Through money laundering, criminals fund and profit from illicit activity such as arms sales, narcotics, human trafficking, contraband smuggling, embezzlement, insider trading, bribery, and fraud schemes. In addition to organized criminal groups, professional money launderers perform money laundering services on behalf of others as their core business.

The scale of money laundering globally is difficult to assess. Still, a widely quoted figure from the United Nations Office on Drugs and Crime (UNODC) estimates that money laundering schemes cost 2-5% of the world’s total GDP – an estimated $2 trillion.

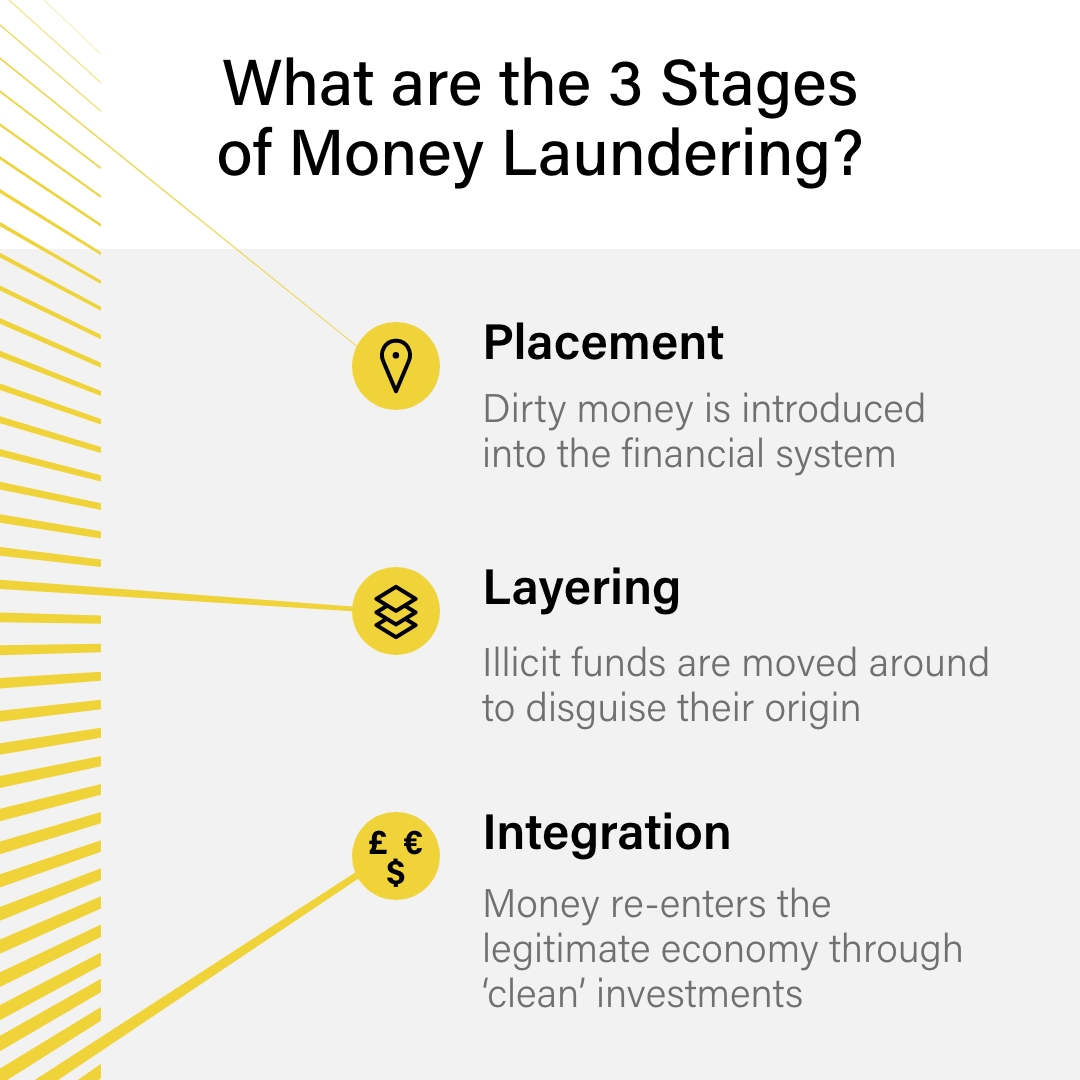

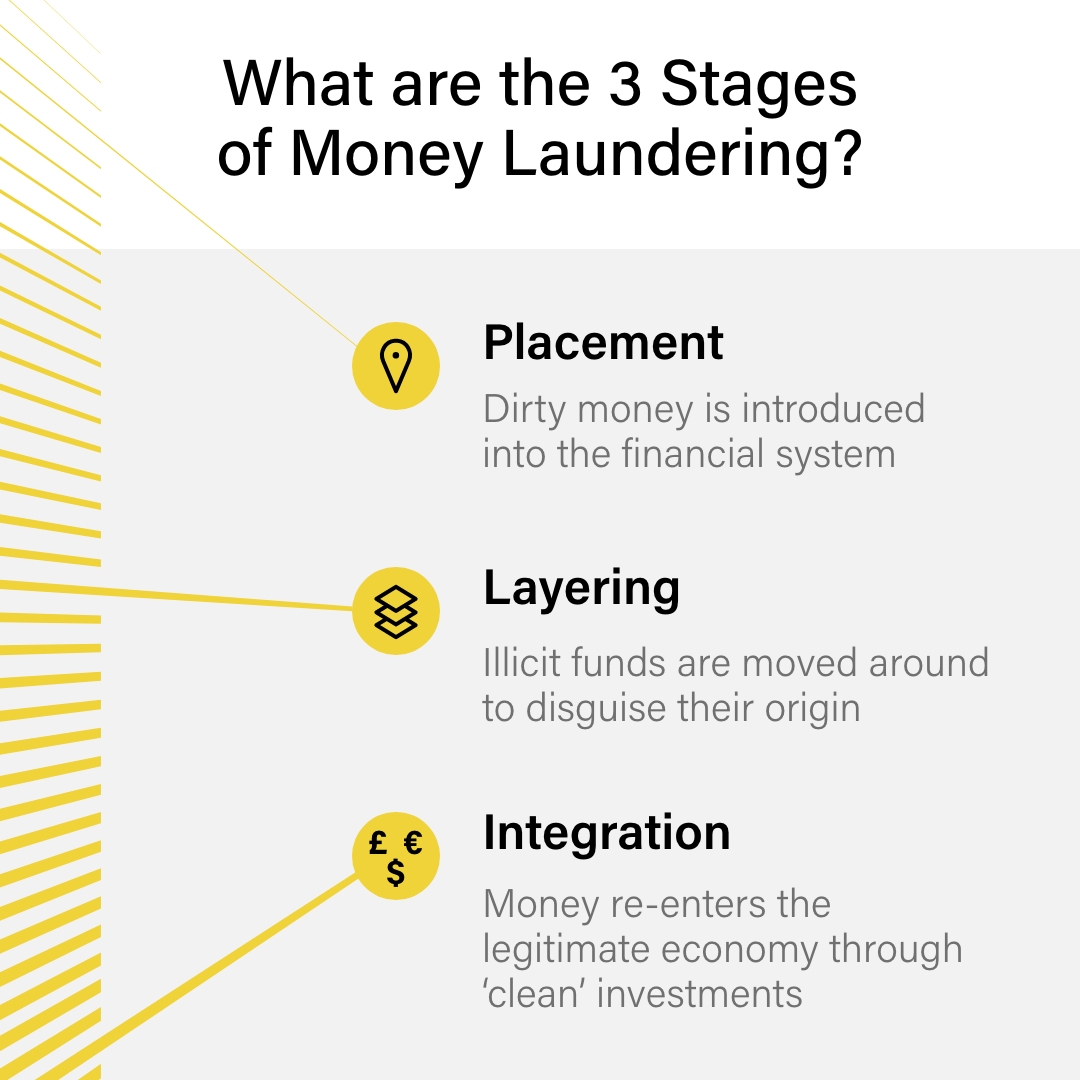

There are typically three stages of the money laundering process to release laundered funds into the legal financial system. These three stages of money laundering are:

Placement is when “dirty money” is introduced into the financial system. This is often done by breaking up large amounts of cash into less conspicuous smaller sums to deposit directly into a bank account or by purchasing monetary instruments such as checks or money orders that are collected and deposited into accounts at other locations.

Other placement methods include:

The layering stage is when the launderer moves the money through a series of financial transactions with the goal of making it difficult to trace the original source.

The funds could be channelled through the purchase and sales of investments, a holding company, or simply moved through a series of accounts at banks around the globe. Widely scattered accounts are most likely to be found in jurisdictions that do not cooperate with AML investigations. In some instances, the launderer could disguise the transfers as payments for goods or services or as a private loan to another company, giving them a legitimate appearance.

While the three stages of money laundering also apply to cryptocurrencies, layering is the most common entry point for crypto, as criminals use it alongside the traditional financial system to disguise the origins of their funds.

Layering tactics to look out for:

