A Guide to ‘The Original 6AMLD’

Uncover what changes have been proposed by the European Commission and how might those changes impact firms.

Download the guideThe European Union’s (EU) long-term goal of a pan-European anti-money laundering (AML) program, is moving closer, with the creation of a central EU authority to combat money laundering.

The EU Anti-Money Laundering Authority (AMLA) will monitor, support, and coordinate the application of EU financial services regulations across the continent – though the responsibility for combating money laundering remains in the hands of member states.

Given the cross-border nature of crime, the AMLA’s centralized remit is a major step toward establishing coordinated AML/CFT measures in the region. It is expected to help harmonize supervisory practices, oversee high-risk and cross-border financial entities, and coordinate financial intelligence units.

While individual member states may go beyond the scope of EU Anti-Money Laundering Authority directives, firms should expect greater consistency across the bloc going forward. Countries outside of the EU, such as the UK, may also aim to align AML programs with the AMLA.

The Authority will have direct supervision powers to crack down on illicit finance across all member states, and a consistent framework to ease compliance for obliged entities who are subject to AML/CFT rules.

It will also be able to impose fines on offenders, with total penalties up to 10% of annual turnover or €10m, whichever is higher.

The EU Anti-Money Laundering Authority will be fully independent, with its own executive board. Its direct supervision will mirror that of the Financial Action Task Force (FATF), while maintaining its own black and gray lists. It will also list countries that pose a threat to the EU’s financial system based on its assessment.

AMLA will be established at the beginning of 2023 and is expected to be fully resourced by the end of 2025, with direct supervision expected in early 2026. It has an anticipated budget of €45.6m – funded through the EU budget and fees from supervised entities – with 250 staff.

