What will 2023 Hold for Sanctions on Russia?

Uncover how Russia sanctions might evolve in 2023 and stay ahead of other shifting sanctions hotspots, such as China, North Korea, and Iran.

Download nowThe second Financial Action Task Force (FATF) plenary under the two-year Singapore Presidency of T. Raja Kumar took place at the FATF headquarters in Paris on February 22-24, 2023. In attendance were delegates from over 200 jurisdictions of the Global Network.

Discussions centered around:

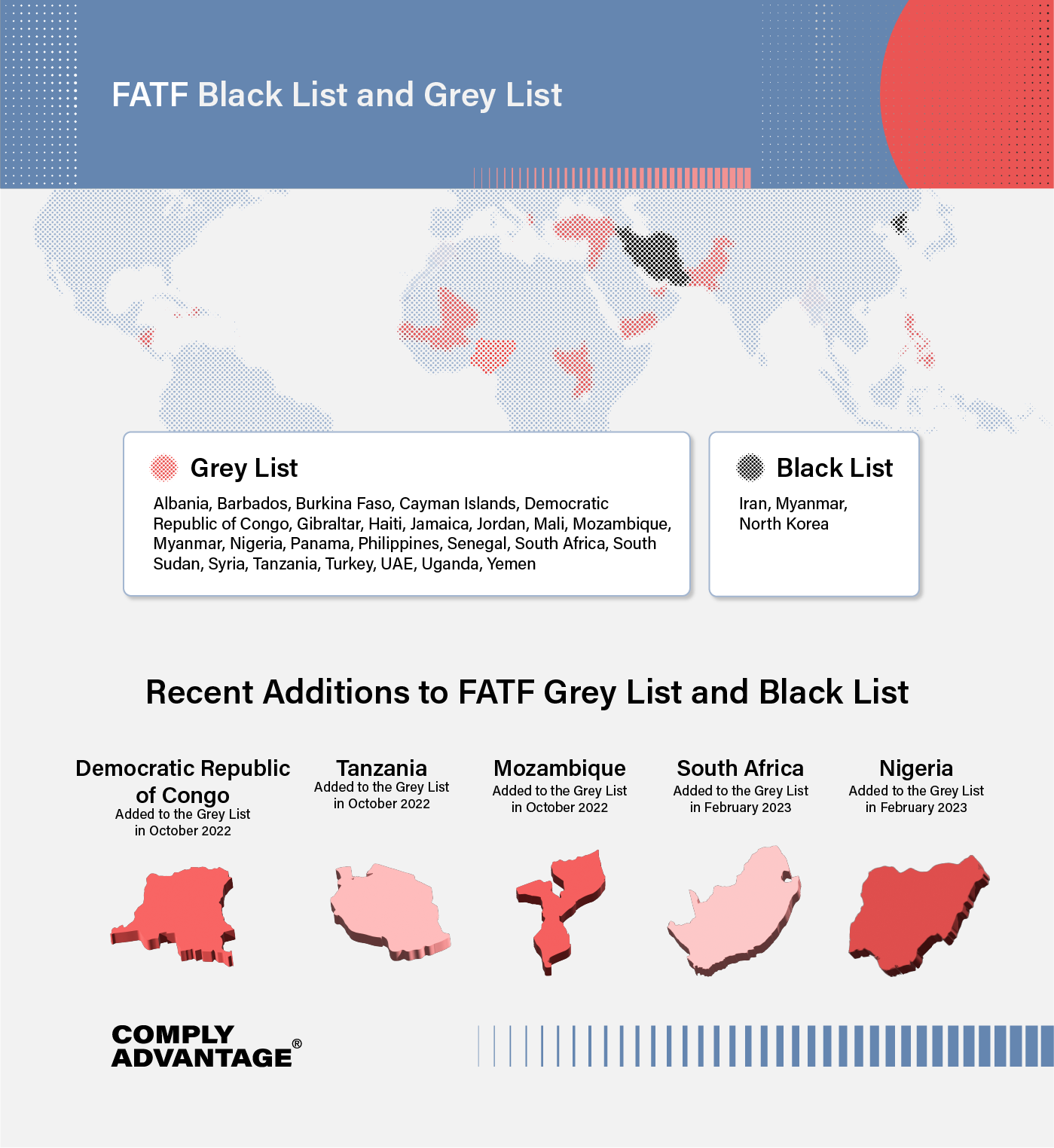

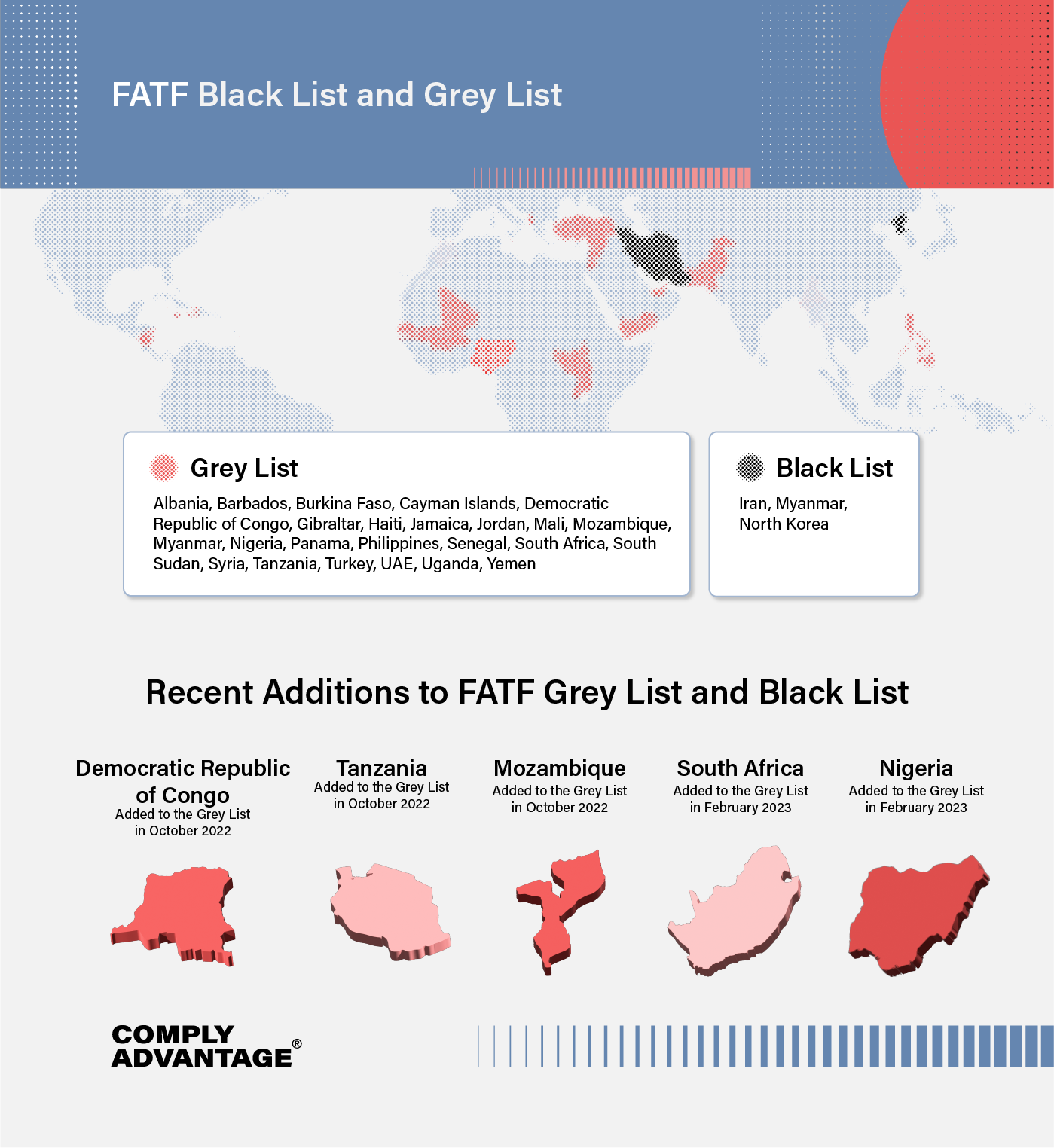

Following the FATF’s most recent update, the grey list comprises 23 jurisdictions. The FATF’s decision to add Nigeria and South Africa to the grey list results from deficiencies in combating illicit finance and organized crime. While the “grey-listing” may expose Africa’s two largest economies to greater scrutiny from international banks, analysts have also indicated that it will impact foreign direct investment and affect the ease at which state-owned entities can borrow funds from abroad.

Nigeria was originally subject to increased monitoring in 2007 due to various loopholes in its legal and regulatory system. However, it was taken off the grey list in October 2013 following the country’s full implementation of its mutually agreed action plan. In light of the most recent plenary, Nigeria has been added to the grey list again.

To be removed from the grey list, Nigeria must complete the following nine actions:

After Turkey, South Africa is the second G20 economy to have been added to the grey list.

