International sanctions are an essential part of the global fight against money laundering and the financing of terrorism (AML/CFT). In the United States, economic sanctions are implemented by the Treasury’s Office of Foreign Assets Control (OFAC), which maintains lists of individuals, entities, and countries currently under sanctions.

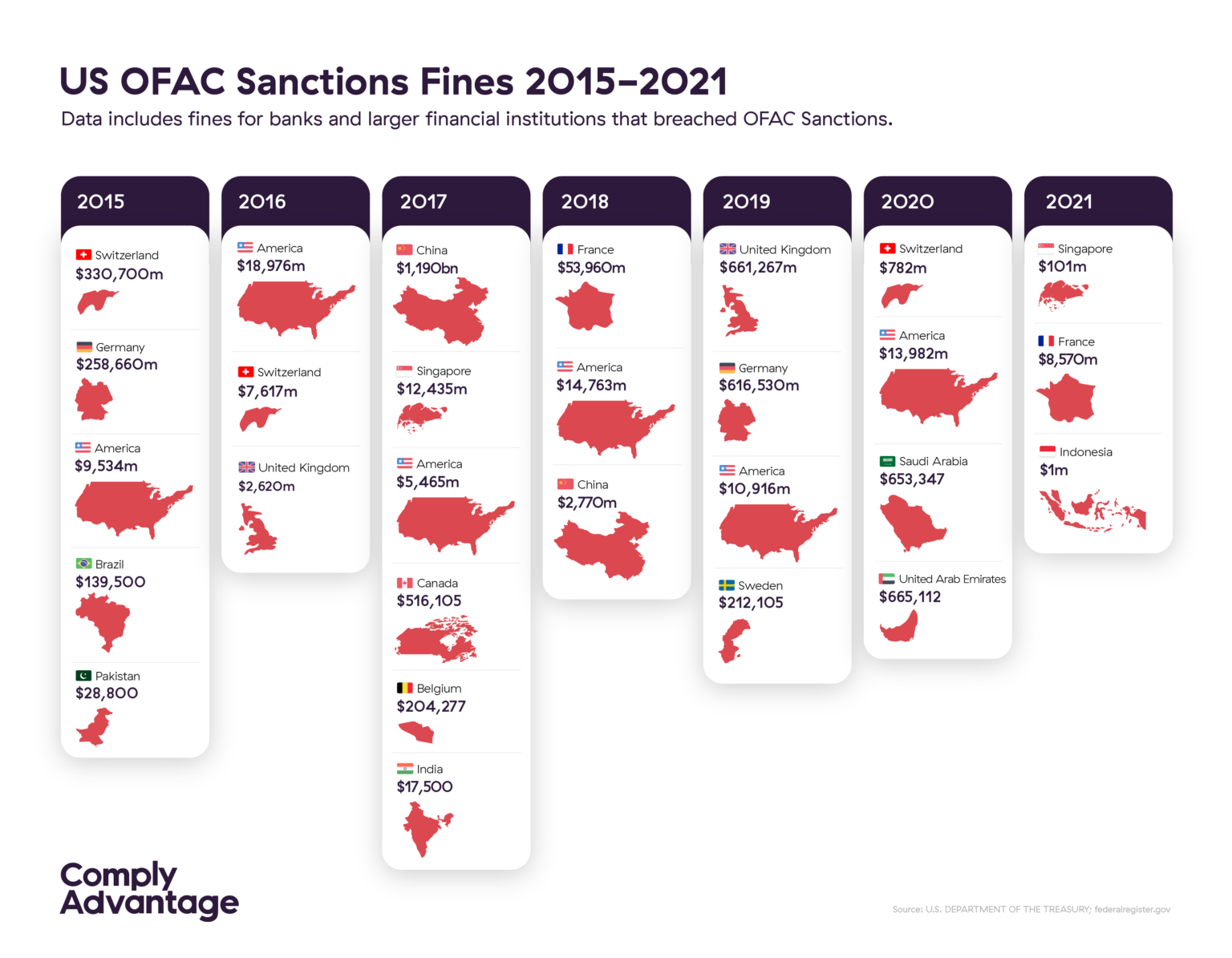

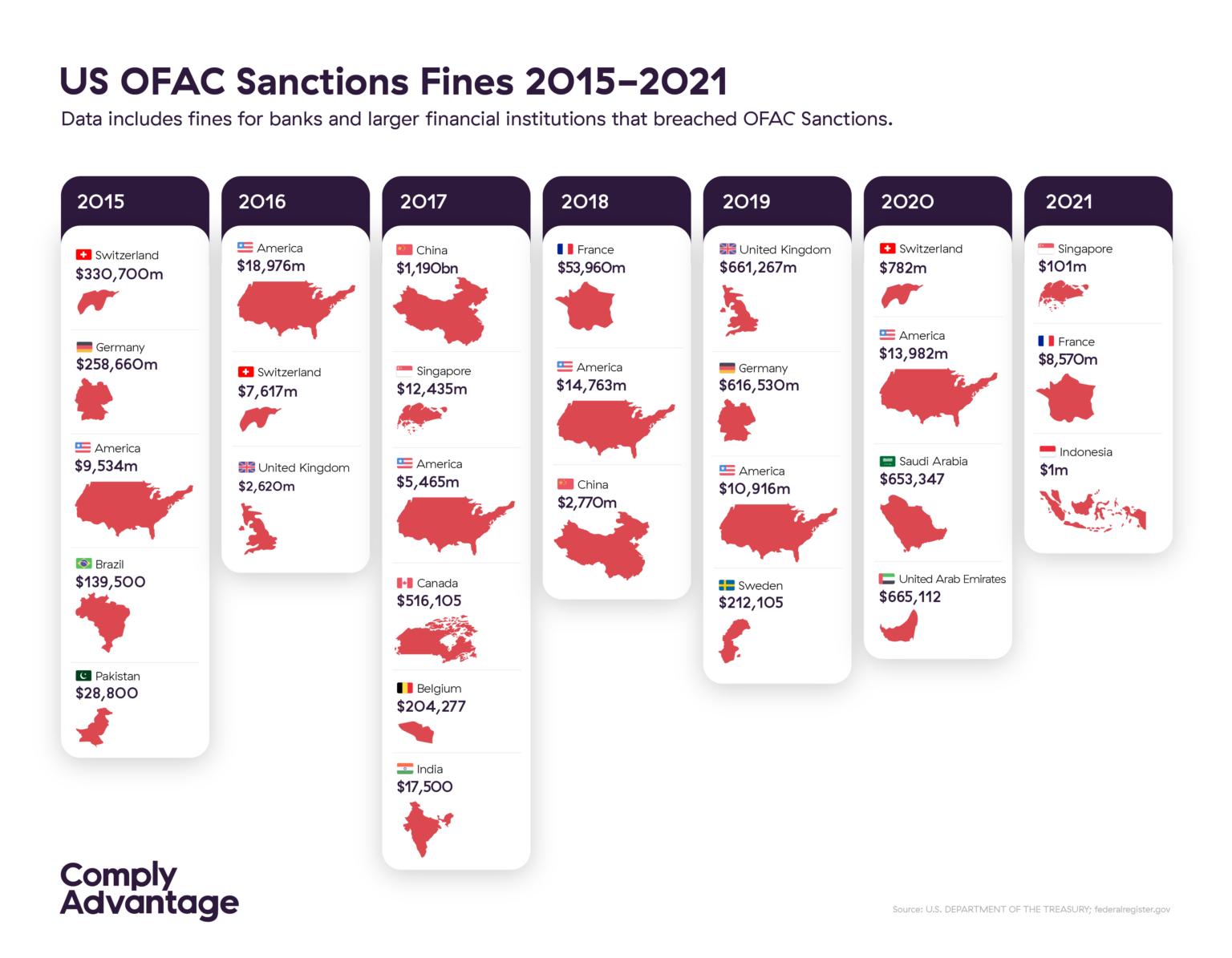

In order to comply with the United States Bank Secrecy Act (BSA), banks, financial institutions and other obligated businesses must implement sanctions screening measures as part of their AML/CFT program to ensure not to deal with criminals or sanctioned terrorists or with states that support crime and terrorism. OFAC sanctions are an important criterion in AML matters and companies that do not comply expose themselves to potentially severe financial and legal sanctions. Thus, in 2019, OFAC imposed a record number of fines for non-compliance on many international companies for an amount of almost$1.3 billion.

The values shown take into account fines imposed on banks and large financial institutions that have violated OFAC sanctions.

That’s why it’s important for companies doing business in the United States to understand how OFAC’s sanctions list works, to be aware of the potential fines they face for non-compliance. and that they know how to effectively check if their customers are on the list in order to avoid fines.