The integration stage of money laundering is the final step in the laundering process. This is when the launderer attempts to integrate illicitly obtained funds into the legitimate financial system. To use the funds to buy goods and services without attracting attention from law enforcement or the tax authorities, the criminal may invest in real estate, luxury assets, or business ventures.

They are often content to use payroll and other taxes to make the “washing” more legitimate, accepting a 50% “shrinkage” in the wash as the cost of doing business.

Common Integration tactics include:

Through procedural filtering, predictive analysis, and machine learning capabilities, efficient AML solutions can help financial institutions detect and prevent suspicious money laundering activity.

With a real-time risk name screening solution, firms can quickly identify blocked/sanctioned persons and prevent them from placing potentially illicit funds into the legitimate financial system. When screening new or existing customers, firms should also screen for politically exposed persons (PEPs) and adverse media – negative news found across various sources that show an increased risk in conducting business with the person or entity at hand.

To identify suspicious patterns in customer transactions, firms should utilize a transaction monitoring software that can adapt to detect changes in customer and criminal behaviors. Risk indicators related to layering and integration methods should also be considered when implementing risk-based rule sets that align with a firm’s risk appetite.

While not all money laundering cases will use the three-stage process – they could be combined or stages repeated several times – the rule of three stages of money laundering frames the thinking of many compliance teams.

Explore the global regulatory frameworks – and the latest proposed updates – from major international financial markets with our insights platform.

Originally published 26 July 2022, updated 27 February 2023

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2023 IVXS UK Limited (trading as ComplyAdvantage).