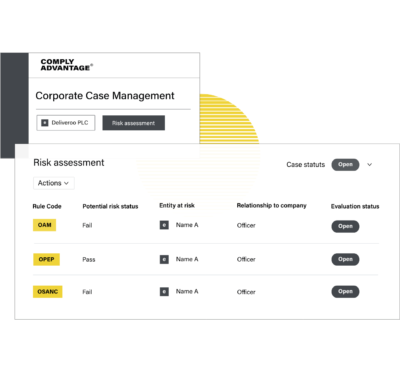

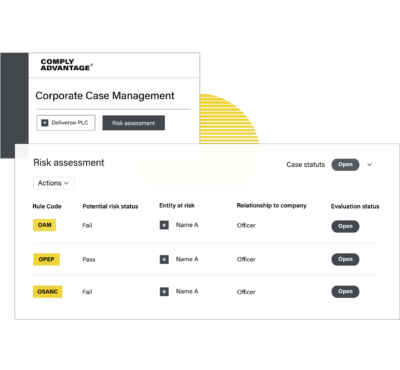

Relationship identification uses AI to expose hidden connections & find new risks

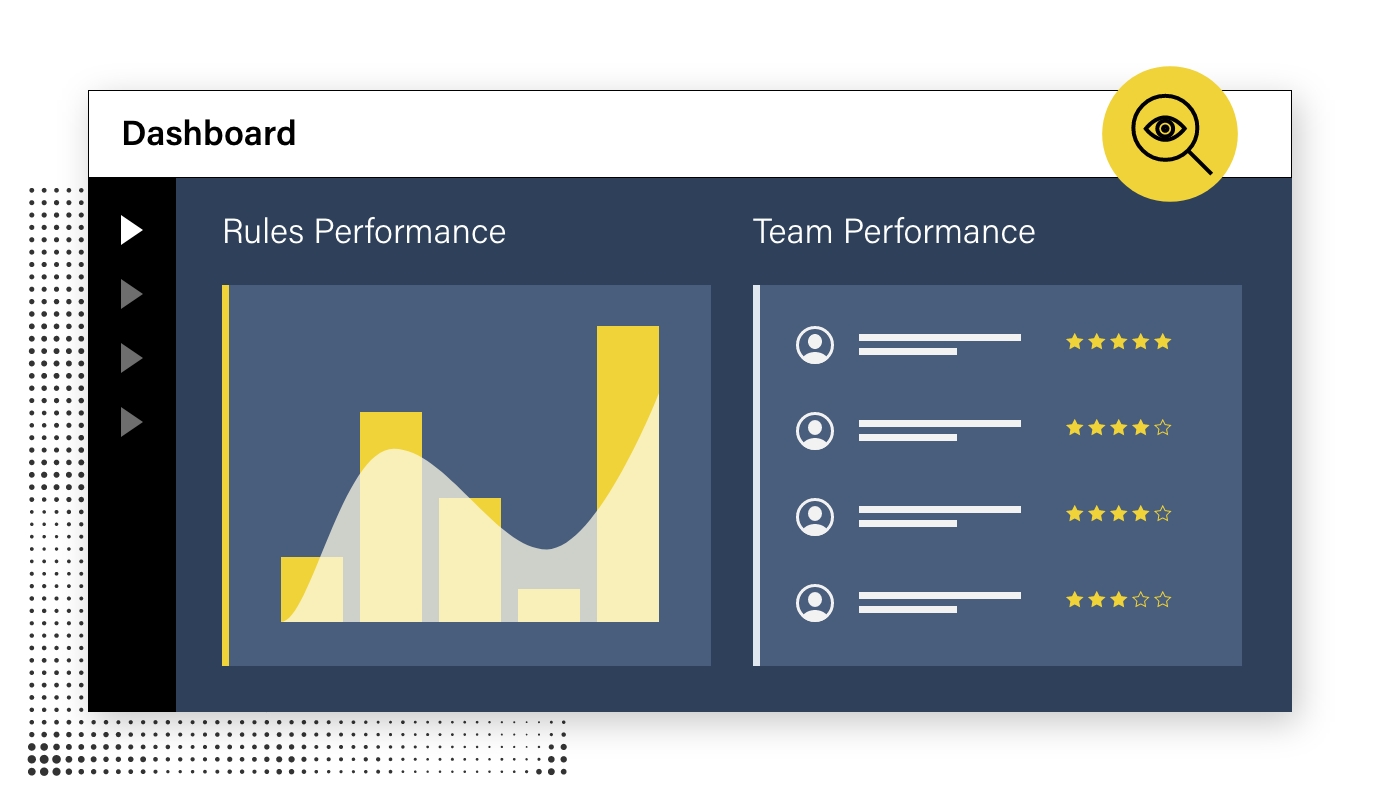

Behavioral analytics to detect financial crime with greater insights, for any scenario