Since the FATF’s announcement, South Africa’s finance minister Enoch Godongwana pledged to work “swiftly and effectively” to address all the outstanding issues listed by the FATF.

South Africa’s addition to the grey list follows its 2021 MER, which detailed:

Despite the FATF noting that the country had made “significant progress” to its AML/CTF system since June 2021, the watchdog listed eight areas that South Africa must work on before it can be removed from the grey list. Going forward, South Africa must:

Cambodia was initially placed on the grey list in June 2011 before being removed in February 2015 after authorities addressed its strategic AML/CTF deficiencies. However, the country rejoined the grey list in February 2019 due to issues surrounding gambling activities and human trafficking.

Following the FATF’s on-site visit in January 2023, the watchdog noted the country’s “substantial progress” in improving its AML/CTF regime. While the country will continue to work with its FATF-style regional body (FSRB), the Asia/Pacific Group (APG), Cambodia is no longer subject to increased monitoring.

While the removal of Cambodia from the FATF grey list is a great success, authorities have been urged by various groups, including the Cambodian Human Rights and Development Association (ADHOC), to not reduce their vigilance. Spokesperson for ADHOC Soeng Senkaruna highlighted that human trafficking, illegal online gambling, and sex trafficking continue to be a threat to Cambodia’s society and economy, so authorities should “remain on the alert”.

