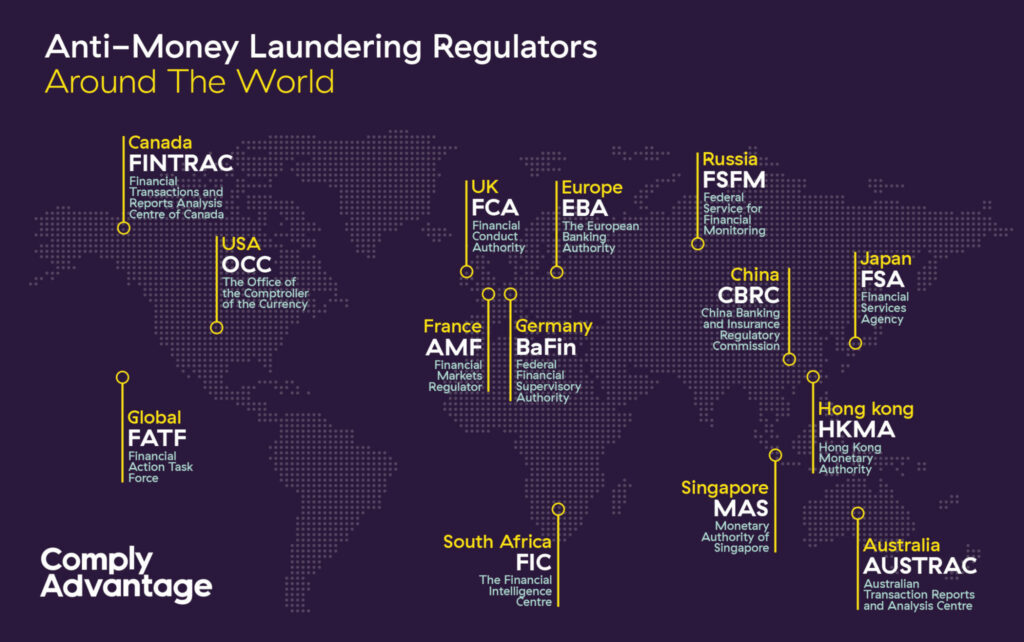

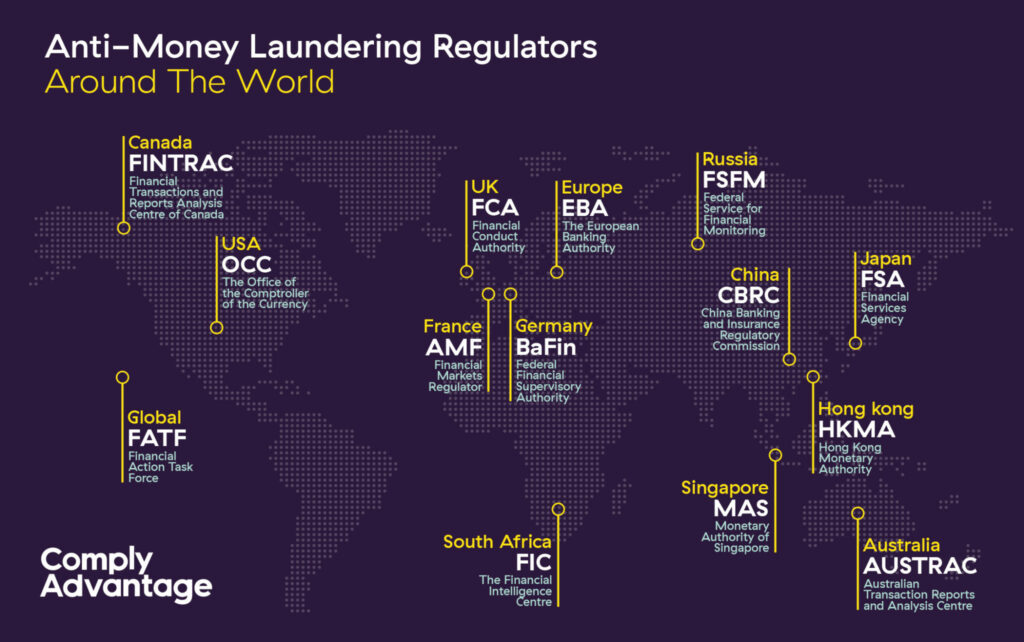

Regardless of where you operate, to comply with anti-money laundering legislation, you must deal with financial regulators and understand the legislation imposed nationally and internationally. Given the breadth of legislative ground to cover, our guide to the main global anti-money laundering regulations and the organizations that apply them is a good place to start.