Transaction Screening using the most up-to-date global sanctions data available

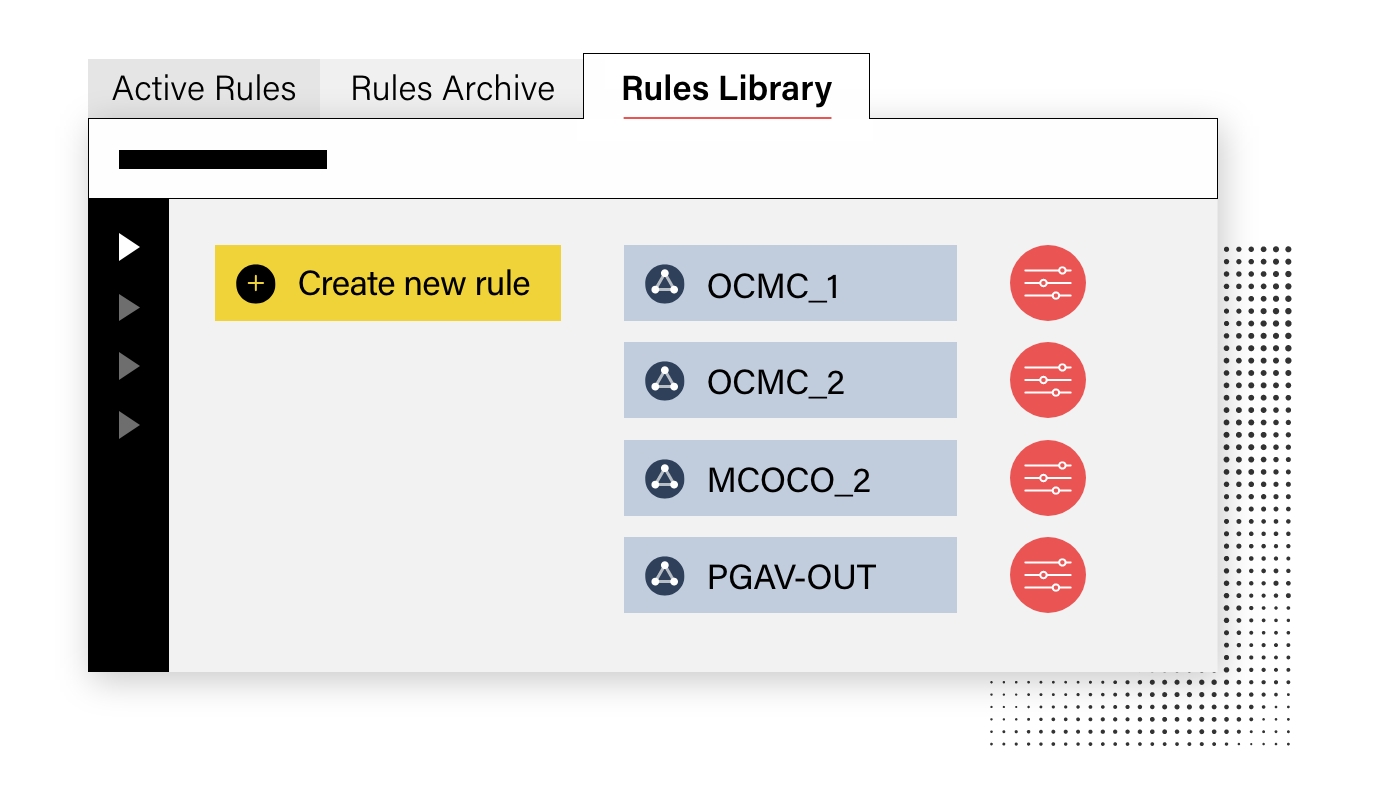

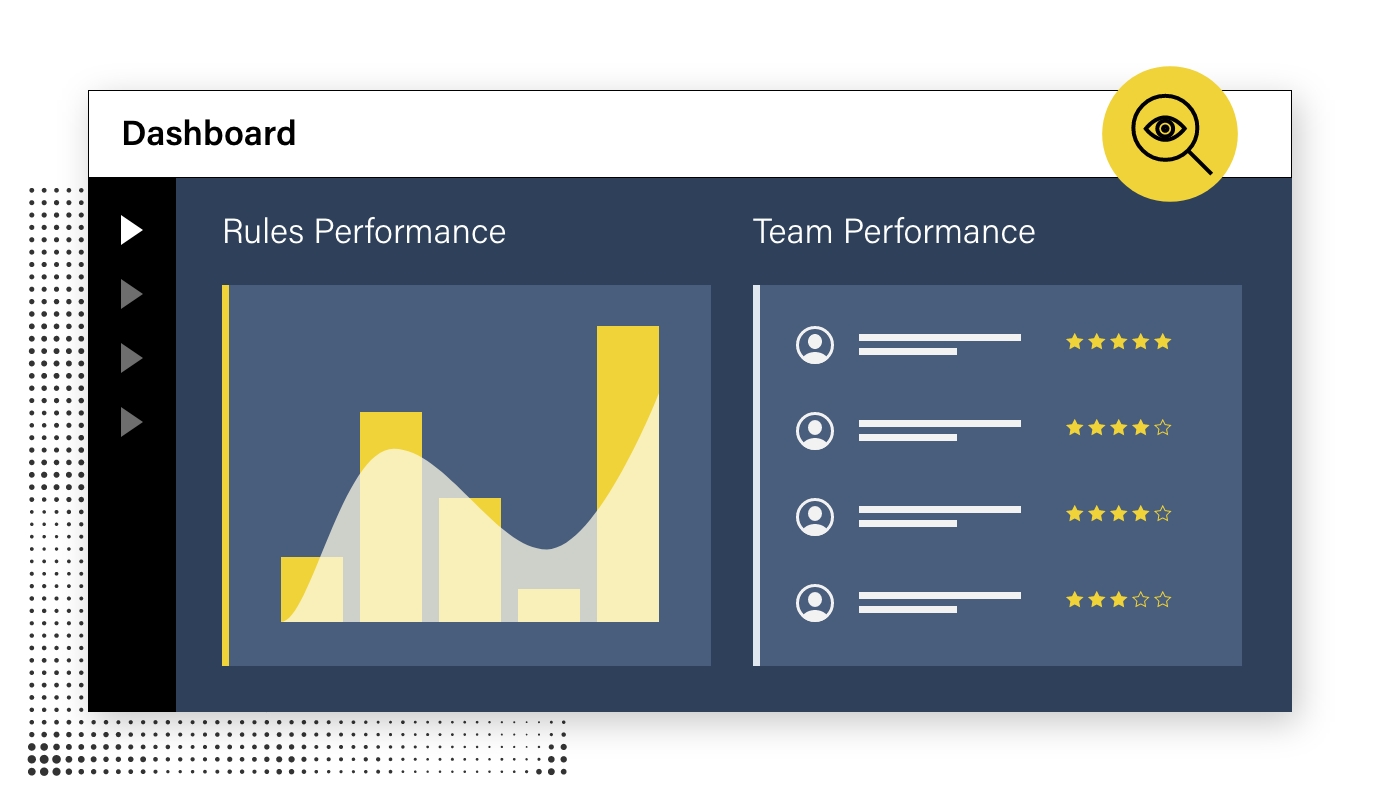

