Adverse Media Screening Solution

Adverse Media is a Competitive Advantage

Santander reduced the cycle time of applying for an account to opening it from 12 days to just 2. Resulting in an 80% reduction in effort for employees and freeing up time to better serve customers.

Get Started

Faster

Customer Onboarding

Enriched

Live Profiles

Reduced

False Positives

Seamless

API Integration

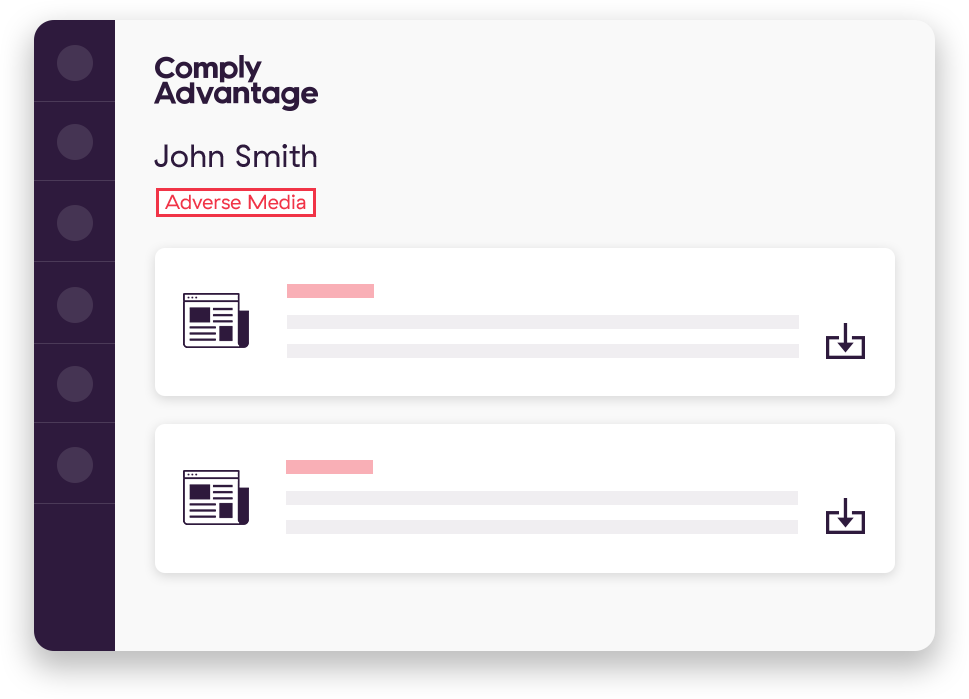

Stay ahead with machine learning

Don’t waste time and money working with the wrong tools. We are at the cutting edge of machine learning classification, collating all adverse information and media you need into comprehensive, structured profiles.