Morocco was originally placed on the grey list in February 2021, merely a week after the country exited the European Union’s “grey” list of tax havens. Since then, Moroccan authorities have worked to:

Following an on-site visit that took place between 16-18 January 2023, the FATF said the country had addressed its technical deficiencies and was no longer subject to increased monitoring.

Speaking about the country’s removal from the grey list, Morocco’s Department of the Head of Government said it “will have a positive impact on sovereign ratings and local banks’ ratings… [and] will strengthen Morocco’s image and its positioning in negotiations with international financial institutions, as well as the confidence of foreign investors in the national economy.”

In what Kumar called “a major step for the FATF”, the plenary also resulted in the membership suspension of the Russian Federation, owing to Moscow’s war in Ukraine violating the organization’s principles. Going forward, Russia will no longer be allowed to attend FATF meetings physically or virtually and is no longer able to access documents reserved for members of the Global Network.

Speaking at the press conference on February 24, Kumar said, “This is the first time a member of FATF has been suspended.”

Restrictive measures were initially imposed on the Russian Federation in June 2022, resulting in Russia being stripped of its FATF leadership positions. In October 2022, the FATF announced additional restrictions on the country’s remaining role as a member of the inter-governmental body, banning Russia’s participation in current and future FATF project teams and excluding the country from meetings of the FSRBs.