The Financial Action Task Force is an intergovernmental organization dedicated to combating money laundering and the financing of terrorism. With 36 member states, FATF’s jurisdiction spans the globe and encompasses all major financial centres. Its primary function is to set global standards for anti-money laundering compliance and monitor their effective implementation. In pursuit of this objective, the FATF regularly publishes updated AML/CFT guidelines. To comply with FATF regulations, Member States and their financial institutions must

The European Union’s anti-money laundering directives are the mechanism it uses to harmonize AML/CFT legislation in its member states. Issued periodically, the Money Laundering Guidelines are updated to reflect current money laundering, terrorist financing and crime risks facing financial markets. The fifth EU Money Laundering Directive (5AMLD) was published on July 9, 2018 and will enter into force on January 10, 2020, while the draft 6AMLDwas published at the end of 2018 and will come into force in June 2021. To comply with the rules of Directive 5-6 AMLD, financial institutions must be aware of the content:

An independent, non-governmental body, the Financial Conduct Authority is responsible for regulating the UK’s financial services industry, including combating money laundering and other criminal activities such as terrorist financing. The general objectives of the FCA are to protect consumers, to ensure market integrity and stability and to promote competition. It is also empowered to introduce and enforce rules and to conduct investigations for these purposes. Concretely, the powers of the ACF include

The Bank Secrecy Act (BSA) is the United States’ primary anti-money laundering regulation and is administered by the Financial Crimes Enforcement Network (FinCEN). The BSA focuses on money laundering, but its scope has expanded to include other financial crimes. For example, it was amended by the Patriot Act in 2001 to include counter-terrorist financing (CTF) measures. Under the BSA, financial institutions must meet a number of requirements, including:

Financial institutions that fail to comply with BSA regulations can be prosecuted under the US Criminal Code, with penalties including jail time and fines of up to $250,000.

The Hong Kong Monetary Authority is responsible for the stability of Hong Kong’s banking system and monetary policy. Under the authority of the Anti-Money Laundering and Anti-Terrorist Financing Ordinance , the HKMA is also the regulatory body responsible for combating money laundering and terrorist financing. In this role, she ensures that financial institutions in Hong Kong meet a variety of legal requirements, the most important being the development and implementation of an effective anti-money laundering and anti-terrorist financing program. . In order to comply with HKMA Anti-Money Laundering Policy,

Compliance officers: Each financial institution should appoint a compliance officer with sufficient authority to take responsibility for its AML/CFT program and suspicious activity reporting.

The Monetary Authority of Singapore (MAS) is mandated to serve as the city-state’s central bank and regulate its financial sector. As such, the functions of the MAS include the conduct of monetary policy, the supervision of financial institutions, the management of reserves and assets, and the development of Singapore’s international financial status. Financial institutions must comply with the MAS Anti- Money Laundering Policy, which is set out in its Advice on Preventing Money Laundering and Combating the Financing of Terrorism, including:

Financial institutions that fail to comply with MAS’ Anti-Money Laundering Policy may be held criminally liable and subject to fines of up to $1 million.

The Australian Transaction Reporting and Analysis Center (AUSTRAC) is the Australian Government’s primary financial intelligence agency responsible for combating money laundering, terrorist financing, fraud and other financial crimes. AUSTRAC operates under the authority of the Anti-Money Laundering and Terrorist Financing Act (2006), and works to identify criminal threats to and abuse of the Australian financial system. As such, AUSTRAC’s efforts to combat money laundering involve:

Law Enforcement: AUSTRAC works with a range of government agencies to implement anti-money laundering and investment fund policy , including police, security and tax services . Individuals and companies that fail to comply with AUSTRAC regulations face jail time and fines.

Want to meet and exceed the expectations of global regulators? Get in touch with ComplyAdvantage today!

Publié initialement 01 avril 2020, mis à jour 31 mars 2023

Avertissement : Ce document est destiné à des informations générales uniquement. Les informations présentées ne constituent pas un avis juridique. ComplyAdvantage n'accepte aucune responsabilité pour les informations contenues dans le présent document et décline et exclut toute responsabilité quant au contenu ou aux mesures prises sur la base de ces informations.

Copyright © 2023 IVXS UK Limited (commercialisant sous le nom de ComplyAdvantage)