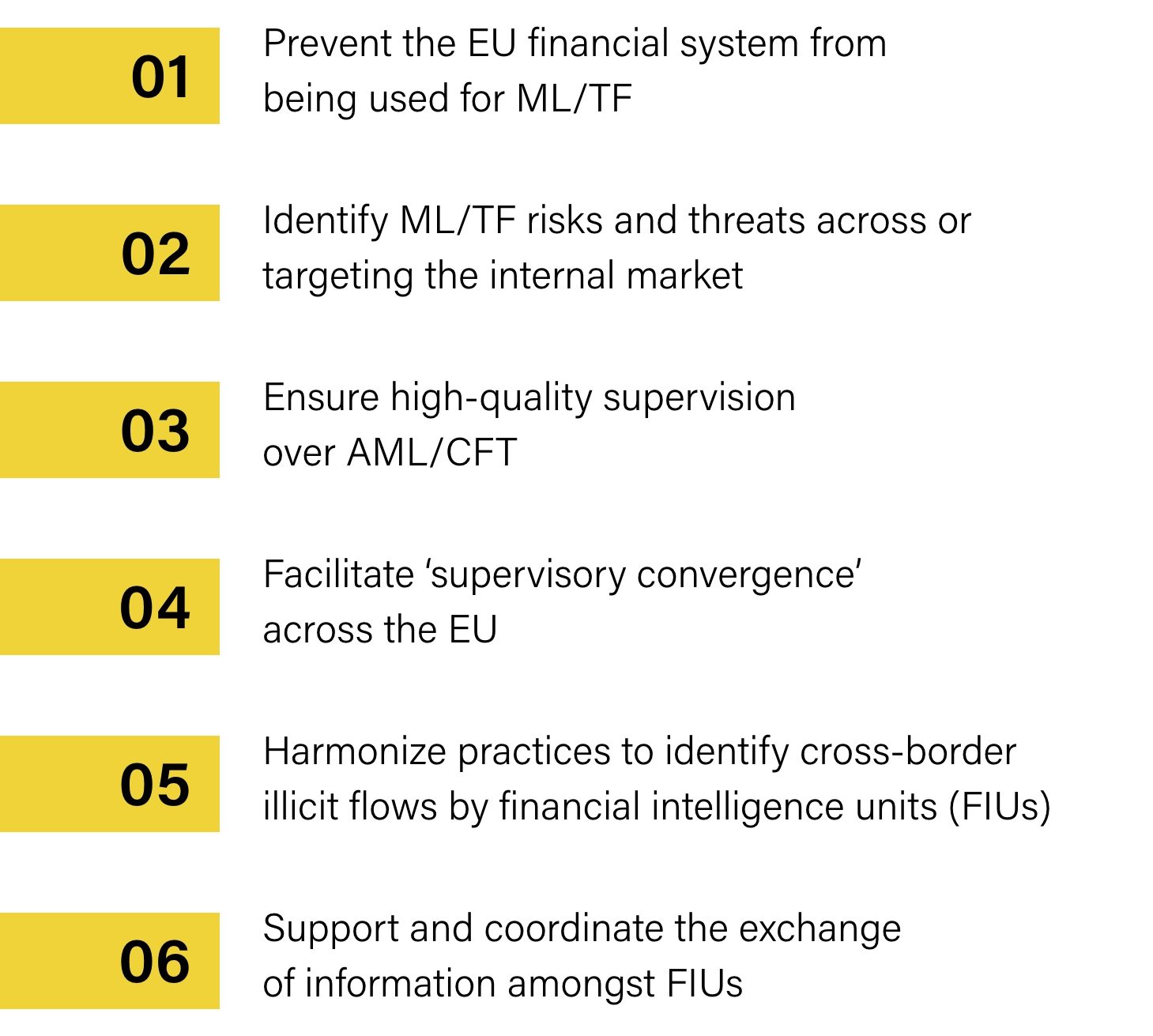

The main objectives of the AMLA are to:

It will have direct supervision over the ‘riskiest’ obliged entities that work across borders – aiming to crack down on money laundering – and oversight over local obliged entities in ‘emergency situations.’ If urgent action on a money laundering issue is needed, the EU Anti-Money Laundering Authority can carry out immediate inspections and order administrative action at these institutions. This includes the option to impose sanctions.

A strong focus will be on large lenders and non-bank financial institutions that operate in multiple EU member states and are seen as ‘high risk’ or engage in ‘sufficiently risky’ business. A list will be published every three years of those institutions that will be under direct supervision, with the first set of ‘selected obliged entities’ to be named on July 1, 2025.

AMLA will also have indirect oversight over other obliged entities. It aims to build stronger common supervisory approaches, maintain an AML/CFT supervisory database with up-to-date information for supervisors, and have oversight of the FIU.net platform, an EU-wide mechanism to enhance the exchange of information and allow joint analysis and cooperation between FIUs.

For the first time, certain types of credit and financial institutions, including crypto asset service providers, will be directly supervised across all member states if they are considered risky.

A new AML/CFT supervisory methodology will have qualitative and quantitative markers and indicators of inherent risk, including customers, products and services, delivery channels, and geographic areas.

The aim is to create a joint supervisory team between the EU Anti-Money Laundering Authority and local FIUs, to enforce a single rule book, based on regulatory technical standards. AML investigations will be carried out jointly, and technical expertise will be shared in areas such as AI, IT solutions, and best practices for identifying suspicious transactions.

Firms should expect more detailed rules on customer due diligence (CDD), beneficial ownership, and the powers and tasks of supervisors and FIUs. They should also note that existing national registers of bank accounts will be connected, speeding up access for FIUs to gain information on bank accounts and safe deposit boxes. Law enforcement agencies will also have access to this system, to help in financial investigations and with the recovery of criminal assets in cross-border cases.

New requirements are also proposed for crypto assets and crypto asset service providers, to collect and make accessible data concerning the originators and beneficiaries of transfers in those assets.

The EU Anti-Money Laundering Authority will also be responsible for preparing and coordinating threat assessments and strategic analyses, developing methods and procedures to select relevant cases for joint analysis, carrying out capacity building for FIUs, and will monitor and support asset freezes.

While many of the measures outlined are not likely to be implemented until the mid-2020s, firms should develop a proactive strategy to avoid the risk of fines, and should closely follow any developments as the EU AML/CFT framework is revamped.

Firms should also consider their response to these changes across a number of key areas, including:

Uncover what changes have been proposed by the European Commission and how might those changes impact firms.

Download the guideOriginally published 22 November 2021, updated 15 December 2022

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2023 IVXS UK Limited (trading as ComplyAdvantage).