Despite being sidelined from the FATF, the group noted that “The Russian Federation remains accountable for its obligation to implement the FATF Standards. The Russian Federation must continue to meet its financial obligations.”

Uncover how Russia sanctions might evolve in 2023 and stay ahead of other shifting sanctions hotspots, such as China, North Korea, and Iran.

Download nowEchoing Kumar’s objectives presented at the June 2022 plenary, the FATF discussed multiple strategic initiatives including improving beneficial ownership transparency and disrupting the financial flows emanating from ransomware attacks.

In July 2021, the FATF announced it would prioritize work related to increasing the effectiveness of global AML measures. To do this, the FATF outlined several focus areas centered around strengthening a culture in which best practices are quickly identified and shared to help drive effectiveness. One such area revolved around completing and amending guidance on beneficial ownership information for legal persons.

It was announced at the plenary that this guidance has now been finalized to help countries implement the revised requirements of Recommendation 24 to stop shell companies from being used as a haven for illicit proceeds. The guidance is due to be published in March.

To ensure a “balanced and coherent” set of FATF standards on beneficial ownership, the plenary also announced further updates will be made to Recommendation 25. In June 2022, the FATF organized a high-level consultation on the proposed changes. With the revised requirements now in place, the FATF said it would begin working on guidance to help countries implement the enhancements.

