The deadline for the private sector to implement the 6th Money Laundering Directive (6AMLD) is looming. Financial institutions and companies that must comply with the regulations are expected to comply with requirements by 3 June 2021. While the European Commission (EC) has not reported on how well member states have implemented the 6AMLD into national law, it is essential that firms operating in the European Union are ‘6AMLD ready’. Because the 6AMLD takes the EU back to fundamental issues about the nature and scope of money laundering as an offence, it is important to consider the impact of 6AMLD on the regulatory environment as well as the ability for firms to comply. The directive itself does not create new financial crime risks but provides further details on a wide range of risks to consider. It also creates greater negative consequences where money laundering and terrorist financing risks are not properly mitigated by regulated firms. This article looks at the changes introduced by 6AMLD, including a high-level overview of the 6AMLD, details of the predicate offenses and how firms and individuals could be penalized for AML/CFT failings, and what this means for firms.

The 6AMLD was introduced in October 2018, only a few short months after the 5AMLD was adopted in May 2018. This was largely in response to the Danske Bank scandal that saw the laundering of EUR200 billion and whose effects still reverberate to this day. The EU recognized that “money laundering remains a serious problem,” damaging the reputation, stability and integrity of the financial system but also continues to pose a security threat in Europe. The 6AMLD was developed to tackle money laundering more effectively using criminal law to facilitate cross-border cooperation. The Directive states that it “aims to criminalise money laundering when it is committed intentionally and with the knowledge that the property was derived from criminal activity” and to introduce “dissuasive sanction.”

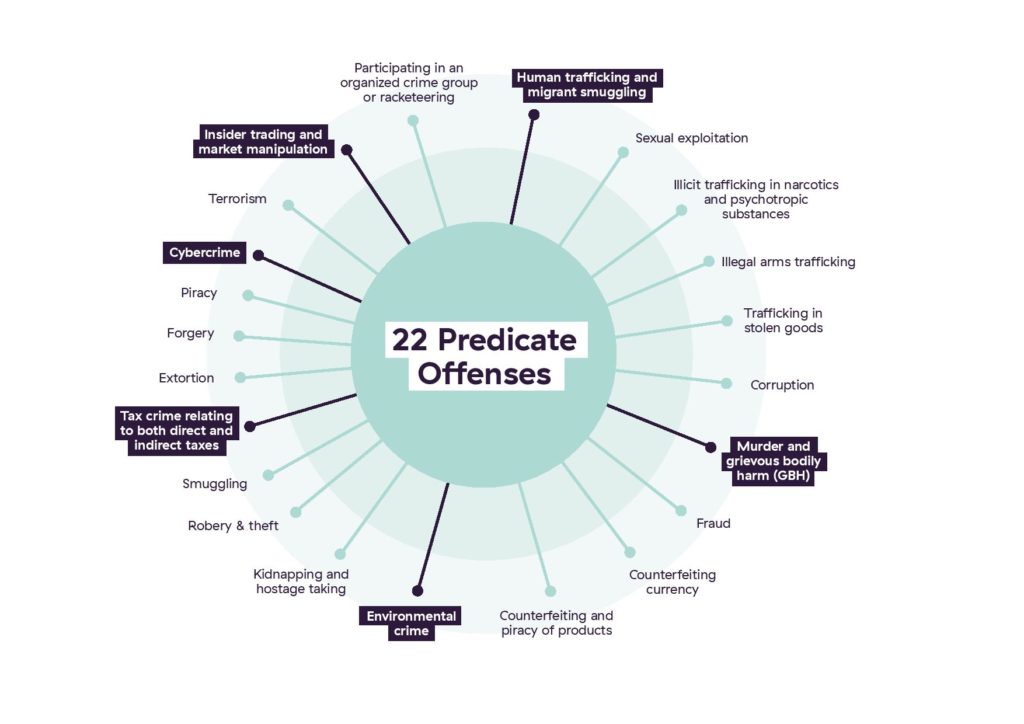

The 6AMLD introduced some key definitions as well as 22 predicate offenses for money laundering. By developing a more comprehensive legal framework, the EU intends to generate uniformity in the criminalisation of money laundering across all member states and address barriers to international legal cooperation on AML/CFT. The term ‘criminal activity’ was defined as “any kind of criminal involvement in the commission of any offence punishable” by imprisonment for more than 6 months or one year (dependent on the jurisdiction) in line with national law. The EU also defined criminal property as criminally-derived “assets of any kind,” not just fiat.

