The Anti-Money Laundering Act of 2020 (AMLA) is the most significant anti-money laundering legislation passed by Congress in several decades. The Corporate Transparency Act (CTA) is part of AMLA which, in turn, is part of the National Defense Authorization Act enacted on January 1, 2021. The CTA provisions in the AMLA authorize the Financial Crimes Enforcement Network (FinCEN) to collect beneficial ownership information and disclose it to appropriate recipients, including federal law enforcement.

The AMLA (including the CTA) provides for:

- establishment of a beneficial ownership registration database

- expanded authority to subpoena foreign banks

- new penalties for misrepresenting or withholding information

- streamlined automated filing of non-complex suspicious activity reports

- expanded whistleblower rewards and protections

- expanded regulatory oversight

- establishment of national AML priorities

- information sharing with foreign branches, subsidiaries, and affiliates

- further government analyses, studies, reports, and rules

Recent FinCEN Proposal

FinCEN has recently issued an Advance Notice of Proposed Rulemaking (ANPRM) to request comments from the public related to the implementation of the reporting of beneficial ownership information as required by the CTA.

The notice is the first step in a number of actions that FinCEN will take regarding the implementation of the CTA. The CTA provisions in AMLA require certain entities to submit beneficial ownership information to a national registry and authorize FinCEN to disclose the information to appropriate recipients, such as federal law enforcement. The reporting requirement is intended to enhance the national security of the United States by creating more transparency regarding the individuals who ultimately own or control the companies required to report. The proposed changes are designed to make it more difficult to use entities to obscure ownership while conducting money laundering, drug transactions, terrorist financing, human trafficking, tax fraud, and other deceptive or illegal activities.

FinCEN encourages all interested parties, particularly those that would be affected by the beneficial ownership reporting provisions or would need access to the beneficial ownership information database, to submit written comments regarding the proposed rules.

Beneficial Ownership Registration for Business Entities

The CTA requires FinCEN to maintain beneficial ownership information reported by certain business entities in a confidential, secure, and non-public national registry. Many other countries have such a registry, but prior to AMLA there was no US requirement for companies to provide information regarding beneficial ownership to a state or federal database. Supporters of this provision believe that the lack of beneficial ownership reporting has provided a loophole for criminals to conduct business and transfer money through opaque ownership structures.

In accordance with the law, beneficial ownership information cannot generally be disclosed by FinCEN except to law enforcement or federal agencies conducting national security, intelligence, or law enforcement activities for use in performing their duties. Additionally, state and local law enforcement agencies can request access to this information if a “court of competent jurisdiction” has authorized the agency to request this information in a criminal or civil investigation.” Financial institutions can also obtain beneficial ownership information from the database to conduct customer due diligence requirements, with the consent of the reporting company.

Changes to Customer Due Diligence Process

The CTA requires the Treasury to revise the Customer Due Diligence Requirements for Financial Institutions (CDD) rule within one year, in order to eliminate customer due diligence requirements for financial institutions that are unnecessary or duplicative as a result of the new requirements for beneficial ownership by reporting companies.

The CDD rule requires covered financial institutions to identify and verify the identity of their customers. This includes identifying each natural person that directly or indirectly owns 25% or more of the equity interests of a legal entity customer and identifying at least one natural person that has “significant responsibility to control, manage or direct” a legal entity customer. It also includes maintaining risk-based procedures to verify the identities of those persons, which includes at least all of the elements currently required under the Customer Identification Rule.

The CDD rule also requires covered financial institutions to obtain a certification from the individual opening an account on behalf of a legal entity that identifies any individuals who meet the definitions under the ownership or control prongs.

The CDD rule requires such institutions to, on a risk basis, maintain and update customer information by establishing policies, procedures, and processes for determining whether and when, on the basis of risk, to update customer information to ensure that customer information is current and accurate.

The CTA amends the Bank Secrecy Act and imposes comprehensive new beneficial-ownership reporting requirements on the reporting companies. This will significantly expand beneficial ownership reporting requirements beyond what is currently required under the CDD Rule. Although there are similarities between the two requirements, the new CTA reporting requirements are broader and will change the responsibilities of the financial institution by shifting some of that responsibility to the reporting company.

It is anticipated that, upon implementation of the national registry by FinCEN, financial institutions will be able to depend on the reporting companies to supply beneficial ownership and control information. Therefore, institutions will no longer need to contact the customer to obtain this information. The reporting companies will also be required to update the reported information in the FinCEN registry, so it is expected that financial institutions will be able to rely on the updated information provided directly to FinCEN rather than contacting the customer.