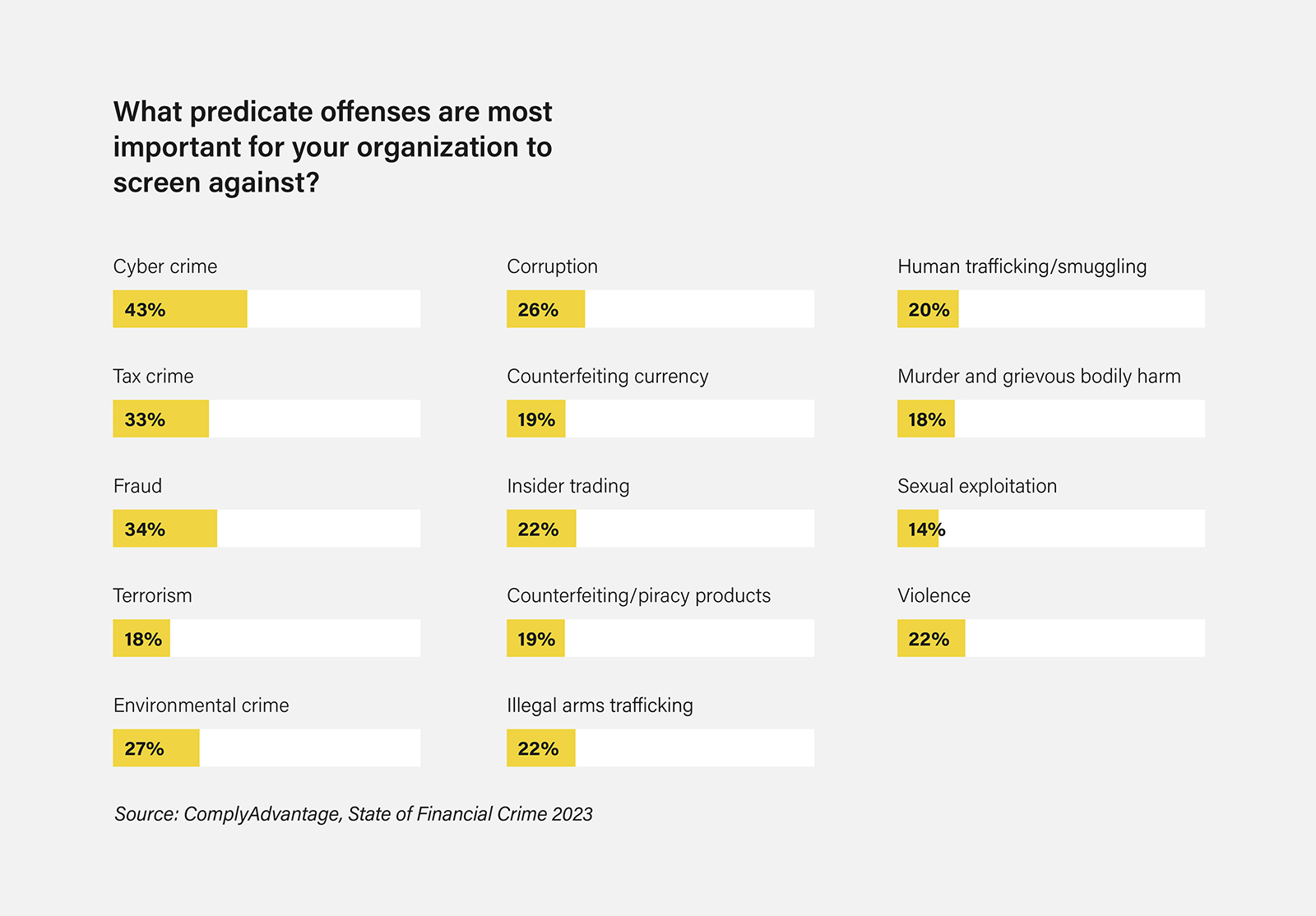

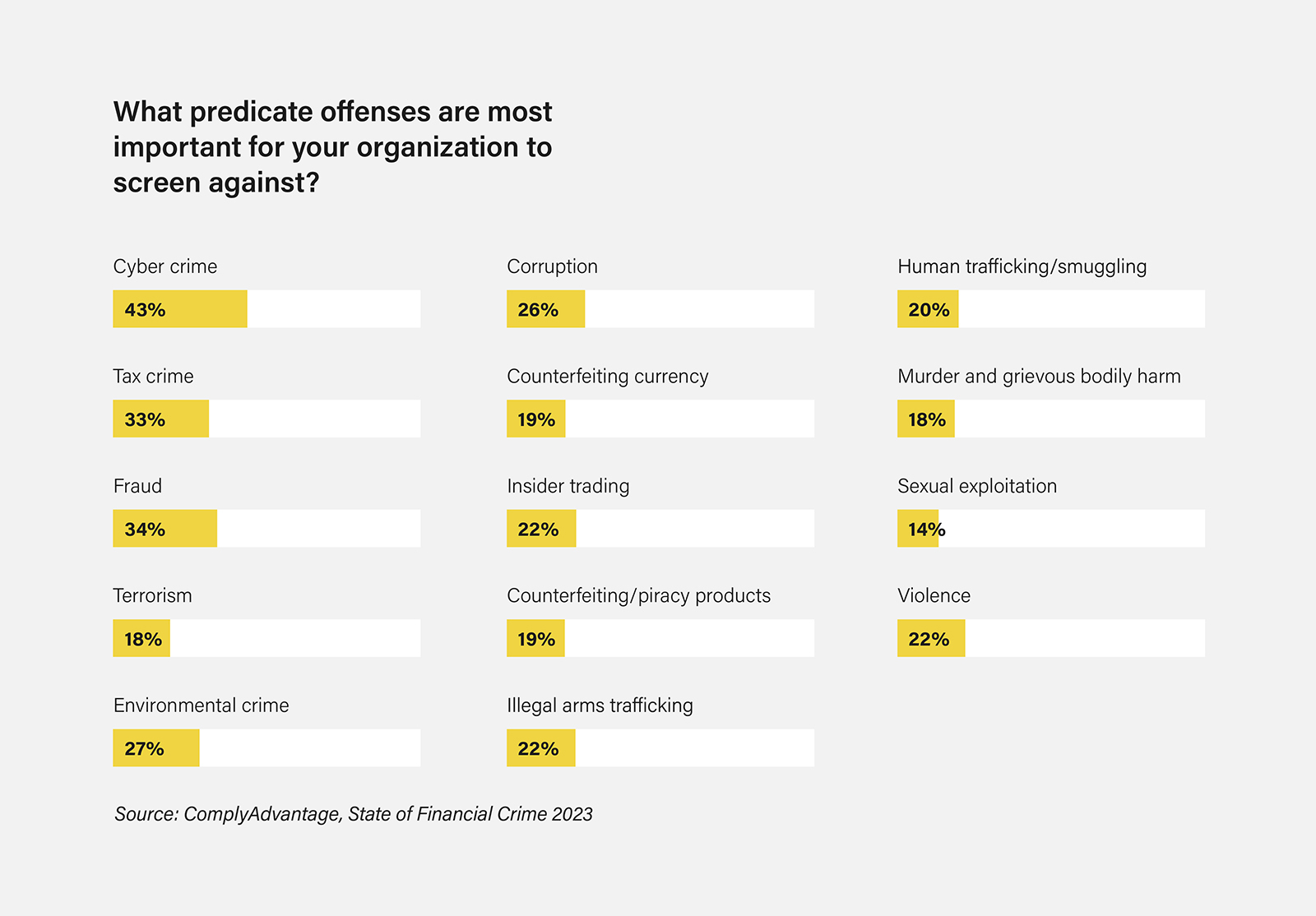

Countering illicit finance related to cyber-enabled crime is another objective of the 2022-2024 Singapore Presidency. In a paper authored by Kumar, the FATF noted that many jurisdictions are finding it challenging to stop or contain cyber-enabled schemes. Our 2022 and 2023 global compliance surveys echo this challenge, with cybercrime emerging as the top predicate offense of concern for compliance teams two years in a row.

As the threat of increasingly sophisticated financial crime techniques continues to rise, the FATF aims to better understand the challenges at large, including specific money laundering techniques. As a result, the global watchdog has completed research that analyzes the methods criminals use to carry out ransomware attacks and how ransom payments are laundered. This report is due to be published in March and will include a list of risk indicators to help public and private sector entities detect suspicious activities related to ransomware.

In light of the upcoming report, the FATF has agreed to create a roadmap to strengthen the implementation of FATF Standards on virtual assets (VAs) and virtual asset service providers (VASPs). A review will take place regarding the current levels of implementation across the global network. The FATF aims to report back on its stocktake during the first half of 2024.