In the context of money laundering, a predicate offense is a criminal act whose proceeds can be prosecuted under any of the money laundering offenses. While many of the crimes listed may be relatively familiar, such as drug trafficking, fraud, counterfeiting, terrorism, extortion, etc., 6AMLD established numerous new crimes for consideration highlighted in the diagram below.

The 6AMLD stated that any criminal offense under national law should also be considered a predicate offense for money laundering. It further introduced the concept of ‘extraterritoriality,’ meaning that countries could prosecute conduct that would be a crime if it had taken place at home or if the offender is a national of that country. 6AMLD clarified that countries could trigger an investigation if an offense is committed “in part on its territory,” which could apply to data server.

The 6AMLD formally detailed the key money laundering offenses countries should criminalize and widened the scope of what should be considered an offence. Offences are listed below:

6AMLD created an additional offense of “aiding and abetting, inciting and attempting” any of the aforementioned offences, specifically targeting professional enablers and gatekeepers,

and introduced the concept of ‘self-laundering,’ which is where a criminal cleans the proceeds generated by his or her criminal activity. The changes are intended to focus attention on the professional enablers of money laundering schemes and otherwise ‘innocent’ criminal associates who might cooperate in the hiding of illicit assets. However, it might have consequences for financial institutions and other obligated firms that make egregious and ongoing failures in their AML/CFT programmes. The 6AMLD also makes it clear that criminal conviction of the predicate offense is not essential for bringing action against those suspected of committing any of the money laundering offenses.

6AMLD extends liability from individuals to businesses. It provides wider grounds for the prosecution of firms, including the failure of senior management to prevent money laundering by more junior members of staff. Businesses can still be liable even if the ‘controlling mind’ responsible for the offence has not been identified or convicted. The concept of corporate failure to prevent money laundering or terrorist financing does not prevent the ability of countries to initiate criminal proceedings against individuals working in a firm.

6AMLD introduces tougher punishments against individuals and corporates that are “effective, proportionate and dissuasive.”The civil and criminal punishments for individuals increased the maximum prison sentences from one to four years and other measures might include fines, bans on running for public office or professional disqualification. For corporates, measures range from being barred from accessing public funding to the temporary closure of business units involved in money laundering, freezing and confiscation of assets, through to full business closure.

There are a range of implications for firms in scope under 6AMLD. This includes firms with operations in Europe or firms who have EU nationals as employees carrying out business that could be in breach of the predicate offenses, even if those offenses have not been criminalized locally. Overseas firms need to ensure that as part of their business-wide risk assessments, they can identify EU operations, employees and clients to ensure that they can measure their exposure to the EU regulatory and legal risks. The introduction of the new offenses is particularly important for ‘Designated Non-Financial Businesses or Professions’ (DNFBPs) in the corporate services, legal, accountancy and professional services sectors – effectively any business that provides advice and support to others on issues such as company formation, organisation or the structuring of corporate finances (tax evasion being a predicate offence too). Financial institutions and virtual assets service providers (VASPs) are also under the spotlight and the introduction of corporate criminal liability means that firms must have in place AML/CFT programmes that comply with EU and local laws that are subject to on-going assurance testing and review.

Depending on the nature of business, client base, business operations, etc., 6AMLD might increase the scope and depth of what financial crime risk means for a firm. While firms are not necessarily expected to carry out a risk assessment against all 22 predicate offences, firms should nevertheless understand their potential exposure. Once firms carry out their business risks assessments looking at their client types, products, jurisdiction, delivery channels and operations, they need to assess their AML/CFT frameworks. This could trigger changes to Client Due Diligence (CDD)/Know Your Customer (KYC) and client risk assessments at onboarding and on an ongoing basis to ensure that the firms controls remain commensurate. This may also require a wider use of technology and controls such as Adverse Media Screening (AMS) and Transaction Monitoring that can detect predicate offenses.

Given the criminal and civil sanctions introduced for both entities and individuals, firms need to ensure that they have a systems and controls inventory in place and that staff receive training that is specific to their roles. In the worst-case scenarios, failure could lead to the end of careers, potential imprisonment and the end of businesses. Saying that ‘I did not know’ will not be an adequate defence. The introduction of 6AMLD might eventually open the possibility for more corporate criminal prosecutions for AML failures in EU countries. 6AMLD should thus concentrate minds amongst senior managers about whether their business is doing enough to manage financial crime risks effectively as a whole.

For further details on 6AMLD, please check out our previous report on 6AMLD. The report provides some pointers on how to think about risks for the business, and how you might conduct a risk assessment to look at strategic issues.

Originally published 04 May 2021, updated 17 November 2021

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2023 IVXS UK Limited (trading as ComplyAdvantage).