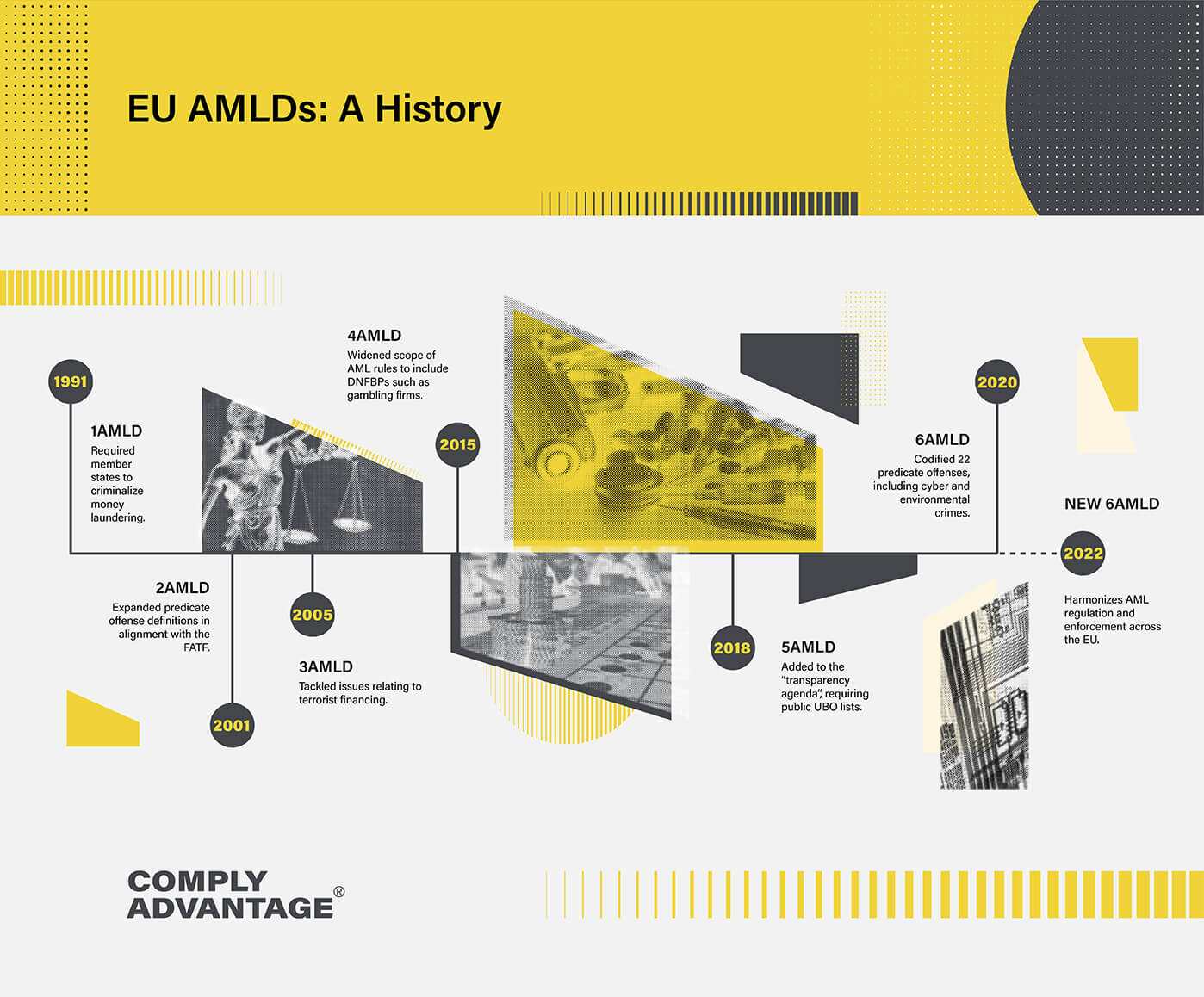

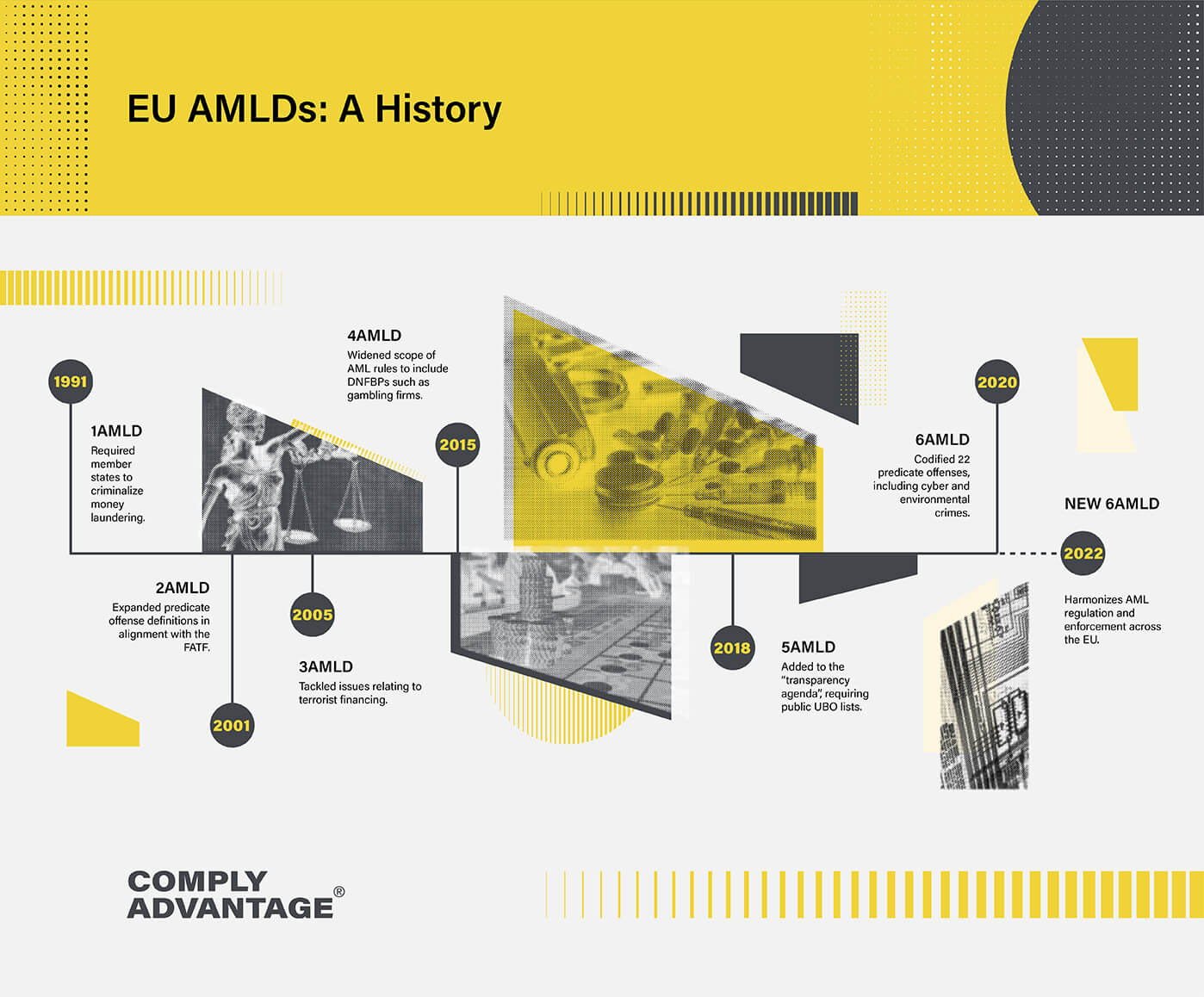

The European Union’s 6th Money Laundering Directive (6AMLD) came into effect for member states on 3 December 2020 and must be implemented by financial institutions by 3 June 2021. Following 5AMLD, which broadly strengthened existing AML/CFT provisions, the sixth anti-money laundering directive aims to empower financial institutions and authorities to do more in the fight against money laundering and terrorism financing by expanding the scope of existing legislation, clarifying certain regulatory details and toughening criminal penalties across the bloc.

With the implementation date on the horizon, now is the time for banks, financial institutions and other obligated entities to ensure they are familiar with the details of 6AMLD and prepare their AML compliance program for the changes that it will introduce.

