- Live AML data generation

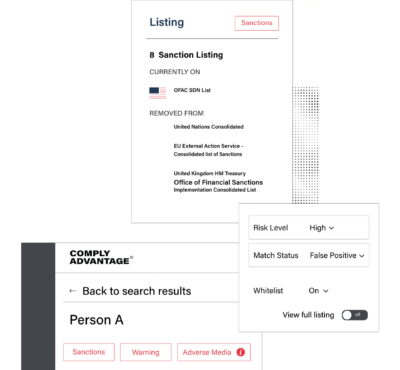

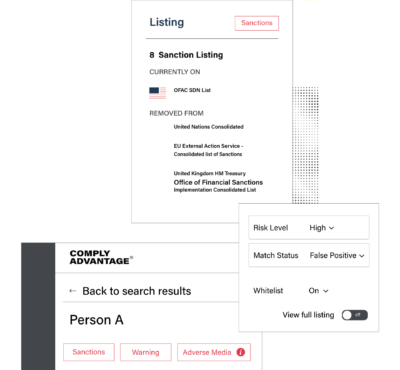

- Combined entity profiles

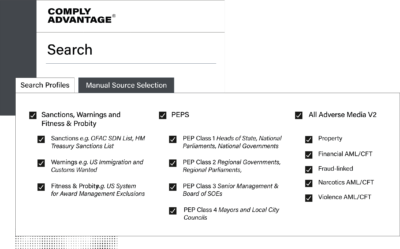

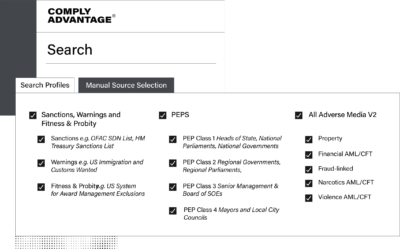

- Real-time screening

- Automated monitoring

- Multilingual support

- Configurable matching algorithm

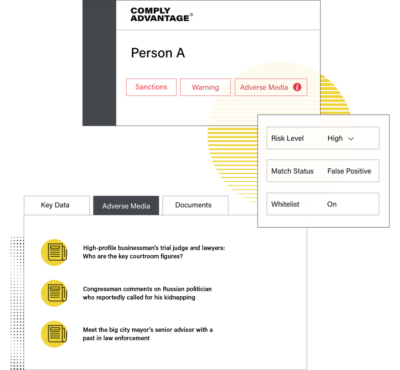

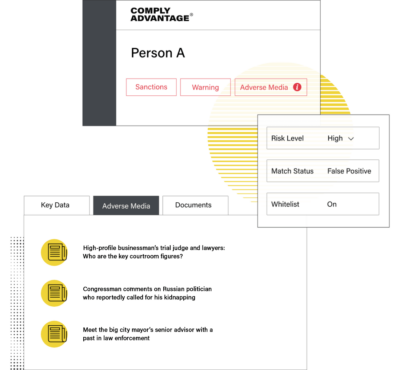

- Whitelisting

- REST API integration

- ISO27001 Level Security

Automate customer onboarding and monitoring with a real-time AML risk database & an effective AML KYC solution.

Request demo