OFAC has been fulfilling its role of administering and enforcing US sanctions since 1950, when this Office was created to impose embargoes on Chinese and North Korean assets. Today, the United States uses economic sanctions to achieve diplomatic and humanitarian objectives around the world and lists the names of sanctioned entities and individuals on its Blocked Persons and Specially Designated Nationals (SDN) List . .

OFAC also maintains a Consolidated List that lists all non-SDN sanctions, although some data from this Consolidated List may also appear on the SDN list. Other OFAC sanctions lists include the Sectoral Sanctions Identification List (which targets Russia), the Foreign Sanctions Fraudsters List , and the Palestinian Legislative Council (non-SDN) List .

OFAC sanctions prohibit companies under US jurisdiction from transacting and dealing with entities and individuals on the sanctions lists. In concrete terms, this means that the institutions concerned must check whether their new customers appear on the sanctions lists each time they start a commercial relationship and continue to check the list periodically throughout this relationship.

Penalties for Non-Compliance with OFAC Sanctions: Violations of OFAC sanctions can have serious financial and criminal consequences. Indeed, fines for non-compliance can reach up to $20 million depending on the seriousness of the violation while additional fines can be imposed for violations of OFAC sanctions, including fines in excess of $1 million for violation of the Foreign Drug Lord Designation Act.

In addition to fines for non-compliance, violations of OFAC sanctions can also result in prison terms of up to 30 years.

OFAC sanctions screening is a significant compliance challenge and institutions must consider several unique factors when incorporating screening measures into their AML program:

Penalty Changes: OFAC’s Sanctions List changes regularly, with target names being updated, added, or removed . For this reason, institutions should monitor not only the OFAC list but also official government publications and relevant announcements regarding new sanctions, and adjust their internal screening process to manage any changes.

Naming Issues: The sanctions screening process must take into account the different naming conventions that characterize the targets on OFAC’s list. These conventions may concern regional spelling differences, missing vowels, contractions as well as the use of non-Latin characters. Additionally, the filtering process should consider targets that use assumed names or aliases to avoid detection.

Noise and false positives: Not all necessary identifiers are always available for targets on OFAC’s sanctions list, which can lead to numerous results, or even false positives, during the screening process. The risk of administrative noise and false positive identifications requires institutions to obtain as much unique identifying information about their customers as possible during the due diligence process.

OFAC has the authority to issue blanket licenses to establishments to authorize, under certain circumstances, dealings and commerce with sanctioned entities. Establishments must apply for a general license from OFAC or, failing that, make a written request for a specific license and accompany this request with all the necessary information .

When developing and implementing their internal AML program, financial institutions should consider the specific challenges of OFAC sanctions compliance. The recommendations of the Financial Action Task Force (FATF) and the Bank Secrecy Act (BSA) require institutions to put in place risk-based AML/CFT programs to meet their compliance responsibilities. Therefore, a meaningful OFAC sanctions compliance program must incorporate powerful and up-to-date OFAC sanctions screening tools as well as the following measures:

Smart Technology

Compliance with OFAC sanctions requires institutions to collect and analyze large volumes of data from a variety of sources. As manual management of this data is not realistic and inevitably leads to potentially costly human errors, establishments should instead seek to integrate appropriate intelligent technological tools that will enable them to comply with regulations.

Automated smart technology doesn’t just make OFAC sanctions compliance faster and more efficient. It also helps reduce the burden of remediating the spurious information and false positives so often generated by sanctions screening. Likewise, smart technology adds consistency to the LCB response. Indeed, institutions can use artificial intelligence and machine learning-based systems to manage unstructured data, detect patterns in their customers’ transactional behavior, and trigger alerts when customers deviate from established risk.

It only takes a few minutes to refresh our Sanctions Screening Tool, which filters through thousands of watchlists maintained by governments and authorities around the world and over 100 international and national sanctions lists.

Publié initialement 01 mars 2021, mis à jour 30 mars 2023

Avertissement : Ce document est destiné à des informations générales uniquement. Les informations présentées ne constituent pas un avis juridique. ComplyAdvantage n'accepte aucune responsabilité pour les informations contenues dans le présent document et décline et exclut toute responsabilité quant au contenu ou aux mesures prises sur la base de ces informations.

Copyright © 2023 IVXS UK Limited (commercialisant sous le nom de ComplyAdvantage)