Explore our AML solutions

Learn more about our transaction monitoring, screening, and customer monitoring and screening tools.

Review nowFrom designated non-financial businesses and professionals (DNFBPs) to virtual asset service providers (VASPs), the breadth of firms subject to anti-money laundering (AML) regulations is greater than ever. Moreover, the regulations themselves – and the criminal activities they’re designed to detect and prevent – are more complex. As a result, AML software vendors have become an essential part of the compliance function in most financial institutions. Improvements in regulatory technology (Regtech) also mean the benefits of partnering with an effective vendor are higher.

However, not all AML software vendors are created equal. So how do firms decide who to partner with?

A good question to start is: Why do we want to partner with a vendor in the first place? Compliance teams should complete a build vs. buy evaluation to answer this and define the objectives of partnering with a regtech firm. Before building in-house, firms need to consider:

This process should clarify the scope of the request for approval (RFP) process and ensure that important considerations related to integration, scalability, and the scope of relevant regulations have been fully assessed.

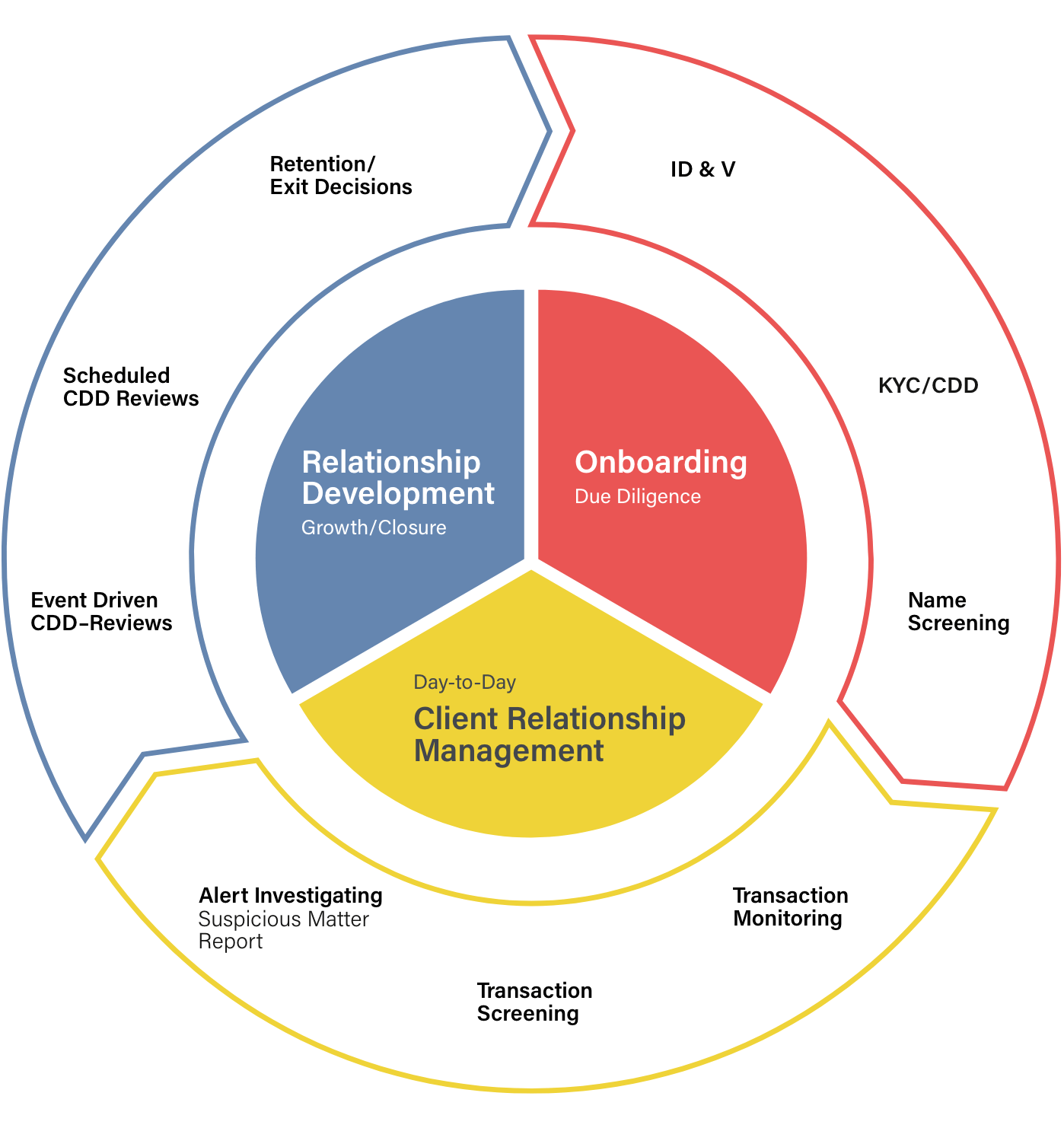

AML software vendors must meet the fundamental needs of a firm’s AML program, considering their customer base, area(s) of operation, and internal capabilities. From a regulatory perspective, an AML program should feature several essential risk-based controls, including customer due diligence (CDD), transaction monitoring, sanctions lists, PEP screening, and adverse media monitoring. The diagram below shows the full scope of activities firms need to consider across the onboarding and relationship development process through to growth or closure.

