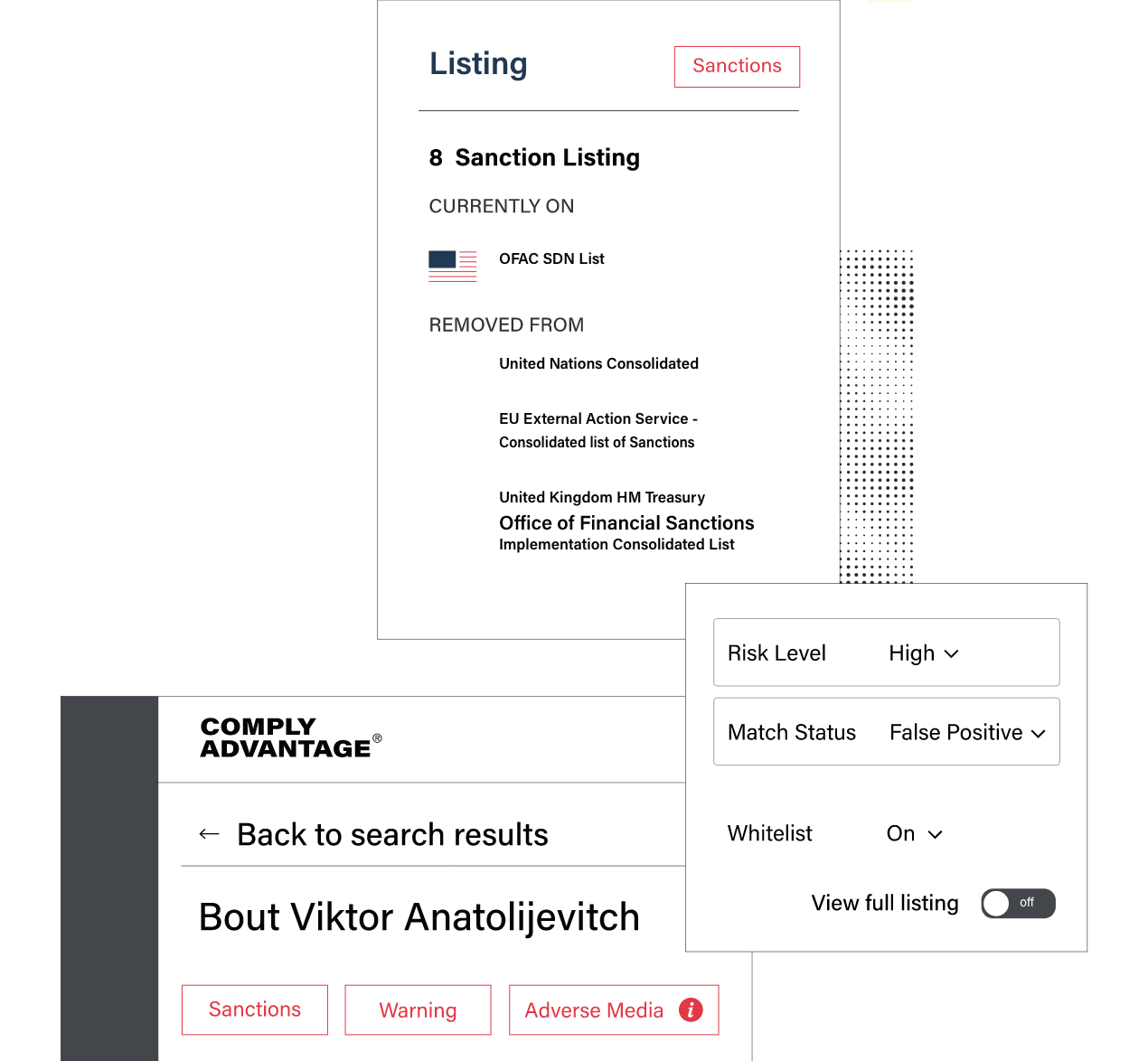

Entities sanctioned by the United States and other governments are statutorily banned from doing business in or with the jurisdiction imposing the sanctions. For example, American citizens, businesses, and governmental bodies are prohibited from interacting commercially or financially with entities covered by US sanctions lists like those issued by the Office of Foreign Assets Control (OFAC). Though a government’s authority is domestic, and technically relevant only to those institutions and individuals subject to US jurisdiction, in this case the nature of sanctions lists and the desire of citizens and businesses to maintain their access to the US financial system makes this power a multilateral tool by effect. UN members, meanwhile, are subject to an obligation under international law to give effect to the UN’s sanctions in local law.

ComplyAdvantage allows you to monitor in real-time the full spectrum of critical sanctions lists.

Watchlists comprise lists issued by law-enforcement or other regulatory bodies, containing individuals or other juridical entities. The lists are targeting law-breaking activities, as well as non-compliant behaviours at the international level, in particular jurisdictions or in specific industries. Distinct from sanctions, the watchlists do not serve as a diplomatic or governmental tool to achieve foreign policy goals or to amend decisions of state and non-state actors who threaten national interests or violate international norms.

We have set up a radically different technical architecture, leveraging data science and machine learning to understand risk computationally. While we still review data manually, our approach results in data being updated in minutes rather than months. By collecting data from such a broad range of global sources, we are able to update our data faster using automated processes. We also are able to corroborate & validate entities and enhance existing data such as DOBs and photographs. We compile disparate data into consolidated, structured profiles, with clear traceable source data and relations to other risk entities. Have the context to make the right risk decisions with a single comprehensive profile, enhanced with the most up to date Adverse Media and AML/CTF information.