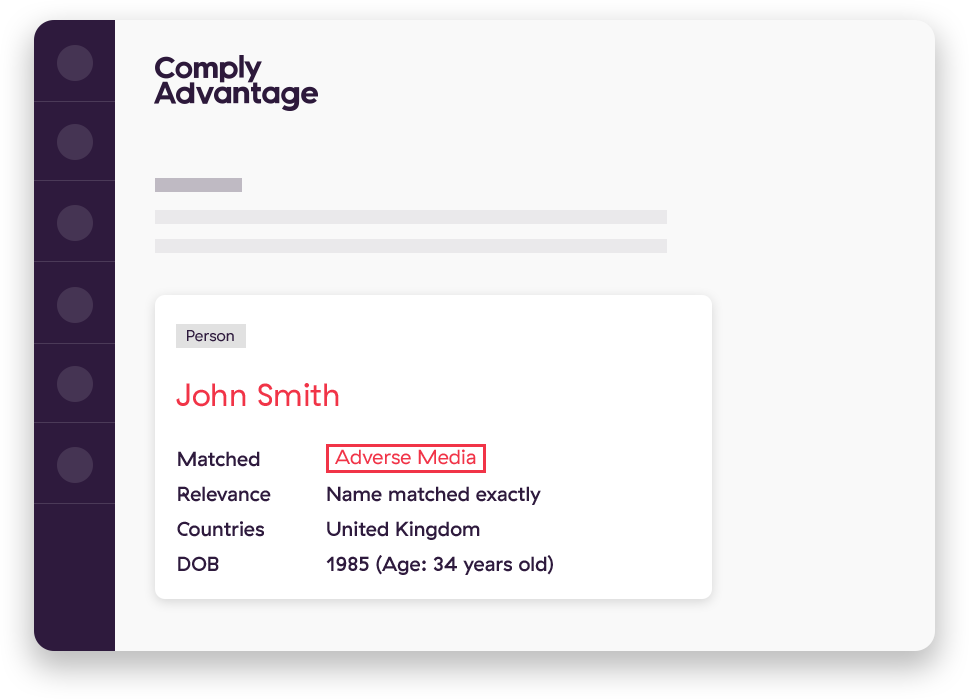

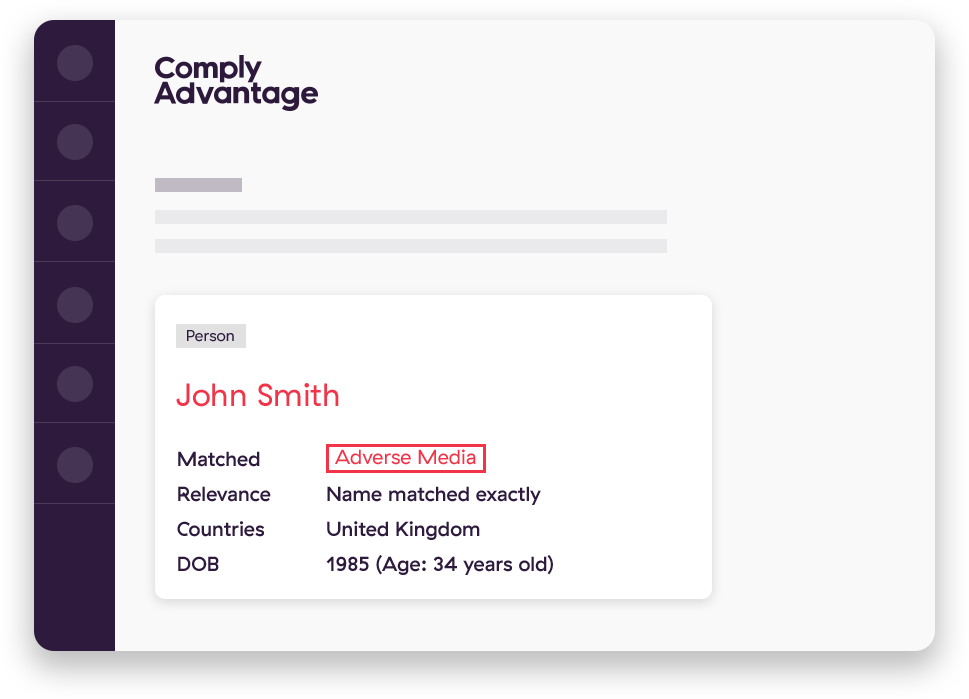

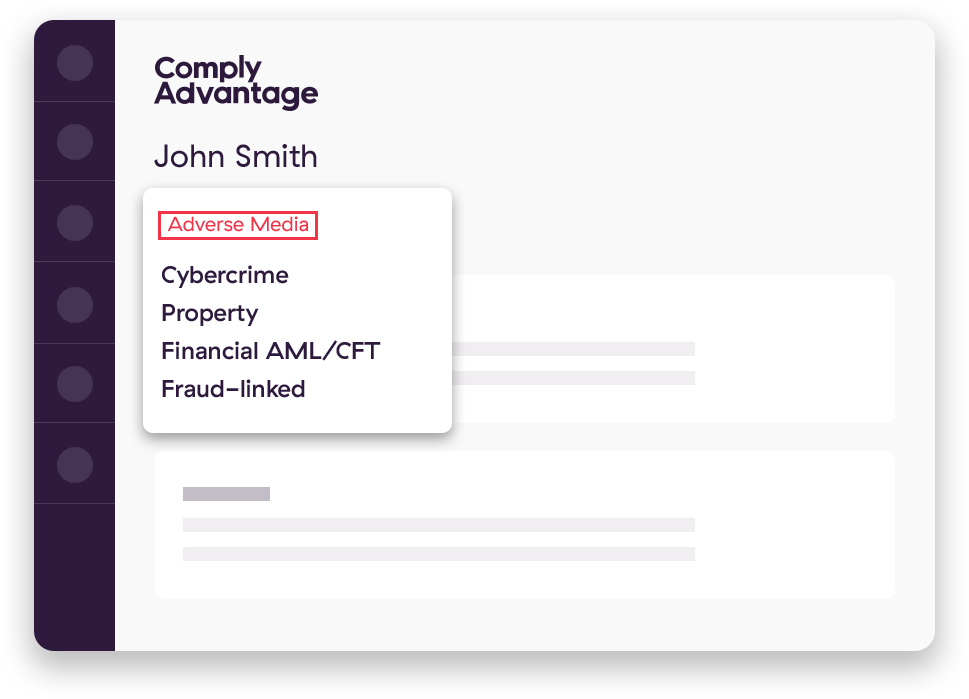

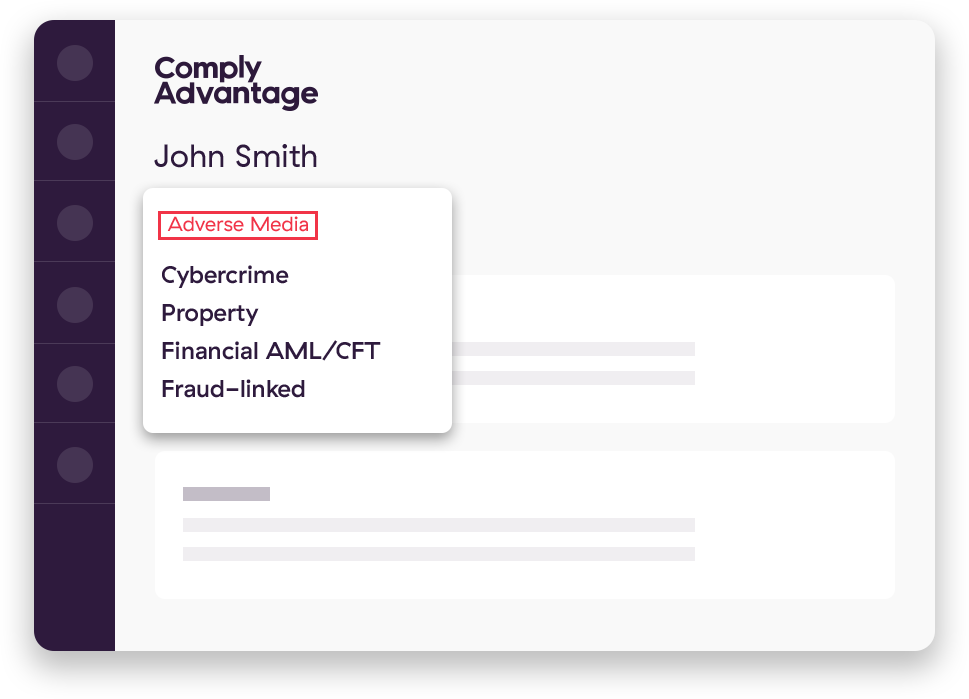

Cut through the noise

All the profiles in our data are accurately labeled with FATF aligned categorization, to speed up customer onboarding cycles and reduce false positives. Find Out More

Reduce the pain of ongoing monitoring

Be alert to changes in customer and organization risk status, with automated adverse information & media monitoring. AIM Insight is an enterprise-level solution with a powerful API and audibility. API Reference

AIM Insight

Find out how we approach analyzing billions of pages for adverse information and media on your customers.

Risk management can’t be holistic if it’s limited to isolated silos in your company.

Integrate our Sanction, Watchlist and PEP data to your KYC workflow and gain a more accurate profile of risk.

Ready to get started?