In addition to those fundamentals, compliance teams need to consider:

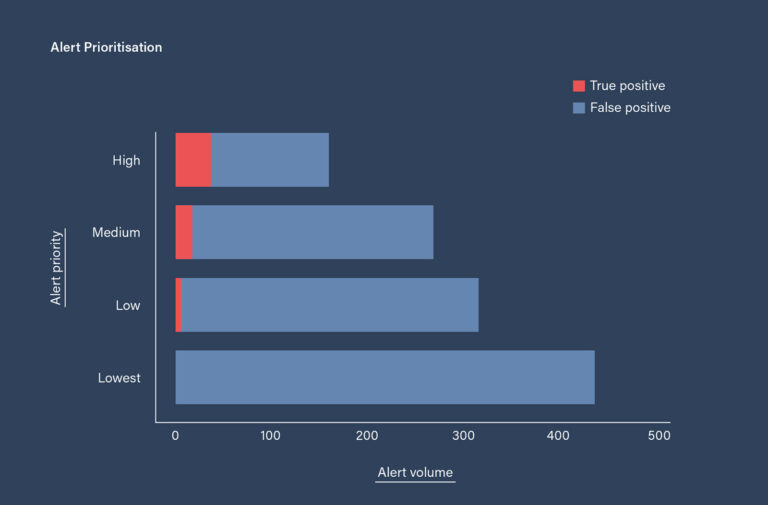

AML software vendors should help reduce false positives

False positive AML alerts represent a significant time and efficiency drain for every financial institution. However, the right AML software vendor can help firms reduce false positive rates. Certain features of an AML software solution are specifically useful in this regard:

Firms should assess the potential of an AML software vendor’s representational state transfer (REST) application programming interface (API) to enhance their existing AML infrastructure:

The AML software vendor a firm implements should complement the skills and expertise of internal compliance staff. However powerful or innovative a solution is, its effectiveness will depend on how it supports the compliance team and advances its compliance objectives.

Practically, this means assessing the strengths and weaknesses of the AML program and the teams that use it. Similarly, a firm’s leadership must have the AML experience and expertise to build an effective compliance program and select the best technology. This may require compliance teams to provide appropriate training and coaching.

Firms must consider how their AML software solution will be deployed within their existing business infrastructure. Some software deployments will require on-premises installation, while others may be able to run off-premises in the cloud.

While there is no one-size-fits-all solution, both types of deployment have benefits and drawbacks:

On-premises software deployments: While software solutions deployed on-premises offer a greater degree of control over compliance infrastructure, that control ultimately means more regulatory exposure for firms. On-premises solutions also entail higher professional service costs, extended implementation periods and may require an IT department capable of performing all necessary maintenance, updates, back-ups, and security processes.

Cloud software deployments: Cloud software solutions offer firms less direct control of their AML infrastructure and reduce regulatory exposure by handling maintenance and security needs as part of their service offering. Cloud solutions also provide flexibility when firms need to scale their AML program up and down and can be deployed rapidly compared to on-premises solutions.

AML requires firms to collect and store a range of sensitive customer information. Accordingly, a firm’s AML software vendor must offer a suitable level of protection from cyber threats and comply with jurisdictional privacy regulations such as the EU’s General Data Protection Regulation (GDPR) and California’s Consumer Privacy Act.

Similarly, the solution should help firms achieve ISO27001 certification. The globally-recognized information security management standard, ISO27001 certification, involves technological and physical security controls. The protection your AML software confers will constitute a significant part of the accreditation process.

With this in mind, firms should ensure they have reviewed, and are comfortable with, their software vendor’s security policies. Vendors should also have disaster recovery and business continuity strategies to ensure that unforeseen circumstances do not disrupt services and compliance responsibilities.

Tools that leverage artificial intelligence (AI) – including machine learning, deep learning, and natural language processing – can significantly enhance a firm’s AML compliance performance. In our State of Financial Crime 2023 survey, 99 percent of senior compliance professionals said they expect AI to positively impact financial crime risk detection. They anticipate specific gains in transaction monitoring. When asked which transaction monitoring use case AI could best help them with, firms overwhelmingly identified three:

As the survey shows, alert prioritization is the top use case firms focus on. Returning to the issue of false positives, with the volume of data available to financial institutions today, AI is a crucial way of ensuring firms can scale effectively while continuing to identify true positive AML alerts more effectively – see the diagram below.

Learn more about our transaction monitoring, screening, and customer monitoring and screening tools.

Review nowOriginally published 19 October 2020, updated 30 January 2023

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2023 IVXS UK Limited (trading as ComplyAdvantage).