RBI Compliant Screening And Monitoring Tools

Meet and exceed the expectations of Global regulators.

Discover our Screening Tools

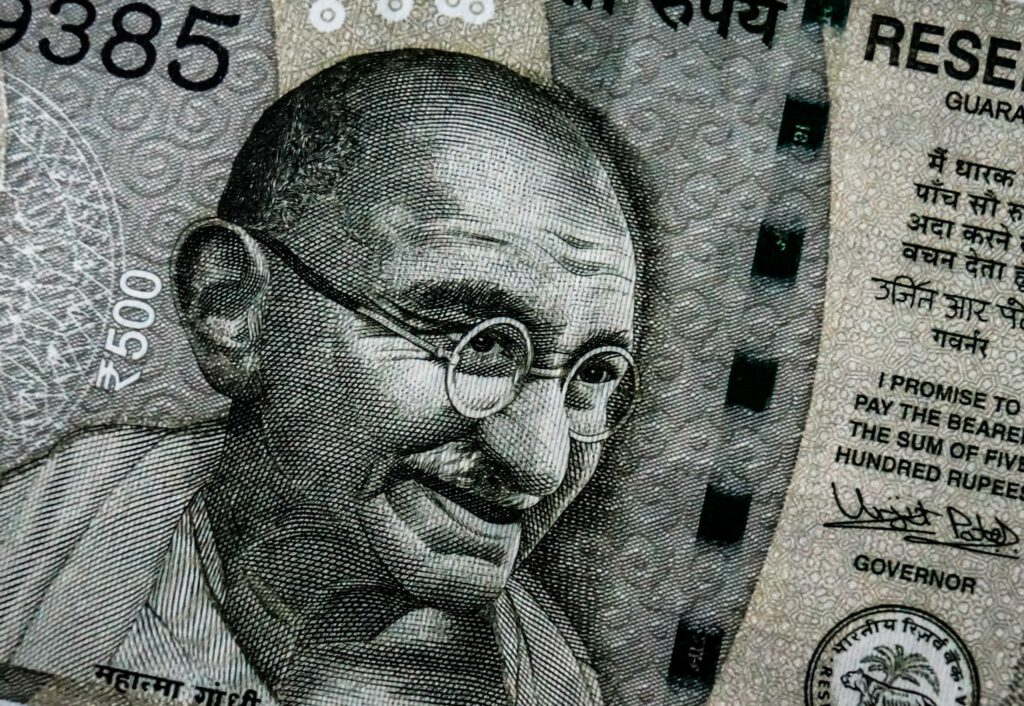

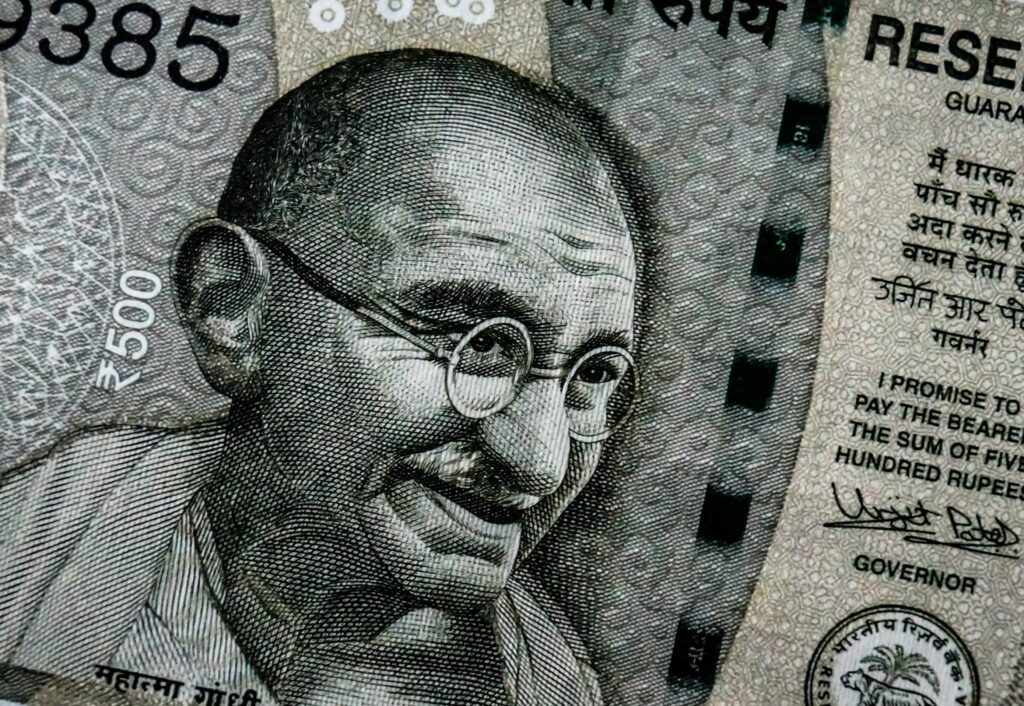

What is RBI? Simply put, RBI stands for the Reserve Bank of India and is responsible for regulating India’s financial markets and maintaining economic stability. Established by the Reserve Bank of India Act 1934, and commencing operations on 1 April 1935, the Reserve Bank of India serves as the country’s central bank and primary financial regulator. The RBI was originally privately owned but was nationalized in 1949 following India’s declaration of independence from the United Kingdom in 1947. Today, as India’s central bank, the RBI is responsible for protecting the country’s monetary stability and does so by regulating the economy, issuing currency, promoting growth, and supervising financial institutions. As part of that supervisory role, the RBI works to combat financial crime, with a focus on anti-money laundering in India and on countering the financing of terrorism.

The Reserve Bank of India is managed by a central board of directors, appointed to four-year terms and led by a governor – currently Shaktikanta Das. Headquartered in Mumbai, the RBI also has regional boards in Mumbai, Calcutta, Chennai, and New Delhi, along with 27 regional offices around the country. Beyond its founding legislation (the Reserve Bank of India Act 1934), the RBI operates under the authority of legislation including the Banking Regulation Act 1949, the Government Securities Act 2006, and the Payment and Settlement Systems Act 2007.

