Learn More about The Evolving Use Of Sanctions

To find out more about global sanctions, geopolitics and best practices, download our guide.

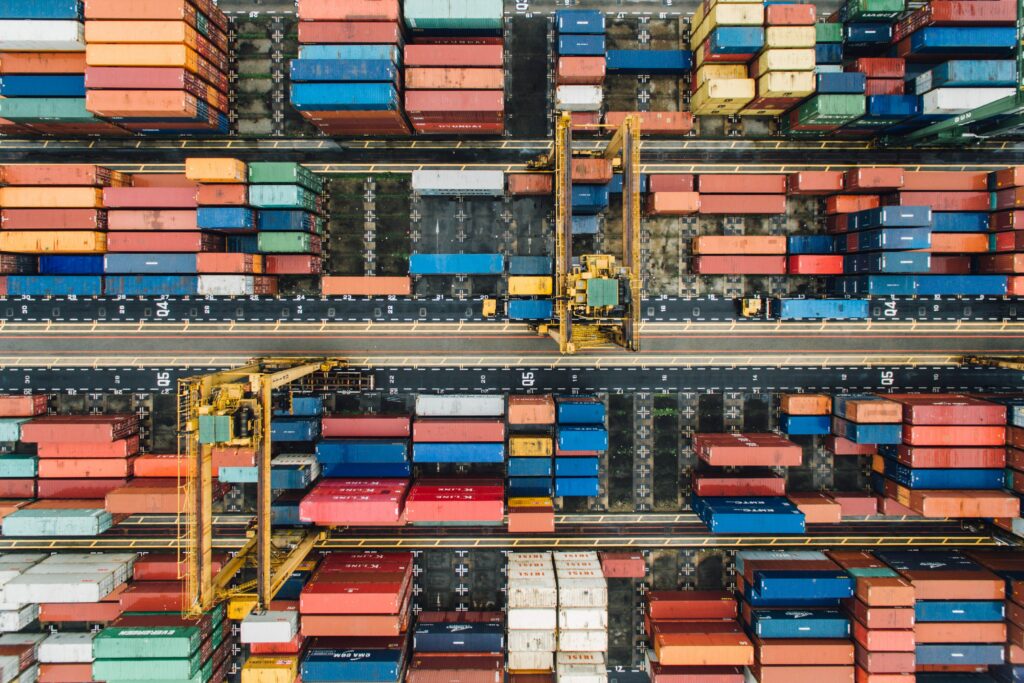

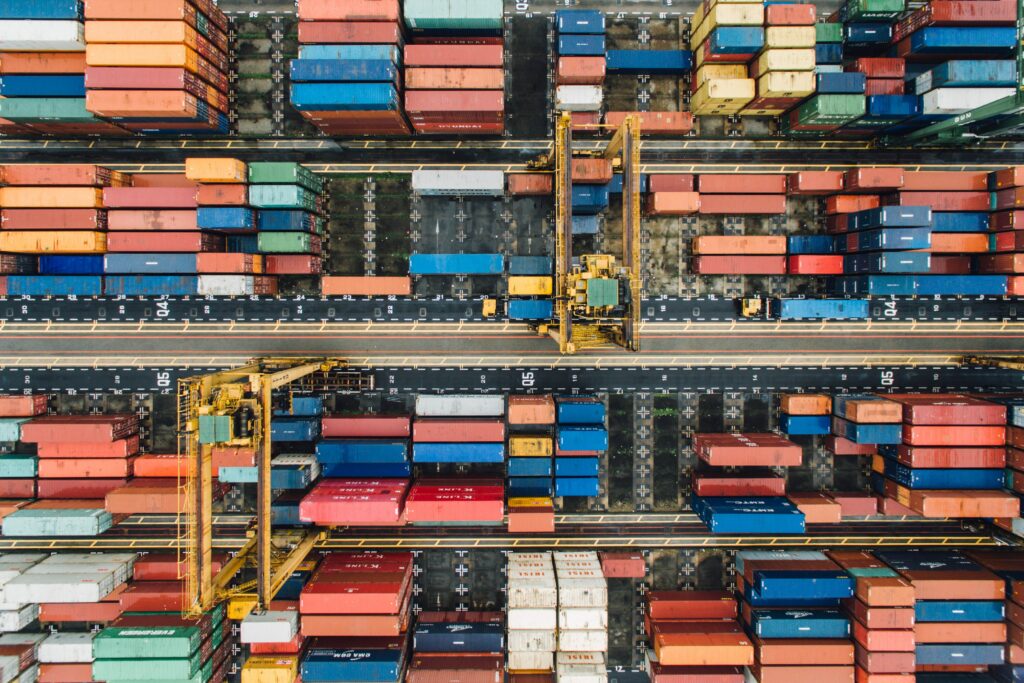

Learn MoreA type of economic sanction, trade sanctions are implemented to restrict trade activities with certain foreign targets, usually as part of a wider sanctions program intended to achieve political or diplomatic goals. Trade sanctions set out prohibitions that may apply to target industries and individuals, or broadly to entire countries: the prohibitions make it a criminal offense for persons in the issuing country to do business with persons that fall under their scope.

Trade sanctions are a cornerstone of foreign policy for governments around the world and are used to punish violations of international law and human rights abuses or to enhance national security. Accordingly, trade sanctions are strictly enforced by regulators, meaning that banks, financial institutions and other service providers should carefully monitor their compliance to ensure they do not incur significant penalties or criminal charges.

Trade sanctions may be imposed unilaterally or target specific forms of trade, or even individuals and organizations. Individual countries may impose trade sanctions as part of autonomous sanctions regimes or, alternatively, groups of countries acting as members of international organizations, such as the United Nations, may impose trade sanctions collectively.

The different categories of trade sanctions include:

Non-tariff barriers: The imposition of peripheral trade restrictions, such as packaging requirements, humanitarian labor requirements, or animal welfare requirements.

While trade sanctions and embargoes occupy the same regulatory space – in the sense that they both involve economic restrictions against a third country – there are practical differences between the two measures. Where sanctions may target specific trading activities or individuals, embargoes are applied much more broadly, often comprehensively prohibiting trade with a target country, or instead prohibiting all imports from, or exports to, that country. In some cases, an embargo may restrict only the import and export of certain types of goods, such as military end-use equipment.

Trade sanctions are used frequently as a way to coerce or incentivize target countries to adhere to international law. Examples include:

US, UK, and EU, sanctions against Russia in response to the 2014 invasion of Crimea, oppression of pro-democracy protests, and the arrest of opposition leader, Alexei Navalny.