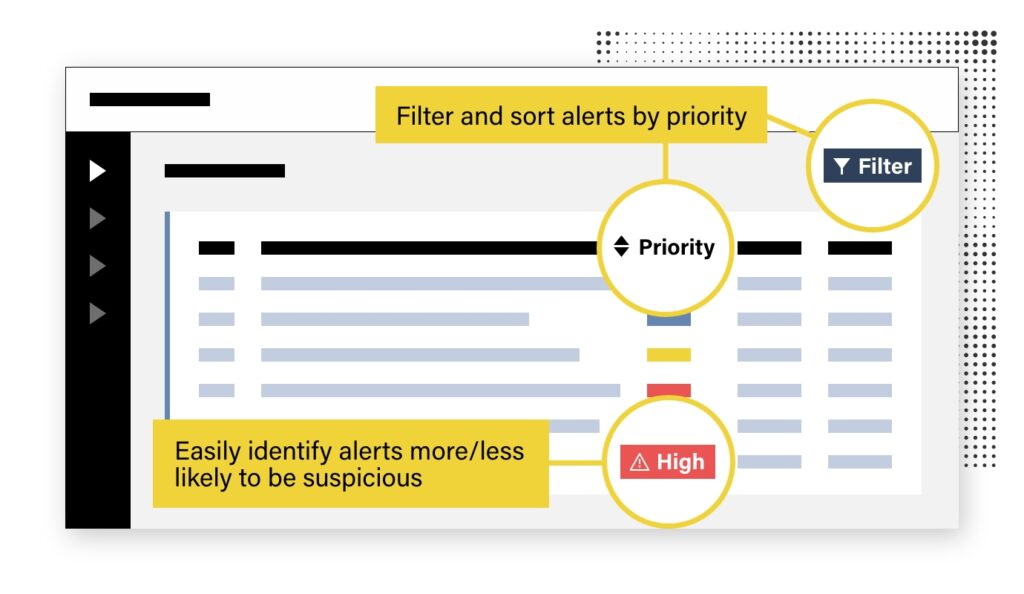

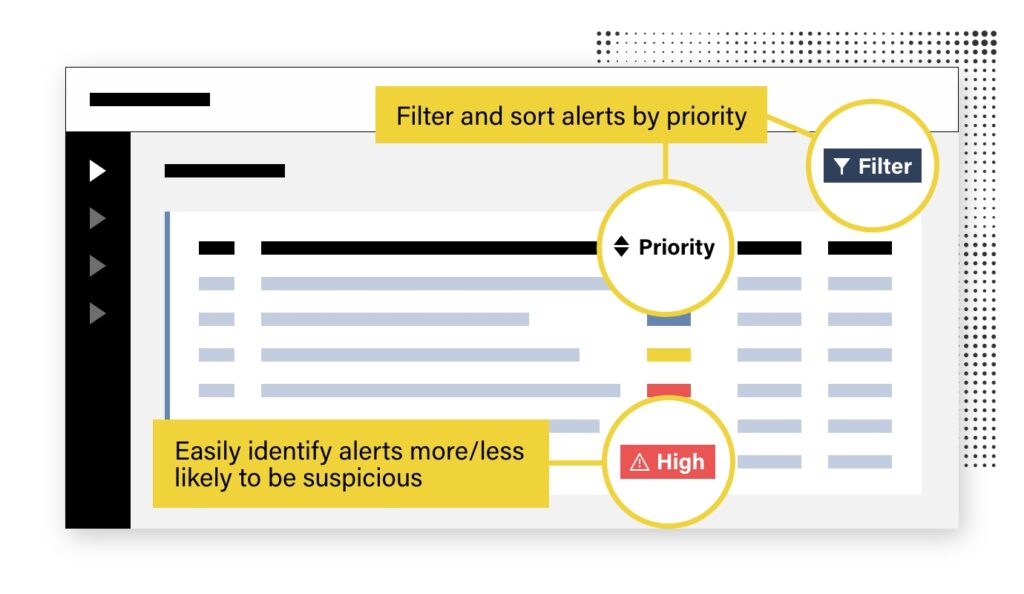

Automatically monitor transactions to detect suspicious behavior and reduce false positives

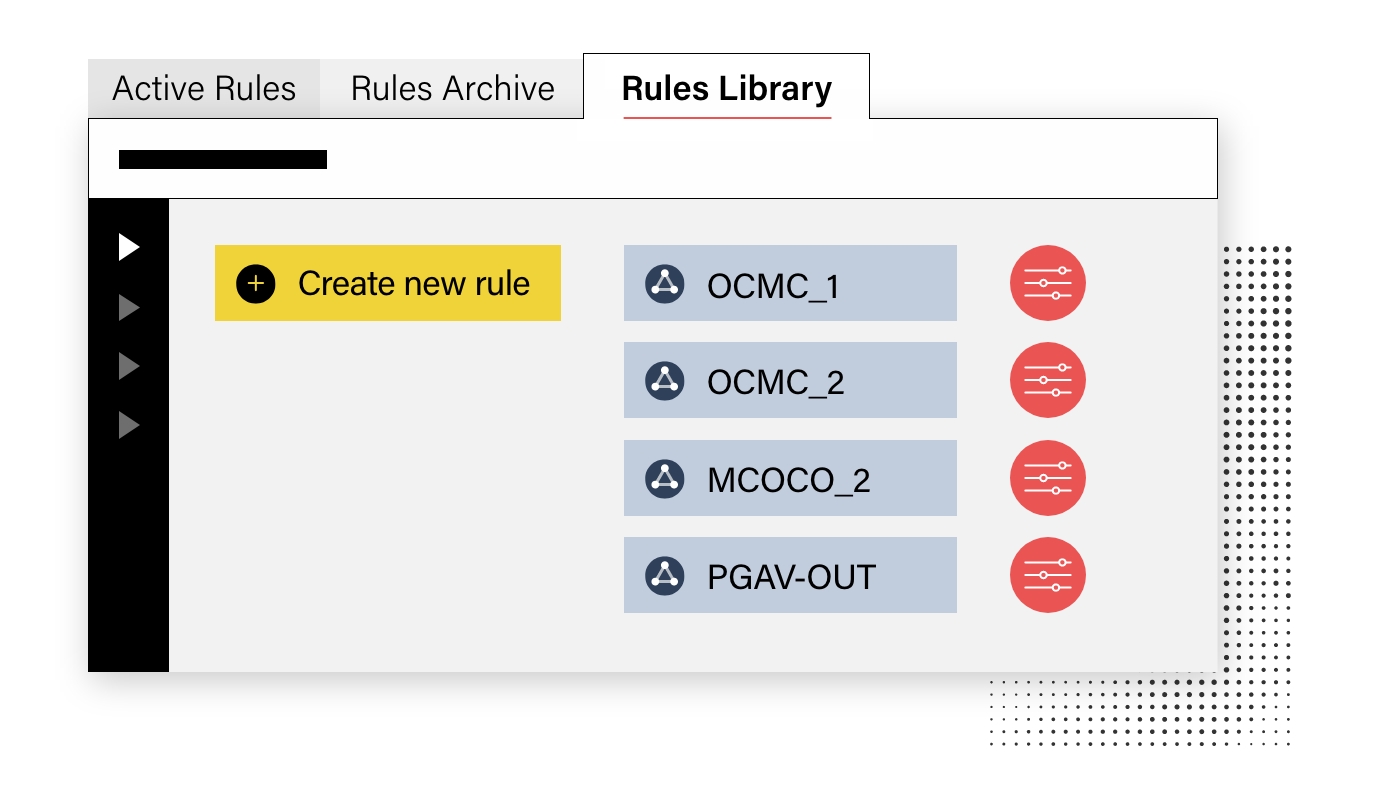

Prioritize and focus on the greatest risks to your business with our transaction monitoring system, which automatically monitors transactions to detect suspicious behavior