With that in mind, what are 6AMLD’s key highlights?

The 6th AML directive harmonizes the definition of money laundering across the EU with the goal of removing loopholes in the domestic legislation of member states. In more detail, as a response to changing criminal methodologies and legislative priorities, 6AMLD provides a harmonized list of the 22 predicate offenses that constitute money laundering, including certain tax crimes, environmental crime and cyber crime money laundering. The inclusion of cyber-crime as a predicate offense is significant since it is the first time it has been featured in this context in an EU money laundering directive.

When the harmonized list of predicate offenses comes into legal effect, firms within member states will have to ensure that their AML/CFT programs can deal with the new risk environment that creates. This means that firms may need to train or retrain employees and adjust their AML compliance programs to ensure that they can detect suspicious activities linked to the predicate offenses.

6AMLD expands the number of offenses that fall under the definition of money laundering. When the directive comes into effect, “aiding and abetting” will also constitute money laundering and be subject to the same criminal penalties. Prior to 6AMLD, EU money laundering regulations sought only to punish those who profited directly from the act of money laundering, but under the new rules, so-called “enablers” will also be legally culpable.

Practically, “aiding and abetting” means that anyone who helps money launderers will themselves be committing the crime of money laundering: that expanded scope also includes anyone caught inciting money laundering or attempting to launder money. As with the harmonized list of predicate offenses, as part of their AML response, firms should now move to ensure their compliance programs are set up to detect and prevent the aiding and abetting of money laundering.

Under the current rules, only individuals can be punished for the act of money laundering; however, 6AMLD will extend criminal liability to allow for the punishment of legal persons, such as companies or partnerships. The new rules mean that a legal person will be considered culpable for the crime of money laundering if it is established that they failed to prevent a “directing mind” from within the company from carrying out the illegal activity. Practically, the new rules will place AML/CFT responsibility on management employees along with employees acting separately.

The extension of criminal liability in this context is intended to hold larger companies to account in the global effort to combat money laundering. The move will allow financial authorities to better target organizations that do not implement AML/CFT effectively. Punishments for legal persons may range from a temporary ban on operations or judicial supervision to permanent closure.

6AMLD introduces a minimum prison sentence of four years for money laundering offenses (the previous minimum sentence requirement was one year). Under the new rules, judges also have the power to fine individuals and exclude entities from accessing public funding.

The increased prison terms for money laundering and potential financial repercussions are part of the EU’s effort to bring consistency to AML/CFT regulation across all member states and reflect the EU parliament’s commitment to stricter enforcement of money laundering rules. Many EU member states already implement punishments for money laundering in excess of the minimum prison sentences required by the 6th money laundering directive.

The crime of money laundering may involve dual criminality, which is the principle that a crime may be committed in one jurisdiction before its financial proceeds are laundered in another. 6AMLD addresses the issue of dual criminality by introducing specific information sharing requirements between jurisdictions so that a criminal prosecution for the connected offenses can take place in more than one EU member state.

In practice, 6AMLD’s provisions for dual criminality require EU member states to criminalize certain predicate offenses whether they are illegal in that jurisdiction or not. Those predicate offenses are terrorism, drug trafficking, human trafficking, sexual exploitation, racketeering and corruption. As part of the process, the member states involved in a prosecution will work together to centralize legal proceedings within a single jurisdiction. 6AMLD sets out a range of factors for authorities to consider when deciding how and where to conduct prosecutions, including the victims’ country of origin, the nationality (or residence) of the offender and the jurisdiction in which the offense took place.

Obligated firms should seek to develop an understanding of the adjusted regulatory scope that 6AMLD has brought, including new predicate offenses that must be monitored and the new risk environment in which they will be operating. In addition to managing their AML resources and training compliance staff, firms need to review their technology deployment in order to ensure that they have the capability to meet the current transaction monitoring and screening obligations.

Our Solutions Help You Remain Compliant With The Latest Financial Regulations.

Originally published 01 May 2020, updated 19 July 2022

Disclaimer: This is for general information only. The information presented does not constitute legal advice. ComplyAdvantage accepts no responsibility for any information contained herein and disclaims and excludes any liability in respect of the contents or for action taken based on this information.

Copyright © 2023 IVXS UK Limited (trading as ComplyAdvantage).