Reporting Companies

The definition of a “Reporting Company” includes all private, for-profit entities that are not otherwise required to register with the SEC, the CFTC, or a state insurance authority and employ fewer than 20 full-time employees and report less than $5 million in revenue on their federal income tax returns. The definition includes corporations, limited liability companies, and other entities that meet the above specifications.

The definition of a “Beneficial Owner” is an entity or individual who directly or indirectly owns or controls 25% or more of the entity’s ownership interest or has substantial control over the entity.

A reporting company must provide certain information to the FinCEN database for each “beneficial owner,” including the owner’s (i) full legal name, (ii) date of birth, (iii) current residential or business address, and (iv) the unique identifying number of an acceptable identification document (for example, a driver’s license or a passport).

Time Frame for Reporting

The time frame for Reporting Companies to provide beneficial ownership information depends on the date of formation of the entity. Reporting Companies formed before the effective date of the AMLA are required to report beneficial ownership information within two years of the effective date of the AMLA requirement.

Reporting Companies formed after the effective date of the AMLA must report beneficial ownership information at the time of the entities’ formation. Reporting companies must also update their disclosures within one year of any change in ownership or control. Any violation of the AMLA beneficial ownership reporting requirements by a reporting company may result in civil and criminal penalties, including the imposition of monetary fines of up to $10,000 and imprisonment for up to two years.

The Effects of Expanded Subpoena Power

The AMLA provides for the expansion of U.S. law enforcement’s ability to subpoena bank records from foreign financial institutions that maintain a correspondent banking relationship in the United States. Previously, the US DOJ or Treasury could issue subpoenas to request records limited to correspondent accounts of a foreign bank maintained in the U.S.

Under AMLA, the authorization is expanded to include the power to subpoena records relating to any account at a foreign bank that is the subject of an anti-money laundering investigation, a civil forfeiture action, or any federal criminal investigation. The revised statute also requires foreign banks to authenticate the requested records, making it easier for prosecutors to use the records as evidence in court. If the bank fails to comply with the subpoena requirements of the statute, the government may assess civil penalties of up to $50,000 per day and seek an order from a U.S. district court compelling the foreign bank to appear and produce records or be held in contempt of court. The consequences of these new provisions are potentially significant. The changes are designed to allow federal investigators to obtain foreign bank records through subpoena power rather than having to rely only on international treaties or cooperation agreements.

Although the law is primarily aimed at combatting money laundering, the broad scope of the statute’s language regarding subpoena power relating to “any investigation of a violation of a criminal law of the United States” means that it can and likely will be used by law enforcement in other matters involving criminal conduct, including high-profile white-collar crimes such as tax evasion, foreign corrupt practices, money laundering by foreign persons, as well as international drug trafficking and national security violations.

However, there are some potential limitations on the expanded subpoena power, including conflicting local bank secrecy and confidentiality statutes, interpretations related to jurisdiction, and judicial review of the burden posed by a specific subpoena. It will be up to the courts to determine the enforceability of a subpoena issued in accordance with AMLA.

1970 to 2021: The Anti Money Laundering Act Timeline: Our US AML Act timeline sets out the most significant moments of AML regulation in the United States, from the introduction of reporting and record-keeping requirements in 1970 to the response to terrorism threats and emerging fintech and cryptocurrency risks in the 21st century.

PEPs, SFPFs and Entities of Primary Money-Laundering Concern

The AMLA contains provisions prohibiting politically exposed persons (PEPs) from falsifying the source of funds, ownership or control of assets, or concealing or misrepresenting such information to a financial institution. Any violations of the above prohibitions are subject to fines, imprisonment, or forfeiture. Entities that are of primary money-laundering concern face similar prohibitions.

Neither Bank Secrecy Act/Anti-Money Laundering (BSA/AML) regulations nor the AMLA defines the term “Politically Exposed Person”. However, US government agencies have stated that they do not interpret the term to include U.S. public officials. The term “PEP” is customarily used in the financial industry to refer to foreign individuals who are or have been entrusted with a prominent public function, as well as their immediate family members and close associates. By virtue of their position or relationship, such individuals may pose a higher risk that their funds may be the proceeds of corruption or unlawful activities.

Although due diligence must be performed on accounts and transactions conducted by PEPs, not all such transactions and accounts are necessarily higher risk. The level of risk associated with PEPs varies in accordance with the country of legal residence, the prior history associated with the individual, and the type of activities conducted by the individual.

FinCEN provides guidance that PEPs should not be confused with the term “Senior Foreign Political Figure” (SFPF), which is defined under the BSA regulations. FinCEN guidance states that Senior Foreign Political Figures are a subset of PEPs.