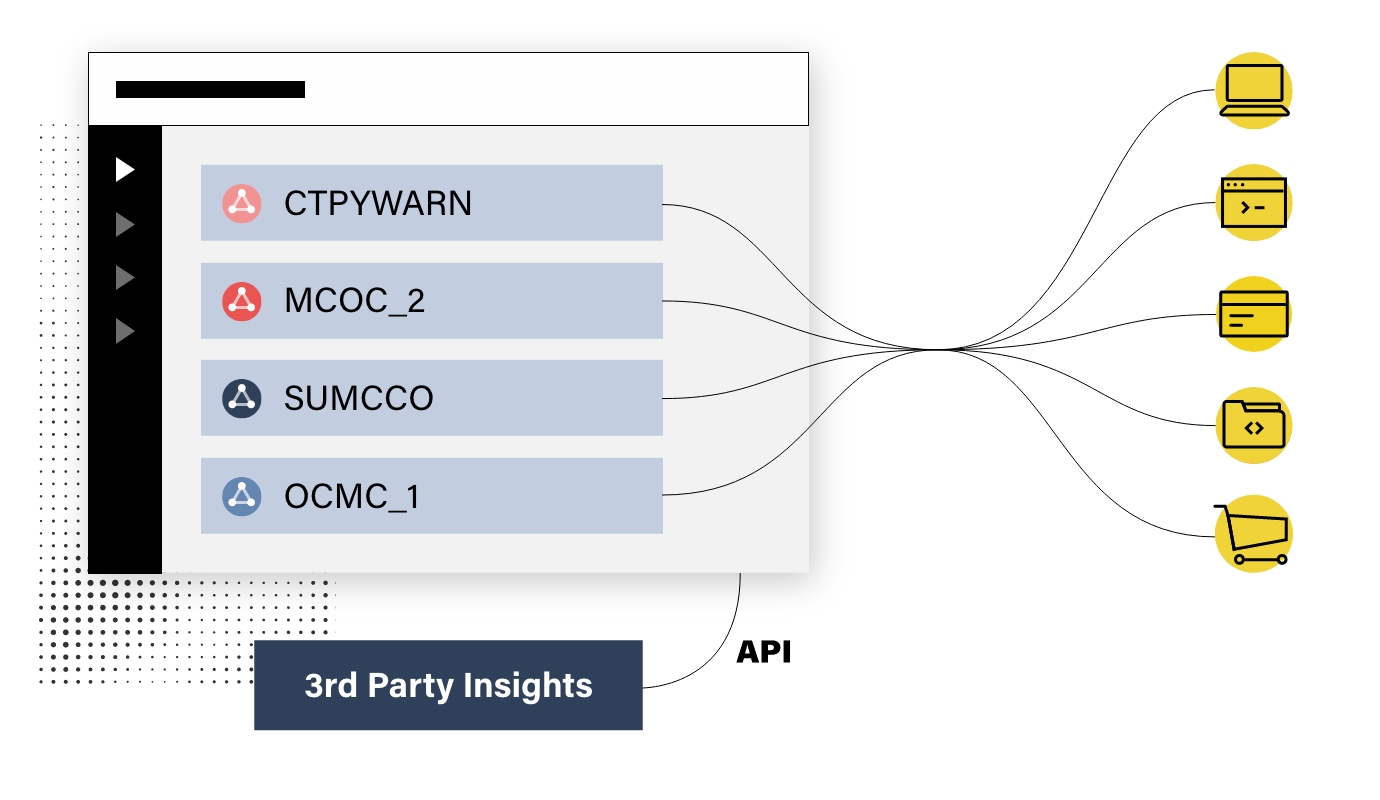

Identify real-time sanctions risk in all parts of the payment message via a single API call