The RBI has authority over banks and financial institutions, and non-banking finance companies in India and sets the legal parameters by which those institutions must operate. As a central bank, the RBI issues currency, manages foreign exchange and acts as a banker for both the government and commercial banks. The RBI’s supervisory authority is directed by its Board for Financial Supervision, which meets once every month to deliberate on regulatory issues.

In its regulatory and supervisory role, the RBI has a broad range of duties and responsibilities, including:

Enforcement: Where there are violations of its rules and regulations it has the authority to carry out enforcement actions against the offending companies. These actions normally take the form of financial penalties.

Compliance Training: The RBI also offers training to banks and financial institutions to help boost compliance performance. It currently maintains three internal training establishments, the RBI Academy, the College of Agricultural Banking, and the RBI Staff College, but liaises with a number of autonomous training institutions.

As a global and regional financial leader, India is a member-state of the Financial Action Task Force (FATF). Accordingly, the RBI works to implement the AML/CFT policy set out in the FATF’s 40 Recommendations. To comply with the regulations on money laundering and terrorism financing, financial institutions in India should create an internal AML/CFT program which:

In order to inform financial institutions of its rules and regulations, the RBI maintains a communication policy built around principles of transparency, comprehensiveness, relevance, and timeliness. The RBI disseminates information through its official website as part of a pre-announced schedule and encourages feedback from financial institutions.

Meet and exceed the expectations of Global regulators.

Discover our Screening ToolsOriginally published 05 August 2019, updated 04 May 2022

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2023 IVXS UK Limited (trading as ComplyAdvantage).