BSA regulations define the term Senior Foreign Political Figure as “a current or former senior official in the executive, legislative, administrative, military or judicial branches of a foreign government (whether elected or not); a senior official of a major foreign political party; or a senior executive of a foreign government-owned commercial enterprise; a corporation, business, or other entity that has been formed by, or for the benefit of, any such individual; an immediate family member of any such individual; and a person who is widely and publicly known (or is actually known by the relevant covered financial institution) to be a close associate of such individual.”

In the United States, AML obligations with respect to PEPs include specific enhanced due diligence obligations for private banking accounts that are established, maintained, administered, or managed in the United States for senior foreign political figures, and general due diligence procedures required for all politically exposed persons. Applicable due diligence policies should be incorporated into the financial institution’s anti-money laundering program.

Expanded Whistleblower Rewards

Formerly, the Department of the Treasury had the discretion to distribute awards to whistleblowers but not the obligation to award payments. Payments were capped at $150,000 and, as such, were said to have little impact on money laundering enforcement.

AMLA seeks to change that by eliminating the government’s discretion to pay an award and mandating payments, increasing the potential amount of whistleblower awards, and providing additional protection specific to money laundering whistleblowers. The protections are modeled after the Dodd-Frank Wall Street Reform and Consumer Protection Act’s (DFA) provisions. As expected, certain classes of individuals, such as regulatory and law enforcement officials and those who participated in the wrongdoing, are prohibited from receiving an award.

AMLA eliminates the $150,000 cap on BSA/AML whistleblower awards, replacing it with a payment ceiling of 30 percent of the government’s collection if the monetary sanctions imposed exceed $1 million. Factors to be taken into consideration by the government when deciding the amount of the award, including the significance of the information, the degree of assistance provided, and the programmatic interest of Treasury in deterring violations, mirroring the factors provided in the DFA.

Certain limitations in the new law may, however, have the effect of lessening the impact of the whistleblower awards. The monetary sanctions on which rewards will be calculated exclude payments for forfeiture of assets, restitution, and victim compensation. This may significantly limit the size of a whistleblower award because large forfeiture judgments are generally sought by the government when resolving BSA/AML matters.

Expanded Protections for Whistleblowers

New whistleblower protections prohibit employers from engaging in retaliatory acts, such as discharging, demoting, threatening, or harassing employees who provide information relating to money laundering or BSA violations to the Attorney General, Secretary of Treasury, regulators and others. This provision was also modeled after the provisions contained in the DFA. In addition, internal whistleblowers who report suspected wrongdoing to their employer, rather than the government, are afforded protection under the Act.

