With a growing, diverse customer base covering global accounting giant BDO Global, consumer skincare brand Dermalogica, and startup incubator Stone & Chalk, Paytron needed a solution that could scale with its user base.

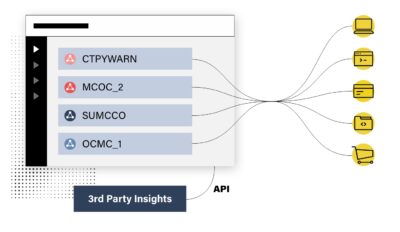

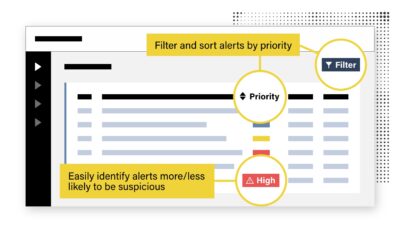

Reduce false positives & increase workflow efficiencies with AI-powered Smart Alerts

Reduce false positives by 70%

Our solution learns from your analysts and data.

Allows you to prioritize and focus on the greatest risks to your business.

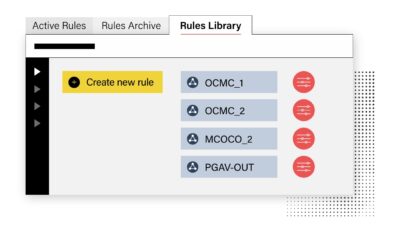

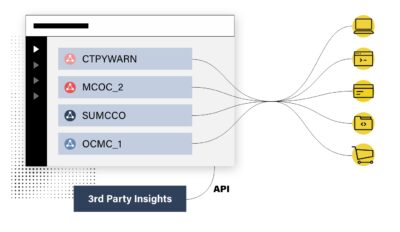

Use your own rules and benefit from AI

Create your own transaction monitoring solution by choosing from our library of red flags and suspicious activity scenarios. Set thresholds based on your risk exposure.

Where rules are unable to detect specific activity, our AI capability fills the gap to precision.

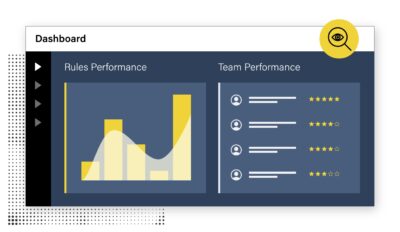

Reduced false positives by up to 70%

Saved 80% of time spent on building risk scenarios

Monitored billions of transactions at 100 TPS with sub second response time

Went live within 2 weeks

With a growing, diverse customer base covering global accounting giant BDO Global, consumer skincare brand Dermalogica, and startup incubator Stone & Chalk, Paytron needed a solution that could scale with its user base.

Alviere, an embedded finance platform, helps non-financial institutions provide their customers with integrated financial products. It needed a solution to improve operational efficiency and streamline productivity within its compliance department.

PingPong needed a solid solution to streamline its due diligence checks to meet its compliance obligations across many different jurisdictions and build trust with its new and expanding customer base.