Most governments have established enforcement authorities to manage the implementation of trade sanctions. In the United States, sanctions enforcement is the responsibility of the Office of Foreign Assets Control (OFAC), which maintains the US’ Specially Designated Nationals (SDN) and Blocked Persons List. The SDN list sets out the individuals and companies that are currently targeted by US trade sanctions.

To find out more about global sanctions, geopolitics and best practices, download our guide.

Learn MoreFirms must ensure that they operate in compliance with trade sanctions when onboarding new customers and handling transactions. In practice, this means implementing a sanctions screening solution as part of their AML/CFT program, and checking customers against the relevant international sanctions lists (such as the SDN list). If a match is found, a firm should implement an appropriate compliance response, including suspending the transaction, freezing assets, and notifying the appropriate authority.

Sanctions compliance challenges: Trade sanctions present unique compliance challenges. Firms must ensure that their screening solution reflects the level of sanctions risk that they face, but not be so onerous that it creates an unmanageable administrative burden for compliance employees or negatively affects customer experiences. With that in mind, firms should seek to perform risk assessments of their customers during onboarding and throughout the business relationship, and use that data to inform their compliance response, subjecting higher risk customers to more intensive controls.

Similarly, trade sanctions screening measures should account for the difficulties inherent in screening foreign customers, or transactions that involve foreign parties. Practically, this means ensuring that the screening solution is updated with the latest sanctions data in order to ensure that checks are accurate and reliable. Sanctions solutions should also be set up to account for the use of nicknames and aliases, along with the naming conventions of certain territories: Arabic and Chinese names, for example, use characters from non-Western alphabets, and often reverse the name-surname order.

In addition to an effective sanctions screening solution, In order to properly comply with trade sanctions regulations, firms should ensure that the following measures and controls are in place as part of their wider AML/CFT program:

Discover how our clients have made compliance painless with our software.

Request a DemoOriginally published 22 September 2021, updated 24 May 2022

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2023 IVXS UK Limited (trading as ComplyAdvantage).