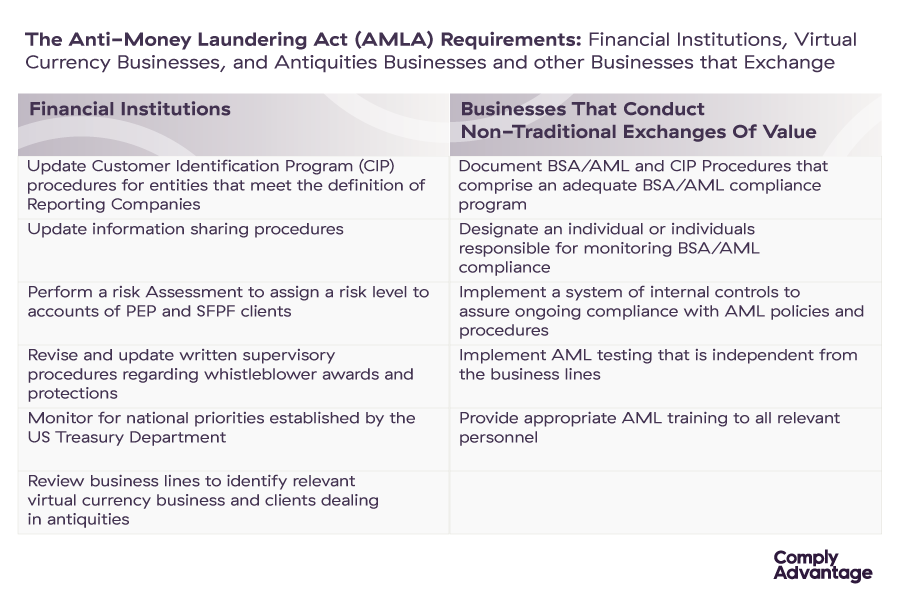

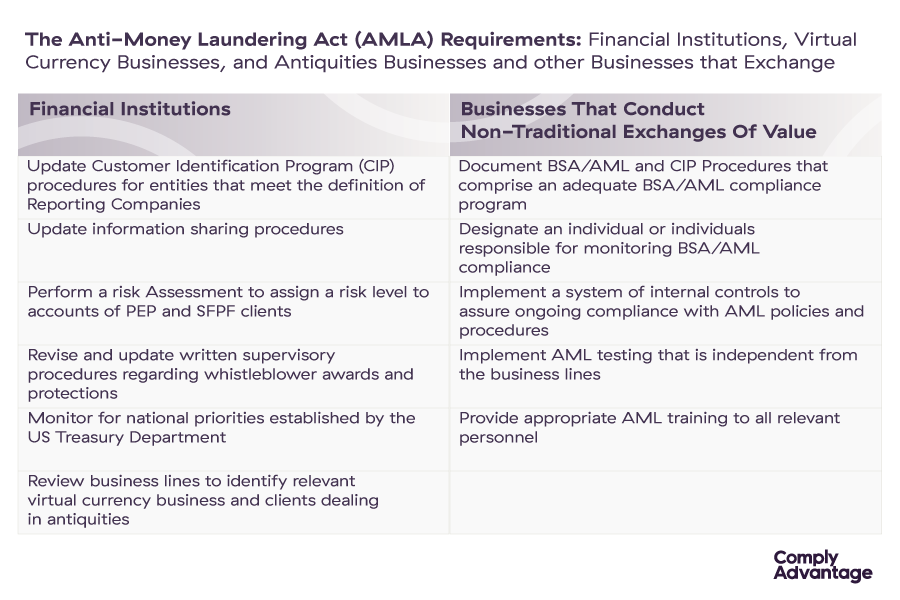

Expanded Regulatory Oversight

AMLA expands BSA to regulate businesses that conduct non-traditional exchanges of value including virtual currencies and antiquities. AMLA provisions state that individuals and entities that exchange or transmit value using a product that substitutes for currency (for instance, cryptocurrency) are subject to BSA registration and compliance requirements. AMLA also amends the definition of “financial institution” to include entities conducting antiquities businesses.

AMLA provides for Congressional oversight of deferred prosecution agreements and non-prosecution agreements relating to BSA. AMLA mandates the Department of Justice to submit annual reports to Congress containing details of the deferred prosecution agreements and non-prosecution agreements relating to BSA violations that were entered into, amended or terminated with any person during that year.

AMLA requires a study by Congress of the practice of causes and effects of “de-risking” by financial institutions. Many financial institutions have instituted a practice of “de-risking” by minimizing or terminating business relationships instead of managing the risk of customers deemed to pose higher risks to the business. The Comptroller General of the United States has been directed to study the causes of de-risking and the effects on the economy.

Impact on Compliance Programs and Reporting

The AMLA requires the Treasury Department to establish national priorities to enhance anti-money laundering and counter terrorist financing. The AMLA also requires financial institutions to incorporate the identified priorities into their risk-based AML compliance programs. Regulators will be encouraged to examine institutions’ AML programs for compliance with the stated national priorities.

Information Sharing

The AMLA provides financial institutions with the ability to share AML/BSA-related information with their foreign branches, subsidiaries, and affiliates. The AMLA codifies prior guidance authorizing financial institutions to work together to share information with other financial institutions to provide information regarding potential suspicious activity and help enhance AML/BSA compliance. Treasury and FinCEN are required to conduct a three-year pilot study regarding information sharing. The Treasury and other supervising agencies will establish “best practices” for these information sharing arrangements.

Additional Provisions

AMLA contains several additional provisions, including requirements for the Department of Justice to submit an annual report to the Treasury containing metrics and information on the use of data from financial institutions filing suspicious activity reports. Treasury will use this information to assess the usefulness of such reporting to law enforcement agencies and provide feedback to the financial institutions.

In addition, AMLA requires:

- FinCEN to establish streamlined automated processes for filing noncomplex suspicious activity reports

- Treasury to conduct a study as to whether the current dollar thresholds for CTR and SAR filing are appropriate or should be adjusted.

- Treasury to issue rules regarding the standards for testing technology used to comply with the BSA/AML laws.

Full Effect of AMLA

The AMLA provisions comprise approximately 1,500 pages of updates to the BSA and AML laws providing new requirements and guidance regarding AML and counter terrorist financing. Many of the sections of the statute require government agencies to conduct further analyses, actions, studies and reports. Therefore, the full effect of AMLA on financial institutions and private companies can be evaluated only after AMLA has been fully implemented, but AMLA will likely have a broad impact on the way that the government investigates and prosecutes financial crimes.

Request a Demo: Speak to our experts to explore our compliance tools and ensure your business is protected