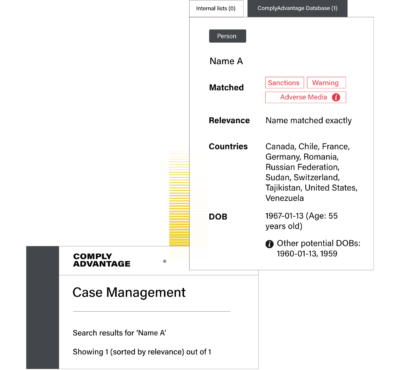

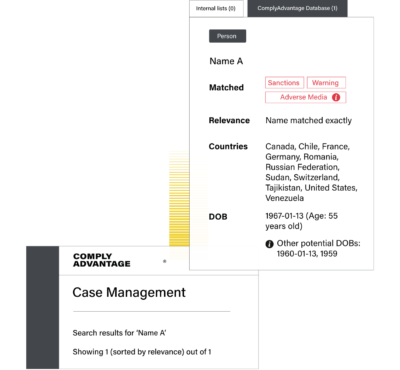

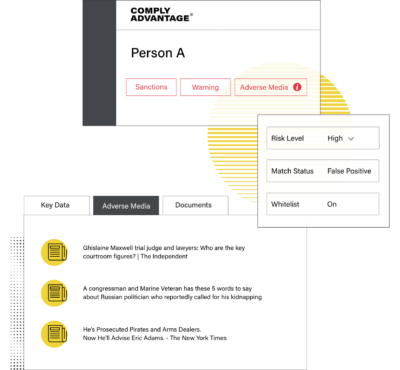

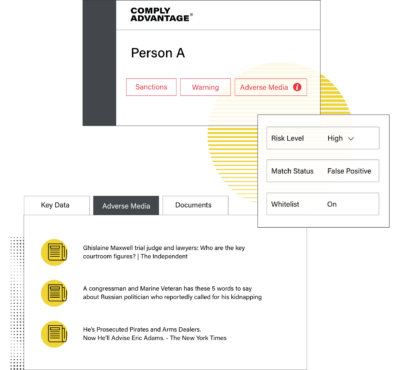

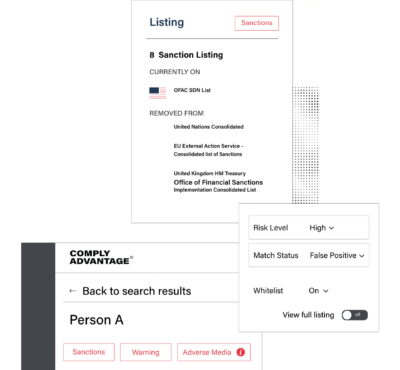

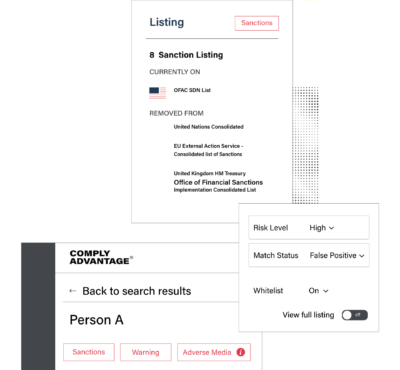

Automated data collection technology, augmented by human reviews, continuously verifies and extracts data from more than 1300 global sources – including sanction lists, PEPs and RCAs, OFAC, UN, HMT, EU and DFAT.

Watchlists used by our transaction screening software are updated automatically within 15 minutes, eliminating time lags between watchlist updates and your screening system being updated.

Transaction monitoring is the ongoing process through which financial transactions are monitored to identify any suspicious activity that may indicate money laundering, terrorist financing and other financial crimes.

Transaction monitoring is an important part of a companies AML program as it enables compliance with the latest national and international regulations.