Yes. Lists of individuals, legal entities, vessels, issued by relevant law-enforcement or regulatory bodies. Entities on such lists are either involved in law-breaking activities at international level or in particular jurisdictions, under investigation or found guilty of regulatory breaches in their operating industry, which may indicate a significant financial, compliance, or reputational risk.

This information can be used when determining whether or not to engage in a business relationship with potential customers, counterparties and suppliers. It might equally be of use when making payments, and determining whether or not a payment is being made in the furtherance of crime, or as part of a financial crime, such as a money-laundering or insider trading scheme.

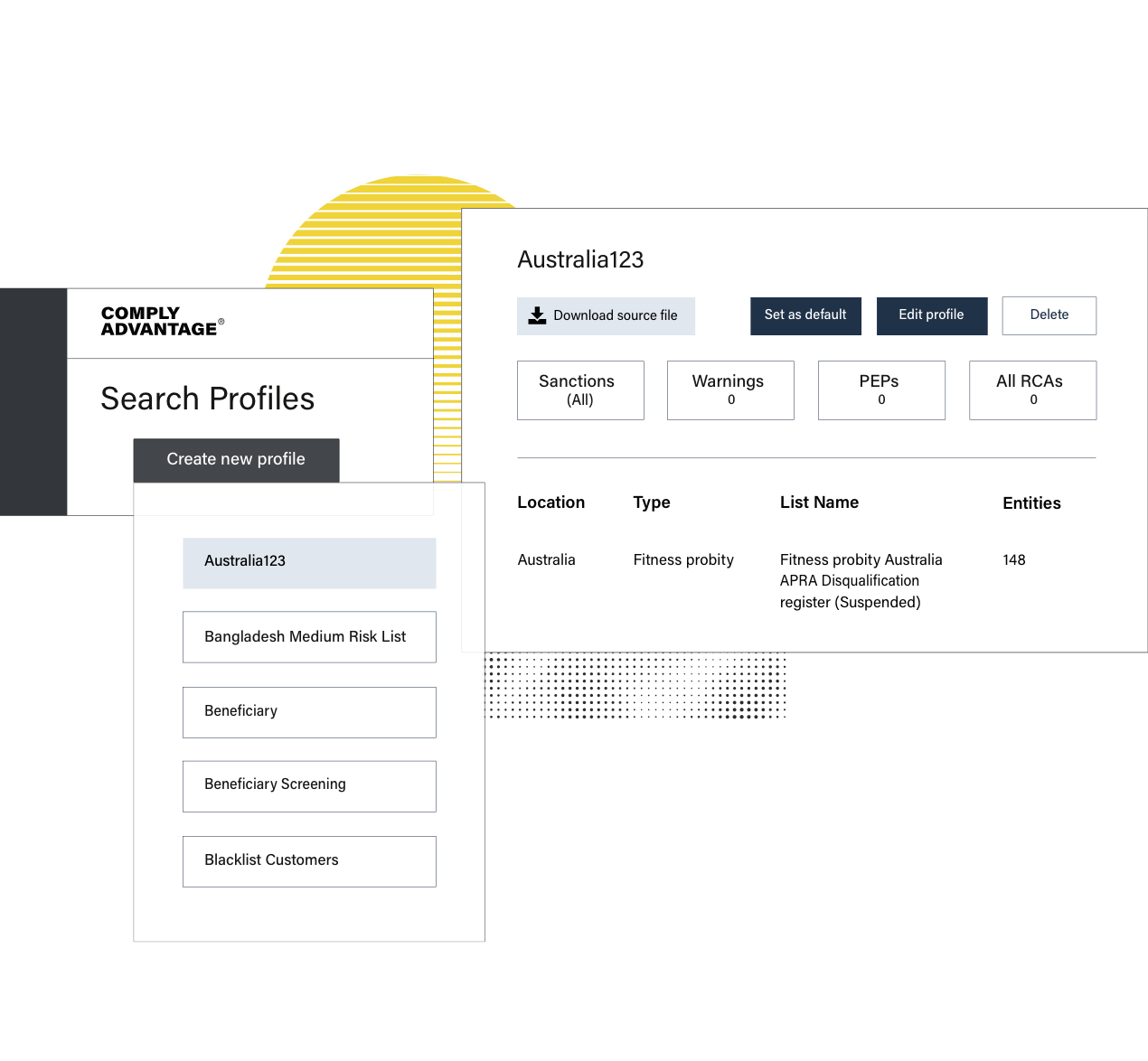

The ComplyAdvantage data set includes, without limitation, regional, national and international data-sets.

Yes. ComplyAdvantage’s fitness and probity data set encompasses individuals who have committed transgressions but who might not necessarily have committed offenses that would lead them to be denied funds or bank accounts. It might however lead you to reassess a potential business relationship with these entities.

Therefore this category encompasses lists of individuals and legal entities which have been disqualified or otherwise restricted from holding certain positions or participating in certain activities such as publicly-funded contracts due to regulatory or code of conduct breaches.

The ComplyAdvantage data set includes, without limitation, regional, national and international data-sets.

Yes, advance your customer screening with powerful, flexible “fuzzy matching” search capability that allows you to optimize for the reduction of false-positives in-line with your risk based approach. Our search algorithm accounts for all the major sources of mismatch in the name screening industry, such as name derivatives, phonetically similar names, spelling & typos, fuzzy matching and different name forms.

We leverage 1000s of sources that contribute to our comprehensive global coverage: OFAC, UN, HMT, EU, DFAT and many more. List from around the world, 14 languages supported.

Sanction updates every 15 minutes.

A look at the newest trends and updates from key sanction regimes around the world.

A global watch list sets out the names, details, and other relevant information of targets that have been designated by government authorities for sanctions measures.

See how over 2000+ high growth fintechs have made compliance painless