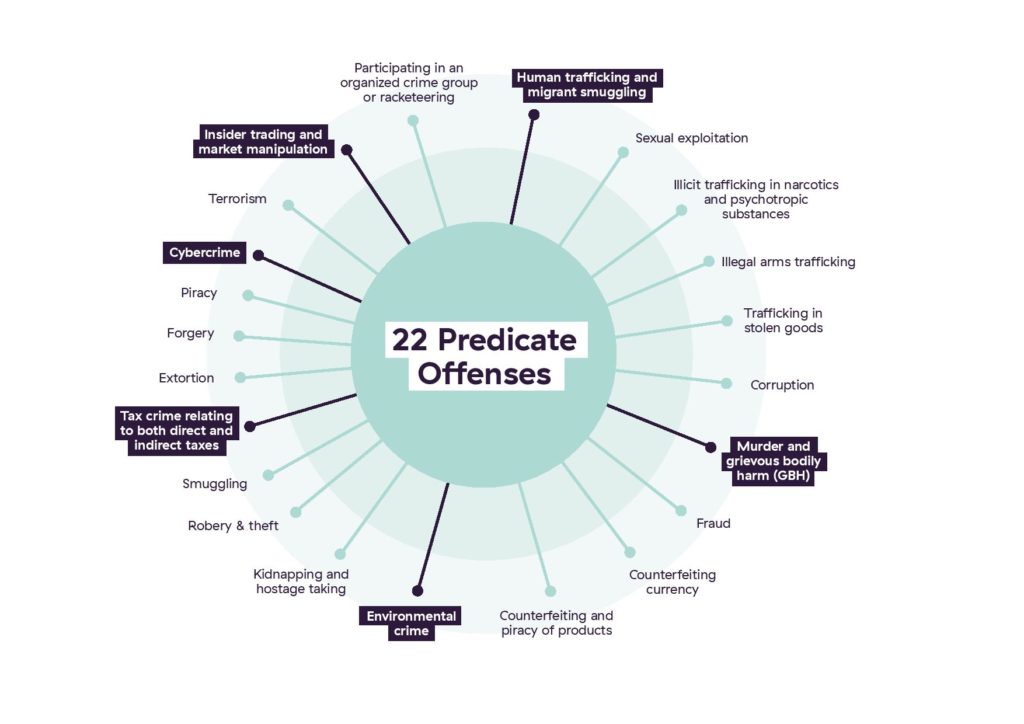

The EU’s Sixth Money Laundering Directive (6AMLD) closes certain loopholes in member-states’ domestic legislation by harmonizing the definition of money laundering across the bloc. 6AMLD places a particular focus on ‘predicate offenses’. Introduced on 3 June 2021, 6AMLD expands its list of money laundering predicate offenses to better reflect the modern threat landscape.

Institutions should make themselves familiar with the changes it introduces.

A predicate offense – or predicate crime – refers to a crime which is a component of a larger crime.

In a financial context, the predicate offense would be any crime that generates monetary proceeds. The larger crime would be money laundering or financing of terrorism.

6AMLD replaces 5AMLD and was transposed into law across all member-states on 3 December 2020 – and must have been implemented in those territories by 3 June 2021. In more detail, 6AMLD defines and expands the list of crimes that qualify as money laundering predicate offenses:

The broad spectrum of money laundering predicate offenses set out in 6AMLD means that financial institutions must adjust their adverse media screening process to ensure they identify the appropriate breaking news stories.

Given the time-consuming and labor-intensive work involved in that process, adverse media categorization is a valuable efficiency tool that allows institutions to sort and prioritize news stories and gauge the degree to which the adverse media changes a client’s risk profile. Categorization complements automated screening, helping to reduce employee workloads and transform an institution’s ongoing compliance performance.

Adverse media categorization is a valuable KYC due diligence tool, especially since the FATF recommendations state that financial institutions must “understand their client’s reputation”, including previous criminal liabilities like involvement in money laundering investigations. Compliance with that direction requires adverse media screening – which traditionally involves time-consuming manual checks of vast, unsorted amounts of news reports, blog articles, and social media.

It’s important to make sure that any negative news screening tool used is capable of identifying media by specific categories. This cuts down on noise and keeps alerts focused on what’s relevant by avoiding false positives. Depending on the risk-based approach to AML businesses are taking it may also be prudent to receive different alerts based on different categories to make it easier for compliance officers to discover what’s relevant.

Categorizing adverse media allows firms to prioritize that workload, and gauge the level of risk associated with each client more efficiently. Negative news categorization may also better facilitate automated screening, in which searches can be further tailored to client profiles and regulatory environments. Automation allows firms to identify and assess adverse media, reduce false positives, and maintain the level of compliance performance that regulators expect without becoming a predicate offense.

Originally published 10 October 2019, updated 27 February 2023

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2023 IVXS UK Limited (trading as ComplyAdvantage).