Insurance

Get a detailed view of risk throughout the customer lifecycle

Fraudulent claims are increasing. So too is regulatory pressure. Together, they are reshaping the insurance sector. Insurance companies must ensure they can quickly identify hidden risks.

With automated AML processes, compliance teams can uncover suspicious entities and activities in real time. Our solutions enable insurance companies to meet regulators’ expectations today, and to keep up with constant changes in regulation.

Why ComplyAdvantage?

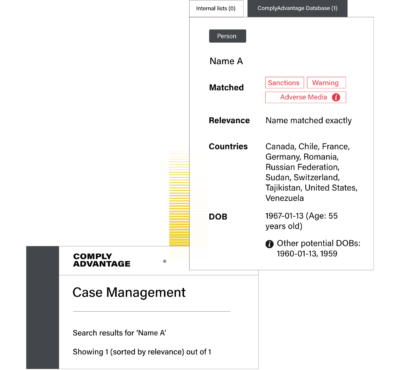

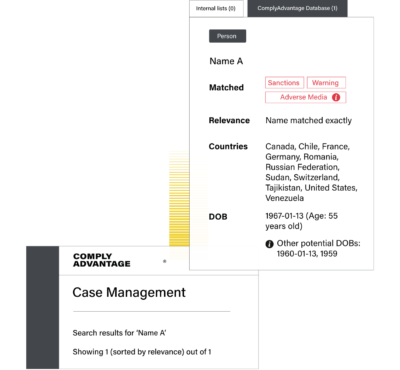

Screening & Monitoring

Optimize your workflows

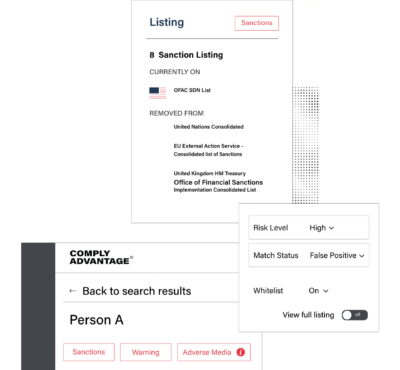

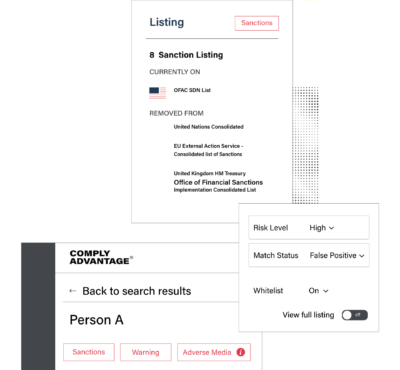

- Screen with confidence against sanctions lists, watchlists, and politically exposed persons (PEPs). Detect fraud on claims and check claim payments before processing them.

- Automate online quote-to-bind application processes.

- Optimize workflows with our intuitive user interface. Insurers, reinsurers, brokers, and underwriters can easily adapt as their business scales.

- Easily integrate our solutions. Our two-way API enables seamless integration with your tech stack.

Adverse Media

Deep dive into your client risk profile

- Use machine learning to find the risk in the noise. Our solution analyzes millions of articles every month.

- Spot changes in risk status. Safeguard your reputation and protect your business from fraud.

- One comprehensive profile contains all the known relevant risk data on an entity. It’s enhanced with rich, contextual information.

All the profiles in our database are accurately labeled with FATF aligned categorization.

Learn More

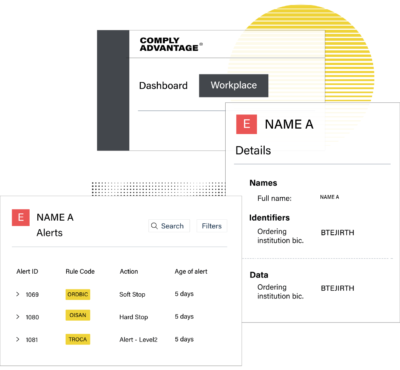

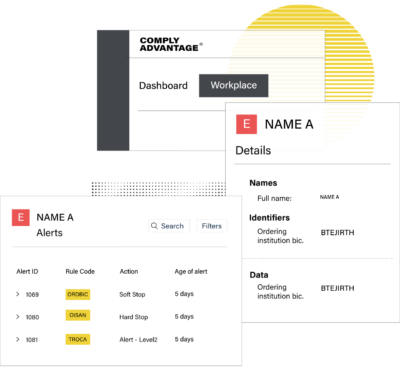

Transaction Monitoring

See suspicious activities in real time

- Monitor movements in and out of life insurance policies. Our solution enables real-time monitoring, so you can prevent fraud.

- Use insurance-specific rules. Adopt our recommended rules or use your own, all tailored to your risk-based approach.

- Meet the requirements of regulators and auditors with a user-friendly interface. Our solution provides an electronic audit trail, too.