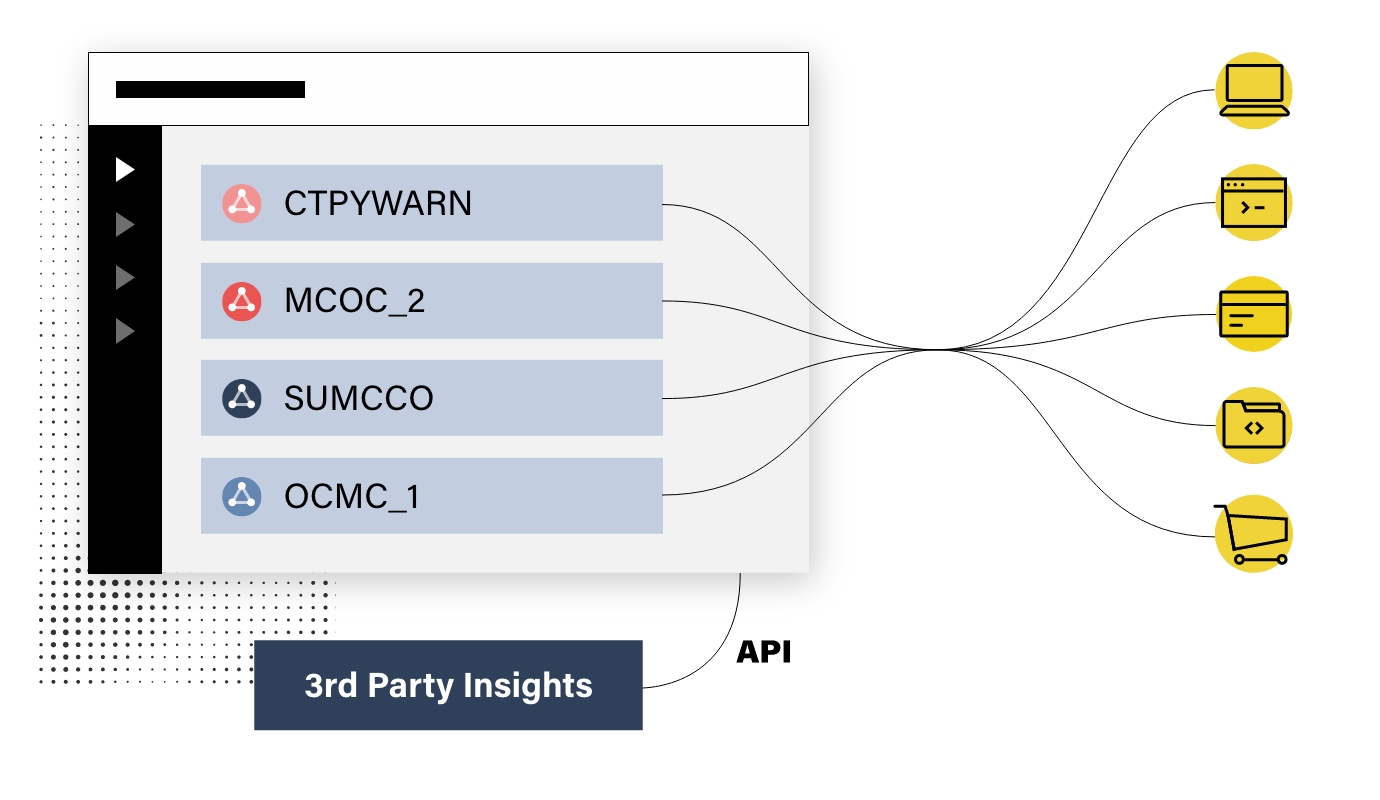

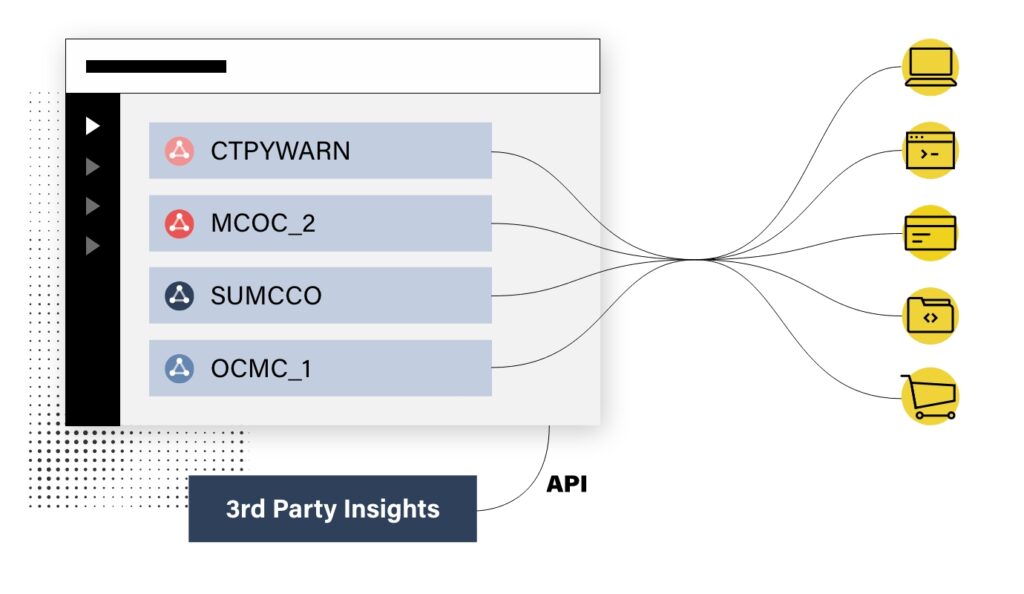

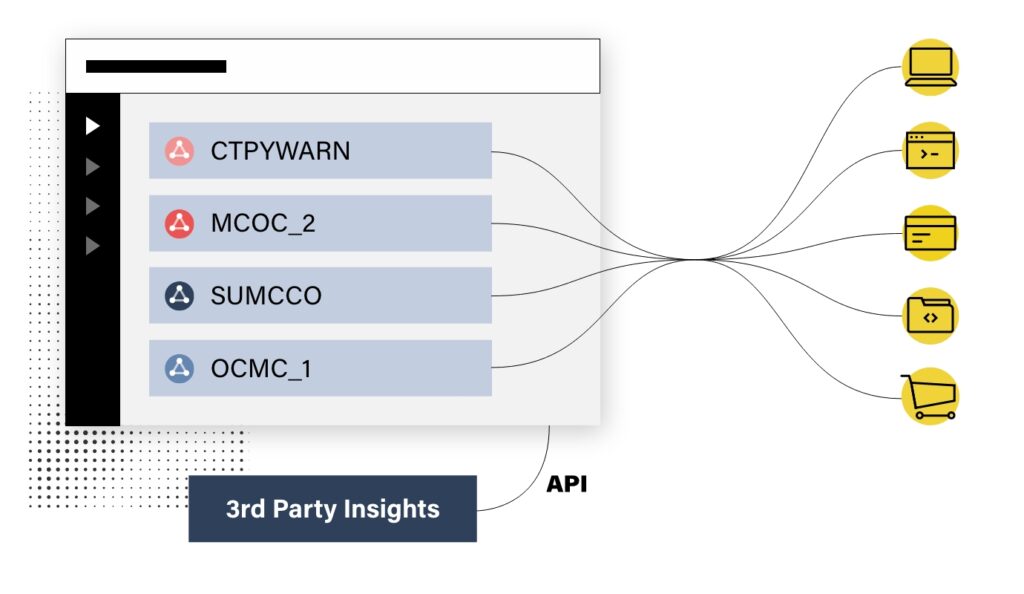

The ComplyAdvantage API enables you to integrate your systems with our services to automate many of the functions available through the web user interface. Our API follows the REST convention and accepts and returns JSON data. View our API docs.