Following the plenary, on February 27, the FATF published a new report on Money Laundering and Terrorist Financing in the Art and Antiquities Market. The report aims to increase awareness and understanding of the risks associated with said markets, helping public and private sector entities identify suspicious activities by listing risk indicators and threats associated with cultural objects. The report also includes a list of good practices, which include:

Finally, the FATF announced that the next Vice President to succeed Ms. Elisa de Anda Madrazo from Mexico will be Mr. Jeremy Weil from Canada. Madrazo will step down on June 30 with Weil due to hold the vice presidency position for two years from July 1.

Compliance staff should ensure they are familiar with the outcomes of the February plenary – particularly relating to any upcoming MERs in countries they operate in. Regarding the changes to the grey list, firms must update the risk scores of relevant countries, with appropriate levels of due diligence being administered as required going forward.

Dates related to forthcoming guidance issued by the FATF should also be noted. Such guidance will help shape and inform the future regulatory approach national bodies take.

The next FATF plenary is due to take place in June 2023.

Previous plenary coverage from ComplyAdvantage can be found here:

Uncover the evolving anti-money laundering regulatory landscape, examining global trends and key themes in major economies.

Download nowOriginally published 02 March 2023, updated 02 March 2023

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2023 IVXS UK Limited (trading as ComplyAdvantage).