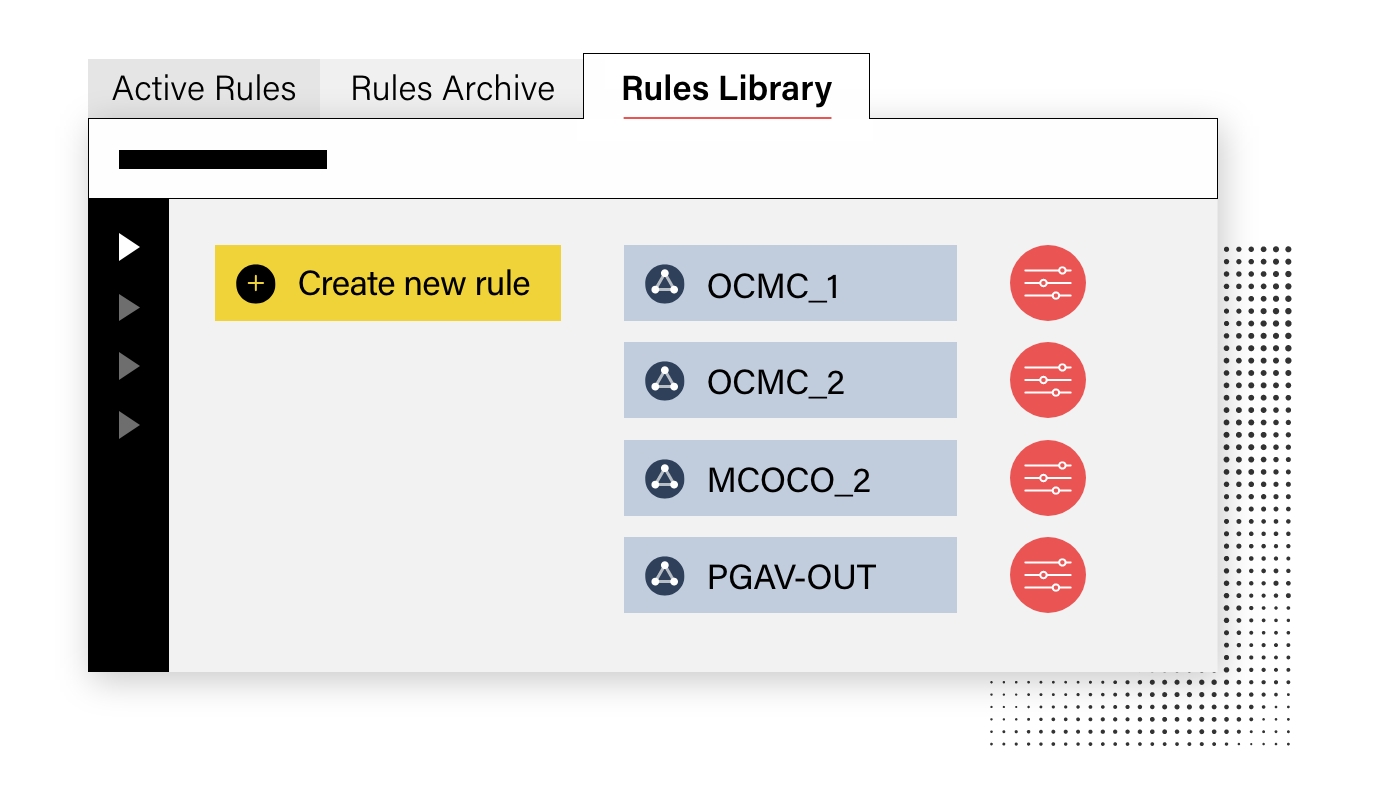

Yes. Our transaction monitoring system can run on any data that you provide to us (data that is captured within a transaction). This not only allows the engine to detect suspicious scenarios, but also allows the tool to speak in your language, using your own variables, codes, definitions, etc that are unique to you.

Identify where your business is exposed to money laundering and fraud risks. Prevent these risks in real-time with our wide range of offerings.

Optimize the efficiency of AML/KYC screening, reduce friction and automate your onboarding and monitoring.

Learn More

Cut through the noise and analyze true adverse media context at scale with the most accurate adverse information and media entities in the world.

Learn More

Screen against real-time sanction and watchlist data and bethe first to know about critical changes to your customers’ risk status.

Learn More

Stay compliant with comprehensive sanction and watchlist coverage, monitored in real-time

Learn More